Markets Today - Singing from the same hymn sheet | Business Research and Insights

Today's Market Harmony

US stocks started the week cautiously due to conversations hinting at a more aggressive approach from the Federal Reserve, as well as worries about the upcoming earnings season. The drop in US Treasury yields put pressure on the value of the USD, while the AUD struggled due to concerns about China and lower prices for bulk commodities.

Switzerland: Consumer Price Index (year-on-year%) for June came in at 0.0, falling short of the expected 0.2. Switzerland: Producer Price Index (year-on-year%) for June was -5.4, lower than the projected -5.0.

US stocks started the week with a hesitant attitude, fluctuating between positive and negative territory. The cautiousness was fueled by the Federal Reserve's hawkish comments and worries about the upcoming earnings season. Following last week's rise in yields, US Treasury yields declined overnight, aided by a decrease in US consumer inflation expectations. The drop in Treasury yields had a negative impact on the US dollar, however, the Australian dollar failed to gain traction due to concerns about China and lower prices for bulk commodities.

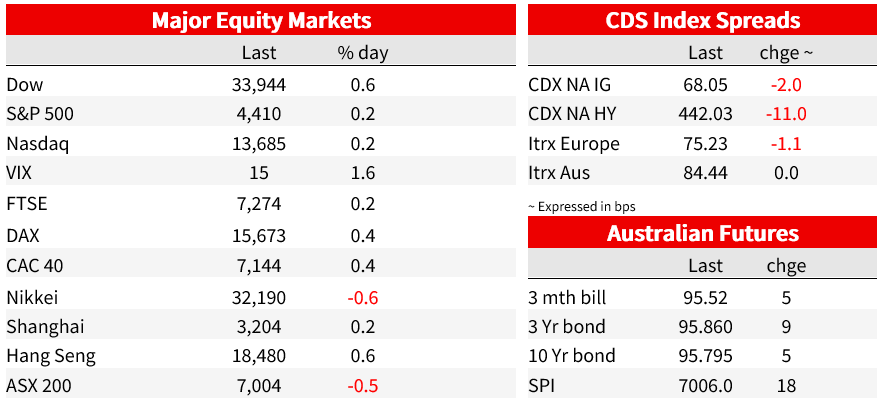

US stocks have had a difficult time finding a clear direction at the beginning of this week. The S&P 500 traded back and forth between positive and negative territory, ultimately closing with a slight increase of 0.24% (the NASDAQ had a smaller gain of 0.18%). Despite this small victory, it's worth mentioning that some of the biggest stocks, like Amazon and Tesla, suffered losses of nearly 2%. Prior to the release of the US Consumer Price Index (CPI), several Federal Reserve speakers made their voices heard, with most expressing a hawkish view.

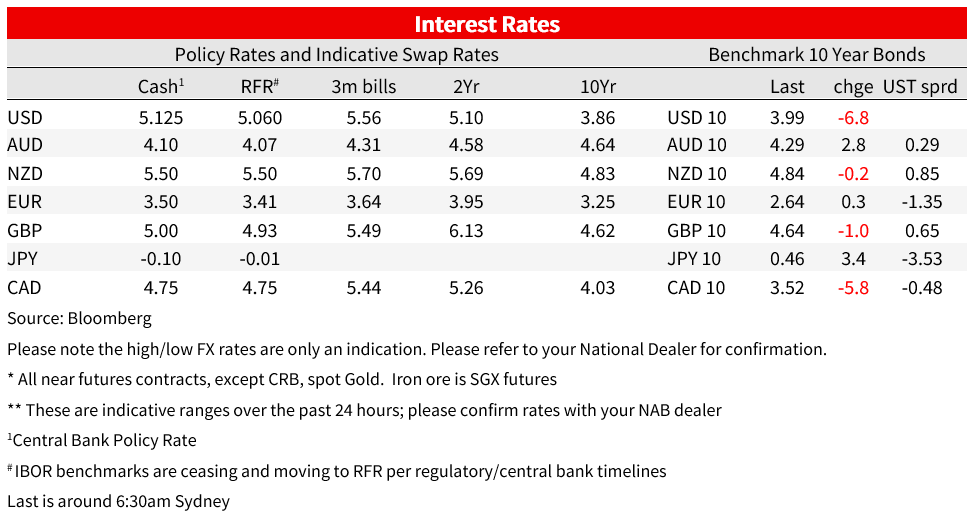

Federal Reserve officials, Barr, Mester, and Daly, are in favor of raising interest rates in the coming months to lower inflation back to 2%. Mester believes that in order to achieve sustainable inflation at 2%, the funds rate will need to increase and remain at that level for a period of time. Daly similarly thinks that a couple more rate hikes will be necessary throughout the year to bring inflation back to a sustainable 2% level. On the other hand, Bostic from the Atlanta Fed has a slightly less aggressive stance, acknowledging that inflation is currently too high but also recognizing the need for patience due to signs of an economic slowdown.

