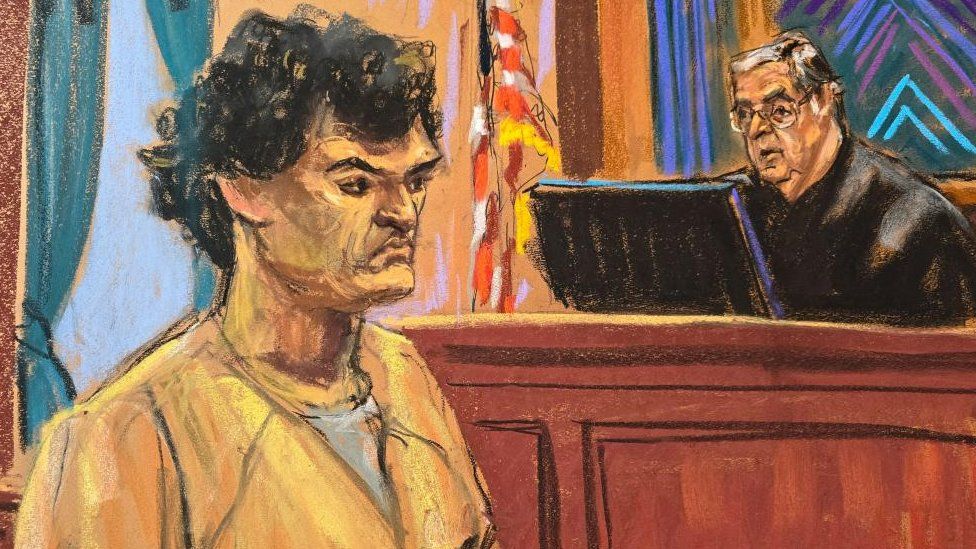

Fallen 'Crypto King' Sam Bankman-Fried gets for 25 years for fraud

Rewritten: Written by Natalie Sherman, Kayla Epstein, and Michelle Fleury, this section of the blog discusses a different perspective on a particular topic using alternative vocabulary.

Sam Bankman-Fried, one of the co-founders of the crypto exchange called FTX that unfortunately did not succeed, has been given a 25-year prison sentence. This punishment comes after he was found guilty of tricking both customers and investors of the company, which is now bankrupt.

The decision solidifies the downfall of the ex-billionaire who gained notoriety for being a prominent supporter of cryptocurrency prior to his company's sudden collapse in the year 2022.

He was discovered to have taken billions of dollars from clients prior to the company's collapse.

During his court appearance, the individual who is 32 years of age expressed that he is aware of the fact that numerous individuals feel very disappointed.

"I apologize for what happened at all stages," he murmured softly and distinctly prior to his sentencing.

Before it met its demise, FTX used to be one of the biggest cryptocurrency exchanges globally. This catapulted Bankman-Fried to business stardom, and attracted millions of customers who utilized the platform to purchase and exchange cryptocurrencies.

Gossip about money problems caused a sudden increase in people withdrawing their deposits in 2022. This led to the company collapsing and revealing Bankman-Fried's wrongdoings.

Last year, a New York jury found him guilty of wire fraud and participating in a scheme to launder money. During the trial, it was revealed that he had unlawfully obtained over $8 billion from clients and then diverted the funds towards buying real estate, making political contributions, and investing in other ventures.

On Thursday, Judge Lewis Kaplan criticized Bankman-Fried for his dishonesty during the trial. He stated that Bankman-Fried had lied about his knowledge of his companies using customers' entrusted money for different motives, claiming that he was unaware until the last minute.

The judge stated that the person was aware that their actions were not right and involved breaking the law. Despite this, they regret that they misjudged the possibility of consequences and getting caught. However, the person is not willing to confess to their wrongdoing.

Even though Bankman-Fried expressed regret for the loss suffered by his customers, he did not express any remorse for the horrible crimes committed, according to the speaker.

Although 25 years is a severe punishment for imprisonment, it is significantly lower than the maximum sentence Bankman-Fried could have been given as per the government's regulations, which exceeded 100 years.

Where does our motivation come from? Some people might say it comes from within ourselves, while others might say it comes from external factors such as rewards, recognition, or social status. In reality, it's likely a combination of both. Our intrinsic motivation is what comes from our own internal desires, passions, and interests. We do things because we enjoy them or because they align with our values and goals. Extrinsic motivation, on the other hand, is driven by external factors such as financial gain, job promotions, or pressure from others. Both types of motivation are important and can overlap. For example, someone might have a natural love for writing (intrinsic motivation) but also recognize that publishing their work could lead to financial gain or career advancement (extrinsic motivation). Understanding where our motivation comes from can help us better manage and cultivate it. By tapping into our intrinsic motivation, we can find more joy and fulfillment in our daily tasks. And by recognizing external motivators, we can set goals and create rewards that drive us towards success.

Sam Bankman-Fried's parents, Barbara Fried and Allan Joseph Bankman, shared their deep sadness about the verdict, saying that their hearts were shattered.

