Norsk Hydro: Some Positives, Fairly Valued

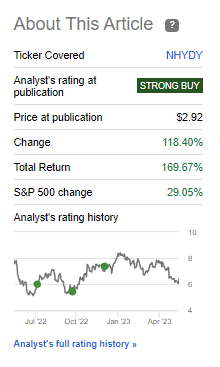

I made a good investment in Norsk Hydro ASA. It was one of my best in the past few years. I called it a "STRONG BUY" in February 2020 when its native ticker was trading below 28 NOK. I bought a lot of shares in Hydro at that time.

Even though there has been a recent decrease, the outcome remains the same since then.

NHYDY has been mentioned in an article on Seeking Alpha. The article is about the potential growth and investment opportunities in NHYDY. It states that NHYDY's revenue has increased by 20% and its net income by 56%. The author also states that NHYDY is expanding its business in Southeast Asia and the Middle East. The article concludes that NHYDY is a strong investment opportunity and its growth potential should not be overlooked.

My picks and timing might not be agreed with, but my strategy to find a 3-year outperformer remains the same. It has a TSR of almost 170%. When I trimmed my stake, it was over 165% with dividends. This strategy is successful and I use it for all my investments. You can become richer from it.

We'll check out the latest results. I'll explain why I'm not very excited about the company right now.

Norsk Hydro's Valuation Remains Low

The company is unstable. It's Hydro, and it depends on energy and commodity prices. It goes up and down a lot, but that's okay. We know that's how it is.

The yield's stability doesn't matter. The company added dividend floors to help shareholders. This is okay if we are aware of it. Why is it not a problem?

We can account for it. We can discount it if needed.

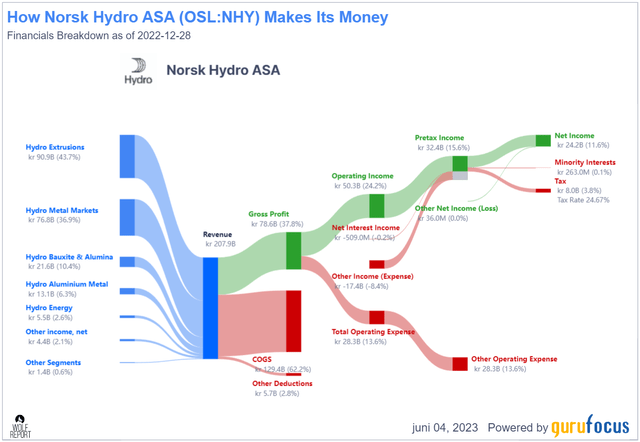

Norsk Hydro earns a lot of money from aluminum. It's one of the top companies.

The mining and metals industry's profit margins are compared to those of this company. This company's margins are in the 85-93rd percentile, including net, operating, and gross levels. Returns on assets, equity, invested capital, and capital employed for this company are also high. Currently, this company has a high dividend yield, but it may not stay that way. This company's business model is easy to comprehend.

The company has a mix of extrusions, metals, bauxite/alumina, Circal, Energy, and small ones. The mix is great for the company and internationally. Hydro has a double-digit net income with a high gross margin of 35-40%. This means their COGS is below 63% and their OpEx is efficient with less than 15%.

Important information comes from basic numbers, which many investors ignore. It's common to invest in poor performing companies and then be confused when their value doesn't improve. Checking a company's margins and business model is easy and available in data services.

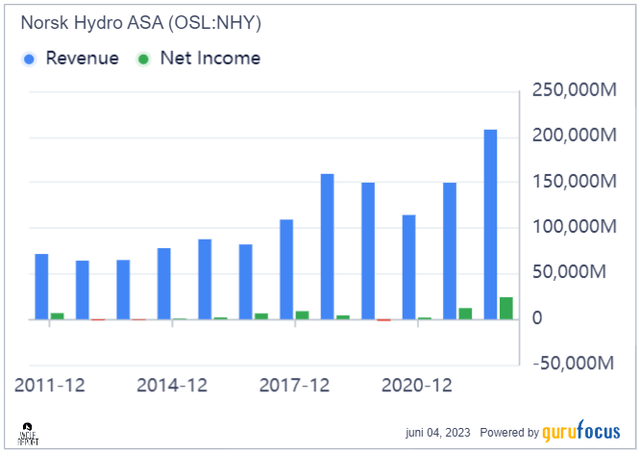

Hydro is doing well with a good income trend. But there is some risk. I only invest when it's safe.

Norsk Hydro - a company in Norway - released their revenue and net profits. This news was reported by a website called GuruFocus. It is important for investors to know this information. Knowing the company's revenue and net profits can help investors make decisions about whether or not to invest in the company.

The game is about volatility. You buy company cheap. You hold until it outperforms. You trim when price too high. Investors forget it is a cyclical business. The company has 50/50 ratio on analysts. They are unsure about Hydro forecasting. It's natural. Hydro is too volatile.

To make money, we should use simple investment methods based on valuation.

We only have 1Q results. They were reported in late April, a month ago.