Apart from the predominantly aggressive statements from the Federal Reserve and the release of US Consumer Price Index on Wednesday, investors in the stock market appear to be cautious about the upcoming earning season which starts in full swing later this week when major US banks announce their second quarter financial results. According to a survey conducted by Bloomberg, investors are closely monitoring for any indications of reduced profits as the rise in interest rates starts to have an impact, causing optimism for a smooth economic outcome to diminish due to persistently high inflation that is causing central banks to maintain their hawkish attitudes.

Shifting our focus to the costs market, following the significant increase in interest rates observed last week, US Treasury (UST) yields experienced a downward trend during the night. The middle term of the UST yield curve spearheaded this movement, as the 5-year maturity decreased by 12 basis points (bps) to 4.238%, while the 2-year Note saw an 8bps decline to 4.863%. At the time of writing, the 10-year Note has dropped slightly below the 4% mark (3.99%), decreasing by 7bps in the past 24 hours.

The decrease in yields has been influenced by multiple factors, which has overshadowed the hawkish stance expressed by most Federal Reserve speakers. The latest US Consumer inflation expectation survey by the NY Fed was released overnight, showing a decline in one-year median inflation expectations for the third consecutive month. In May, the expectations were at 4.1%, but they dropped to 3.8% in June. The inflation outlook for the three-year horizon remained the same at 3% in June, while the five-year measure increased by 0.3 percentage points to 3%. Additionally, Morgan Stanley recommended purchasing 5-year Treasuries as they believe inflation will significantly decrease by the end of the year.

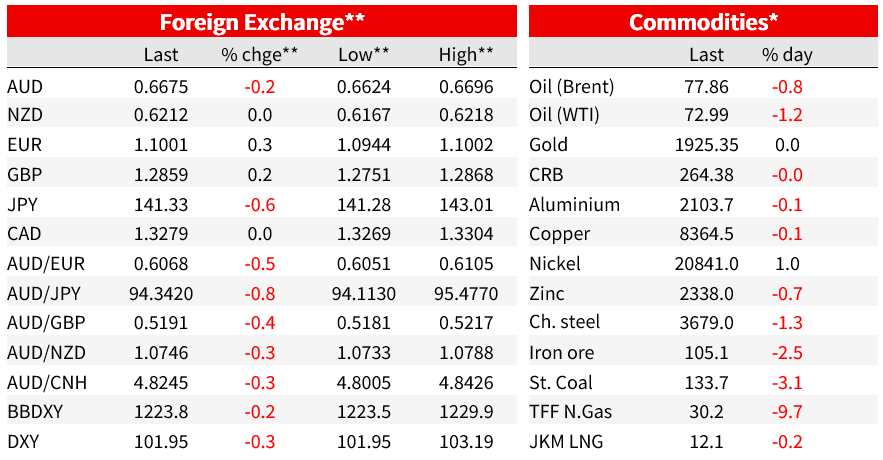

The United States dollar slightly increased in value during our trading session yesterday, but later on it fell due to the decrease in U.S. Treasury yields. The dollar has decreased by approximately 0.25% to 0.3% when considering the DXY and BBDXY indices, and in comparison to the G10 currencies, it has mainly fallen in relation to the Japanese yen and European currencies. The Australian dollar is particularly performing poorly, having decreased by 0.22% in the last 24 hours and starting the new day at 0.6675.

The NOK is performing well, increasing by 1.3%, despite a decrease in oil prices overnight. This growth is mainly attributed to a higher than expected rise in Norway's core inflation, which reached 7.0% YoY in June, surpassing the 6.6% forecast from analysts. This has fueled speculation that the Norges Bank will implement further interest rate hikes. The JPY has also experienced a 0.63% increase, with USD/JPY trading at ¥141.34. This is supported by the decrease in UST yields and cautious behavior in the equity markets. Additionally, the euro has seen a small increase of 0.3% to 1.1002.

The inflation data for China in June turned out to be lower than what was expected. The Consumer Price Index (CPI) inflation dropped from a yearly rate of 0.2% in May to 0.0% last month. This is the lowest it has been in the past 28 months, causing concerns about deflation. On the other hand, the Producer Price Index (PPI) deflation worsened even further last month, going from a yearly rate of -4.6% in May to -5.4%. This is the lowest it has been in over seven years. The lack of price pressure in China indicates that the economy is slowing down, and the weak demand highlights the need for a strong fiscal stimulus.

The information publication had a negative impact on large quantities of goods, which partially clarified why the Australian dollar performed worse in comparison to a weaker US dollar. On that day, iron ore decreased by 3.78%, while thermal coal experienced a decrease of 3.1%.

To find more details about FX, interest rates, and commodities, go to nab.com.au/nabfinancialmarkets. Make sure to read our disclaimer for NAB Markets Research.