The judge was advised by federal prosecutors in New York recently that a lengthy duration was not required.

However, they demanded a minimum of four decades, stating that Bankman-Fried had committed an enormous act of deception, while exhibiting "audacious disregard" for the legal system.

The group controlled by Bankman-Fried is predicted to protest the decision and had previously requested a less severe punishment of approximately five to 6.5 years in duration.

It was reported that he had no history of violence and had never been in trouble with the law before. Additionally, they mentioned his struggles with mental health and believed that the customers would receive a sizeable amount of money under a plan that is currently being processed in court for bankruptcy.

In court on Thursday morning, the lawyer representing the victims argued that they deserve to have their money returned to them. He suggested that the perpetrator should be given a sentence that requires him to work diligently to repay all that he has taken.

Mitchell Epner, previously a federal prosecutor and now a lawyer at Rottenberg Lipman Rich, expressed his astonishment regarding the judgment. He mentioned that Bankman-Fried may have the possibility of being set free from jail after approximately 13 years.

According to Jennifer Taub, who is a law professor at Western New England University and has extensive knowledge on white collar crime, the duration of the punishment seems fitting in her opinion.

She stated that finding the proper equilibrium between his age and the intention of dissuasion is crucial.

During the judgment, Judge Kaplan stated that imposing a life sentence may not be required, but Bankman-Fried should receive a penalty that deters him from engaging in unlawful activities in the future.

He stated that the man poses a significant threat and it should not be taken lightly. There is a possibility that he may commit a severe wrongdoing in the future.

Furthermore, he directed Bankman-Fried to surrender $11 billion that can be utilized to provide restitution to those affected.

Some assets belonging to Bankman-Fried, like his shares in Robinhood, have already been taken over by the government. Last year, Robinhood made over $600m from these shares when they were sold.

The decision had minimal impact on Bankman-Fried's outward expression.

In an official announcement, the parents of the accused person who were present throughout the duration of the trial stated that they are deeply saddened and will persist in advocating for their child's rights.

Bankman-Fried has acknowledged that there were errors in the way he managed things, but insisted that he had good intentions.

Before his sentencing, he maintained that FTX had sufficient assets to reimburse its customers before its downfall. He also stated that the causes of the customers' plight had not been fully explained.

He expressed how numerous individuals, including himself, failed the exchange's customers and he couldn't even keep a track of the number. He mentioned how difficult it has been to see the situation unfold.

Bankman-Fried expressed regret for letting down both his customers and former staff members, such as his trusted allies Caroline Ellison and Gary Wang. Although they testified against him during the trial, Bankman-Fried still spoke highly of them in his statement.

He stated that they constructed a truly exquisite creation, putting in all their efforts, and then he ruined it all. This thought troubles him incessantly, day after day.

Many individuals, consisting of past FTX patrons, acquaintances of his parents, and even unknown individuals, submitted letters to the court to influence the verdict.

Louis Dorigny from California, who used to be a client of FTX, expressed that it was a "mixed feelings" situation for those who are owed money.

I do not want anyone to go to prison, and being locked up for 25 years is an incredibly extensive period of time. However, it does not serve as a helpful reparation for the individuals who were impacted by the theft of their cryptocurrency.

The BBC interviewed Samuel Hapak, who is the head of Wincent, a company that creates software. Wincent represented 200 investors who had invested millions of dollars at FTX, a company that became bankrupt. Hapak stated that he believed the decision made was just.

According to him, a quarter of a century is quite a significant span of time and it appears to be a suitable indication to the industry that it should enhance its efforts.

The decision of Judge Kaplan was that Bankman-Fried could not be advised to be detained in a maximum security jail since there was no evidence to show that he had a potential of being violent.

He mentioned that he was considering the worries expressed by his attorneys and guardians regarding Bankman-Fried's social unease caused by autism spectrum disorder, which could leave him exposed in the correctional facility.

The situation of Bankman-Fried has been under close observation by other leaders and companies in the cryptocurrency industry who are also dealing with legal accusations.

However, he is not the initial athlete in the sector to receive a sentence.

Last year, Karl Sebastian Greenwood, who collaborated with 'Cryptoqueen' Ruja Ignatova, received a 20-year prison sentence for persuading millions of individuals to invest over $4bn in the fake currency, OneCoin.

People also compared his situation to Bernie Madoff, who received a 150-year jail sentence for being convicted of a $64 billion Ponzi scheme.

Marc Litt, a previous federal prosecutor who prosecuted Madoff's case and now works as a lawyer at Wachtel Missry, has pointed out notable distinctions between the two scammers. Litt observed that Madoff was much older than the other fraudster during sentencing and had been engaged in criminal activities for several decades. Additionally, Madoff stole from people he was familiar with and didn't have anyone to attest to his good character, which is different from the other fraudster's situation.

He expressed that the court took those distinctions into account without explicitly saying it, and he trusts that the resultant shorter imprisonment term was fitting and is improbable to be changed during the process of reviewing the case in a higher court.