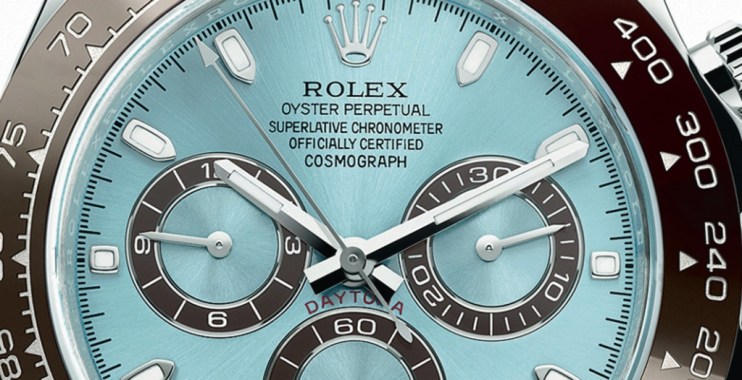

Watches of Switzerland share price plummets 27 per cent after Rolex deal for Bucherer

Blog Post - Friday, August 25, 2023, at 10:07 in the morning

The stocks of Watches of Switzerland plummeted by more than 27 percent today after the announcement of Rolex's acquisition of luxury jeweler Bucherer AG.

Earlier today, the high-end watch retailer, specializing in Rolex watches, attempted to alleviate worries among investors regarding the impact of the acquisition on the company's sales.

According to the company, this acquisition will not result in any alterations to the Rolex procedures for product distribution or allocation.

Yesterday, Rolex made a surprising announcement that they will be acquiring Bucherer, which happens to be one of the largest watch retailers globally.

However, the agreement appears to have instilled concerns among investors that Bucherer will receive more favorable treatment compared to its counterpart, Watches of Switzerland.

Investors appear to be concerned that the merger will result in Bucherer receiving special treatment, such as improved availability of highly sought-after watches, which consumers are eager to purchase, according to Russ Mould, the investment director at AJ Bell.

Watches of Switzerland's attempts to assure the market that there will be no alteration in the way Rolex distributes its stock have been completely disregarded. Although Rolex may have made such assurances at present, they could easily modify their stance in the coming times.

It's important to mention that Watches of Switzerland has been a popular choice among a number of mid-cap fund managers. They will need to carefully examine the Bucherer announcement and determine if it significantly alters the rationale for investing in this company.

The watch industry, including Watches of Switzerland, and the overall high-end market, have demonstrated strong performance despite the prevailing affordability challenges.

During the month of August, the team disclosed a small decline in their earnings for the 13-week period ending on July 30, which amounted to £382m. This represents a decrease of 2.3 percent compared to the corresponding timeframe in the previous year.

Despite this, the article stated that the desire for watches continued to be strong, and the company affirmed its predictions for the entire year. It anticipates earning annual revenue in the range of £1.65bn to £1.7bn.