Superdry announces massive restructuring plan as it exits the stock market

Superdry, an international brand with its headquarters in Gloucestershire, is hoping to improve its financial situation by implementing a significant restructuring initiative. This endeavor will involve several strategies aimed at reducing expenses, such as withdrawing from the London Stock Exchange.

Superdry has declared that it will be withdrawing from the London Stock Exchange as a component of a revamping proposal intended to facilitate the multinational entity in getting back on track from its recent monetary difficulties.

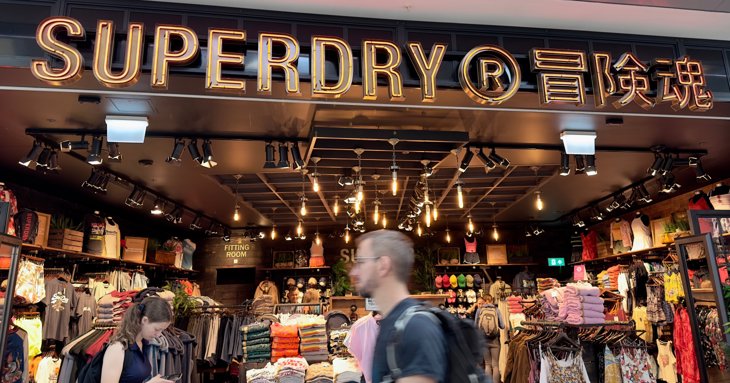

Based in Cheltenham, the fashion company, renowned for its hoodies and outer garments, has more than 94 stores in the United Kingdom, with additional franchise establishments worldwide.

The plan for restructuring mostly entails operating through a fresh target operating system, resulting in a disruption in the stock market. Superdry deems it appropriate to carry out this plan "away from the increased attention of public markets."

Superdry expects to save a considerable amount of money each year by delisting, which will help to achieve its goal of operating more efficiently.

The company needs permission from its shareholders to make an exit. This topic will be talked about at a future gathering for all members before the brand can request for its shares to be removed from the Official List managed by the FCA.

The plan to restructure will also include making changes to Superdry's lease agreements to decrease their losses and responsibilities pertaining to their properties.

After finishing, the strategy will implement several actions intended to reduce expenses in order to prevent the company from entering bankruptcy, such as decreasing the rent payments for 39 stores located in the United Kingdom. Nonetheless, the plan declares that it will not impact the regular operations of Superdry.

The organization is suggesting a plan in which they will issue new shares, commonly known as equity raise. This will help them have enough funds to cope with the difficult trading environment. The CEO and co-founder, Julian Dunkerton, has fully endorsed and guaranteed this proposal.

Shareholders will be presented with two possible paths for the equity raise. Julian and Peel Hunt, who serve as financial advisors for Superdry, will take careful thought before choosing one. The first option, A, includes an open offer where shares are sold for £0.01 each. The total amount raised could reach €8 million. Option B is a placing where shares are sold for £0.05 each, with the total amount raised set at £10 million.

Julian owns around 26.36% of the total shares that Superdry has made available to the public. He has supported all the suggestions that were made during the general meeting, matching the opinions of each director who has shares in the company.

On Tuesday, April 16th, 2024, he stated, "This announcement is an important milestone in the history of Superdry."

Basically, these plans are setting up the company for a successful future after a really tough time. I understand that this will affect everyone connected to the company and I've done my best to make sure their needs are considered in these plans we're sharing with you now.

I have decided to financially support this share offering as a way of showing my ongoing dedication to Superdry, its investors, suppliers, and employees. I still have a deep love for this fantastic UK-based company and its brand, just as I did when I first established it.

Based on a tentative schedule, Superdry intends to implement plans by July 2024.