Norsk Hydro is encountering a downturn in the market. The market is not stable and demand is lower. For the past two years, the company has made good preparations and saved money. This decline can be seen in many areas.

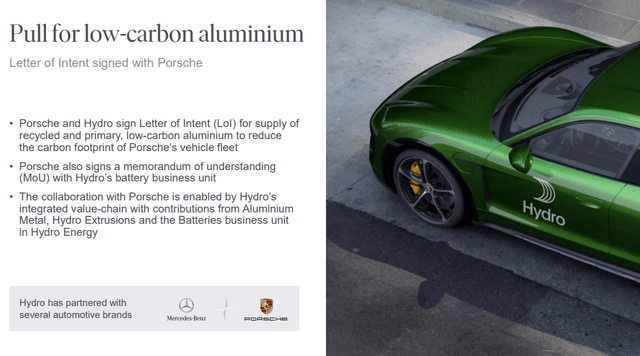

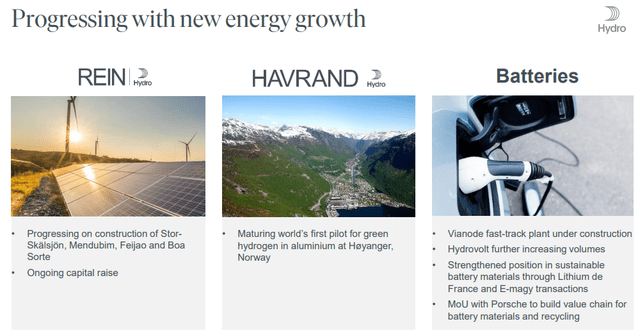

The company aims to earn 8BNOK AEBITDA for Extrusions. They are doing well in their energy growth plans.

The EBITDA of the company went up due to high pricing of aluminum/alumina, recycling volumes, and good FX. But the upstream pricing and energy still affect the company. Despite that, the EBITDA growth was positive. However, without good FX, EBITDA growth would be slightly negative.

Energy prices are going down, which means Hydro's huge gains from high energy prices are getting smaller. The company is doing well, even with the changes in pricing. It is being cautious but things might not be as bad as they have been in the past. This is good news.

To monitor Hydro, focus on the commodity markets and macro. Stay updated on their projects too. These are going smoothly at the moment.

The problem is the share price. It's becoming normal macro-wise. So, I'm lowering the share price a bit.

"Norsk Hydro's Valuation: On The Borderline"

Hydro's share price went down to 68 NOK recently. If it didn't, I would suggest holding onto it. The price at 70 NOK/share is too high. Now it's lower by 2 NOK because of lower results, China, and future risks.

Why just two Norwegian Kroner?

The company's plans make more money. A few years ago, 5-6 NOK/share EPS was good. But now, with Alumetal and other things, we could have a high single-digit EPS even in a downturn. This is just my opinion.

My new PT doesn't think the company is cheap. Hydro has good quality and is priced fairly or slightly below fair value. There is potential for the company to perform well. If we adjust for future EPS, Hydro isn't currently at a 10x P/E, but it should be. A 10x P/E for Hydro predicts a likely 11.9% annualized upside until 2025E, but dividends may decrease due to lower earnings.

Don't use DCF or other models for Hydro because earnings aren't stable. Look at the basics instead. NHY is a BBB rating, less than 21% debt/cap, and has a market cap of about 140B NOK. It's a big aluminum company and very profitable. When it's priced right, you should "BUY" and keep it as long as it makes sense.

In my view, S&P Global's analyst target is too high. There are 14 analysts following Hydro, with an average target between 55-115 NOK and 85 NOK per share. But only 4 analysts recommend a "BUY" while others suggest "SELL" or underperform. This shows analysts are uncertain about the company's value at this price.

I can explain my valuation targets and thought process better now.

If the company's price is less than 68 NOK, then it is a good investment ("BUY"). However, if it costs more than 68 NOK, the situation gets confusing. The market may become volatile, and the result could be underperformance. The company's earnings potential is good, but the market does not always agree. This happened a few years ago when the company's price dropped for no apparent reason. The market is unpredictable, so be careful!

Some experts and stats agree the company is potentially profitable in the future, but the current earnings aren't looking great. This doesn't mean the company is bad, just that it's making changes to its earnings. The share price already reflects this change.

I think the company won't rise much more. So, I am reducing my target price to 68 NOK per share.

I think this about Norsk Hydro now: I am of the opinion: My current viewpoint is: As for Norsk Hydro, I believe: In summary, I think:

Don't forget, my focus is all about: - Simplifying things - Making life easier - Reducing stress - Helping you succeed So, let's keep it simple and clear. We'll show you how to tackle those tricky tasks in a stress-free way. We'll also give you tips and tricks to help you stay on track and achieve your goals. Because together, we can make success easier to achieve.

These are my standards and how the firm satisfies them (in italics).

Hydro isn't cheap, but it's attractive.

This article talks about some stocks that don't trade on a big U.S. exchange. Be careful because they're risky.

This article talks about one company to invest in, but there are others. iREIT on Alpha has better investment ideas. You can subscribe to iREIT on Alpha to learn more.