The 35% return this week takes Eden Research's (LON:EDEN) shareholders one-year gains to 186%

Sadly, there are risks involved when investing, as businesses may face bankruptcy. However, by selecting the correct stock, the potential for earning over 100% is feasible. A prime example is the company Eden Research plc (LON:EDEN), which has already experienced a remarkable rise of 186% in its stock price within the past year. An even more impressive increase of 249% has been observed over the last quarter. If we reflect on this further, we notice that the stock price has risen by 43% in comparison to the price three years ago.

Following a significant rise over the previous week, it is important to investigate whether the overall returns in the long run have been influenced by positive changes in the underlying factors.

Have a look at our most recent evaluation of Eden Research.

Due to Eden Research experiencing a deficit in the past year, it seems that the market is currently placing greater importance on generating revenue and expanding revenue rates. Investors typically anticipate substantial revenue expansion from companies that are not yet profitable. It is well-known that maintaining rapid revenue growth typically results in a surge of profits as well.

Eden Research had an exceptional year, growing their revenue by 49%, which far exceeds what most other companies that haven't yet made a profit experience. The share price also reflected this positive performance, increasing by 186%, as we previously noted. While it's fantastic to see such robust revenue growth, the crucial question is whether they can keep this up. The fact that the share price also rose significantly indicates that investors are optimistic about their prospects. However, as the hype around them dies down a bit, there may be a more favorable time for buyers to get in on this growth opportunity.

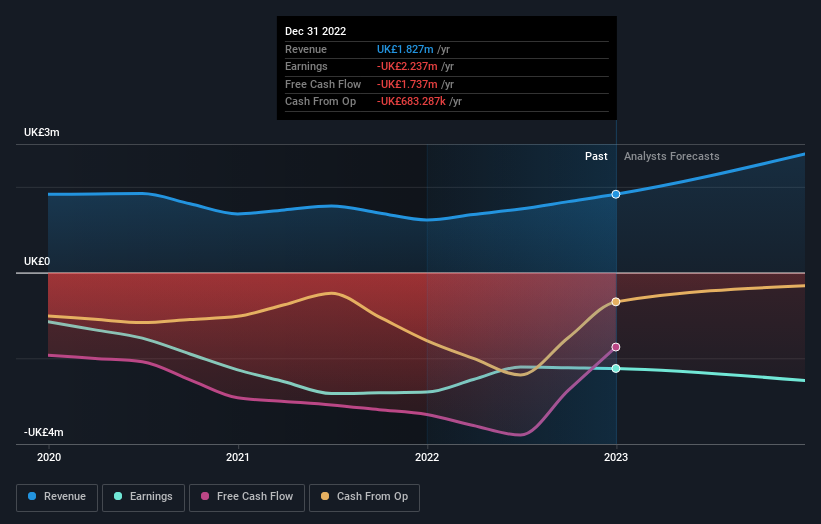

Take a look at the picture beneath to see a comparison of how much profit and income have progressed throughout the years. If you want to see the chart in further detail, simply click on the picture.

If you're interested in delving deeper into Eden Research's stock, you can begin by utilizing this free report which offers an interactive overview of their balance sheet fortitude.

It's great news that Eden Research shareholders have made a significant profit of 186% in the last year. This is a big improvement from the loss of 0.6% per year over the past five years. Although we're slightly concerned, it's possible that the company has managed to turn things around. Observing the share price over a long period of time can give us an idea of how the business is doing. However, to really understand the situation, we need to look at other factors as well. We want to point out that our investment analysis shows that Eden Research has six red flags, three of which may be serious. So, it's important to keep this in mind.

It would be more appealing if Eden Research showcases some significant insider purchases. As we anticipate this, take a look at this list of expanding companies that have had noteworthy insider buying recently, free of charge.

It's important to keep in mind that the returns mentioned in this article represent the average returns of stocks trading on British exchanges, weighted according to market performance.

Do you have any thoughts on this article? Are you worried about the information included? Feel free to contact us directly to share your feedback. Alternatively, you can send an email to editorial-team (at) simplywallst.com.

This blog post from Simply Wall St is quite broad in scope. Our approach is impartial and relies solely on historical information and expert predictions. It's important to note that our articles are not meant to be construed as financial guidance, nor should they be taken as an endorsement to purchase or sell any particular stock. We strive to provide articles that offer in-depth analysis and insights based on fundamental data, which can be beneficial over the long-term. It's worth noting that our analysis may not include recent company announcements or qualitative material that may affect stock prices. At Simply Wall St, we do not hold any positions in any of the stocks mentioned in this article.

Participate in a Paid User Research Session where you can contribute to the improvement of investing tools meant for investors like you. In return for only an hour of your valuable time, you will receive a US$30 Amazon gift card. Register yourself here to join the session.