Ofgem cannot fix the energy market unless ministers scrap the price cap

Blog Post: Monday, August 21st, 2023 at 6:00 in the morning.

Ofgem, the energy regulator, has faced significant challenges even within the regulatory community.

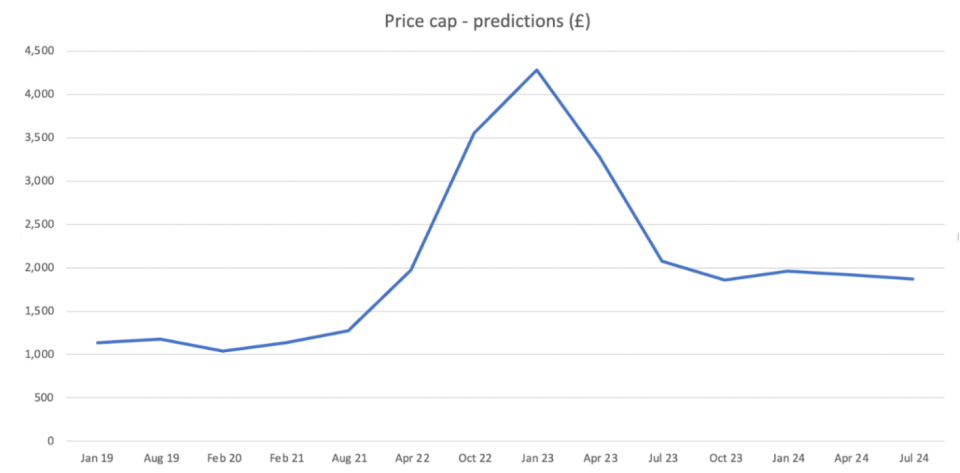

In the last few years, it has witnessed the bankruptcy of 30 suppliers under its supervision, while also experiencing a significant increase in household bills reaching unprecedented levels.

There is almost no indication that the latter will be resolved in the near future.

Although the immediate surge witnessed following Russia's incursion into Ukraine may have subsided, experts anticipate that elevated costs will persist until the nation fully transitions to affordable renewable energy sources. This objective is certainly admirable; however, it will unavoidably incur exorbitant expenses during the interim.

In a typical marketplace, elevated prices would be transferred to consumers.

However, the energy price limit restricts suppliers from engaging in such behavior, prompting Ofgem to adopt an alternative approach. This approach aims to instill confidence in suppliers to sustain their operations, although it may have limited impact on fostering competition within the energy industry.

After facing harsh criticism following the expensive failure of numerous suppliers, Ofgem has taken proactive steps by implementing standards for sufficient capital, tests to ensure financial stability, regulations regarding net asset value, and separating certain segments within the industry.

This signifies a change from the era before 2020 when the governing principles favored reduced regulations and increased competition in the market.

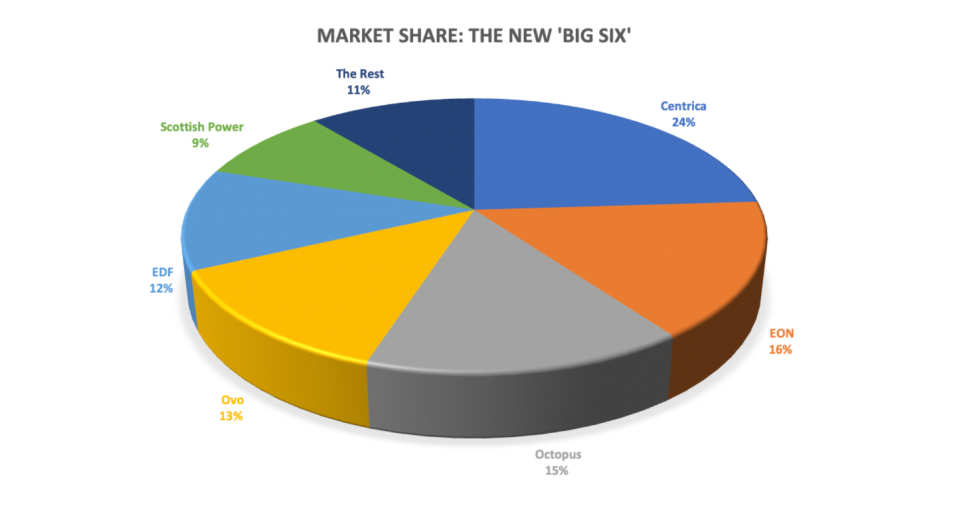

Certainly, following a widespread alarm regarding the dominance of the Big Six, the market witnessed a surge with as many as 70 suppliers in 2018.

It wasn't completely negative – because of this, it created an environment where new companies like Octopus Energy and Ovo Energy could emerge and challenge established companies, which was necessary for competition.

However, when prices increased, the restriction on prices affected those smaller, up-and-coming participants more severely.

Energy companies may have mismanaged their finances, but the fact remains that it was nearly impossible for most of the struggling suppliers to sustain themselves when they couldn't pass on the increased wholesale costs to their customers.

For example, Bulb might have embraced an unsuitable expansion strategy to achieve the status of being the seventh biggest provider with 1.5 million clients – however, the ultimate setback was the implementation of the price limit, which limited its ability to charge customers more than 70p per therm even though the wholesale prices for supplying reached £4 per therm.

The danger lies in the possibility of experiencing more failures in the future, regardless of how diligently Ofgem tries to strengthen its supervision over suppliers, unless the price limit is eliminated.

The Big Six Profit From Ofgem's Cleanup

It is worth mentioning that the crisis benefitted the largest suppliers with the most financial resources, allowing them to endure a prolonged period of financial losses.

Centrica, the proprietor of British Gas, acquired several defunct participants, resulting in the dominance of the Big Six, who now control more than 90 percent of the market due to Octopus' acquisition of Bulb in the latter part of last year.

This was the exact scenario that the government was determined to prevent when it initially implemented changes to the local supplier market ten years ago.

Ofgem's commendable efforts to implement stricter financial reforms may inadvertently impede innovation and hinder the entry of new players into the market. This, coupled with the ongoing existence of the price cap, makes it difficult to envision how any fresh supplier could flourish and offer customers a novel proposition.

Brearley recently expressed concerns about the effectiveness of the price cap and suggested that it should be reevaluated due to its overly generalized approach.

He is not by himself, as Ovo's CEO Raman Bhatia and Good Energy's CEO Nigel Pocklington have also confirmed to City A.M. that the limit should be either redefined or eliminated.

Nevertheless, Ofgem does not have the authority to make such a decision. The price cap was approved by Parliament in 2018 and implemented throughout the industry the next year.

This signifies that, regardless of how Ofgem manages the crisis and cleanup effort, ministers must address one of the main obstacles blocking the market's resolution.

With an upcoming election in the approaching winter, the government is faced with a dwindling amount of time to tackle the hurdles present within the energy sector.

The sector needs to exert additional influence on the government to abandon the flawed price restriction. Otherwise, there is a higher likelihood of more energy providers succumbing to future market instability, resulting in reduced competition and innovation for consumers.