Those who invested in Woodward (NASDAQ:WWD) three years ago are up 57%

When you invest in an index fund, it is quite simple to achieve a return similar to the overall market. However, some of us have aspirations for even higher returns and choose to create our own portfolio. Take Woodward, Inc. (NASDAQ:WWD) as an example; their shareholders have witnessed the share price increase by 54% in the past three years, surpassing the market return of 33% (excluding dividends). However, it is important to note that the recent returns have not been as impressive, as shareholders have only seen a 36% increase, including dividends.

So let's explore and determine if the company's performance over a longer period matches the progress made by its core business.

Take a look at our most recent examination of Woodward.

Although some still teach the efficient markets hypothesis, evidence has demonstrated that markets are dynamic systems that tend to over-react, and investors are not consistently rational. To assess the shift in market sentiment over time, we can analyze the correlation between a company's stock price and its earnings per share (EPS).

In the past three years, Woodward did not see any growth in earnings per share. In fact, they experienced a decline of 16% per year on average.

Therefore, it appears unlikely that the market is predominantly relying on EPS as the primary indicator of a company's worth. In light of this circumstance, it is logical to consider alternative measures as well.

The small 0.7% dividend yield is unlikely to be supporting the stock price. It is easy to understand how long-term investors feel about the decreasing trend in revenue (falling at a rate of 3.2% yearly). It is evident that the past earnings and revenue don't align well with the stock price movement. Therefore, further investigation is necessary to fully comprehend the situation.

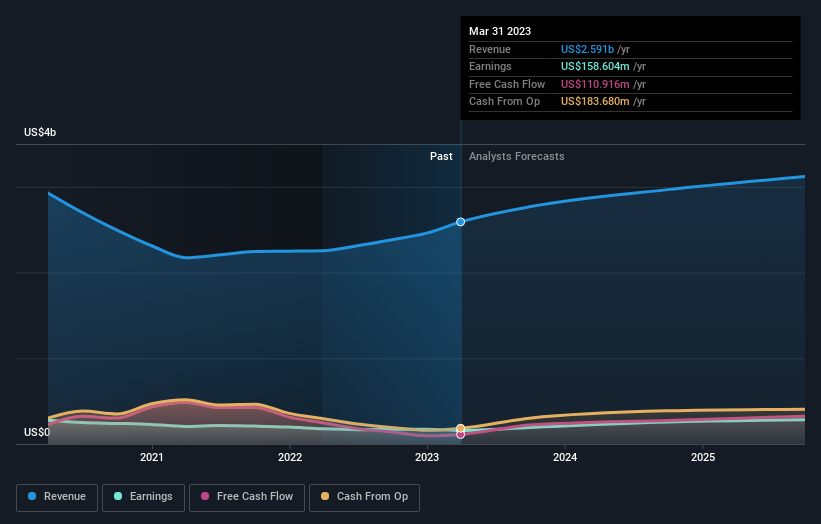

You can observe the fluctuations of earnings and revenue over time in the image provided below (click on the chart to view the specific figures).

We appreciate the fact that individuals with inside knowledge have purchased stocks within the past year. However, it's crucial to consider future earnings as they play a significant role in determining profits for existing shareholders. To gain a better understanding, we suggest referring to this complimentary report that showcases analyst predictions for Woodward.

In addition to assessing the increase in stock value, it is essential for investors to take into account the overall return for shareholders. While the share price return solely represents the variation in the stock price, the total shareholder return (TSR) incorporates the value of dividends (assuming they were reinvested) and the advantages gained from discounted capital raising or spin-offs. One could argue that the TSR provides a more comprehensive evaluation of the profit generated by a particular stock. In the case of Woodward, their TSR over the past 3 years stands at an impressive 57%, surpassing the previously mentioned share price return. This indicates that the dividends distributed by the company have significantly contributed to the overall return for shareholders.

It is pleasing to observe that shareholders of Woodward have experienced a total return on their investment of 36% in the past year. This return includes the dividend payouts. This gain surpasses the annual return over the past five years, which was only 9%. Consequently, it appears that there has been a positive sentiment towards the company recently. In the most favorable scenario, this could indicate that there is genuine business momentum, suggesting that now might be an opportune moment to further explore Woodward. Investors who seek financial gains often verify insider purchases, including the price paid and the overall amount acquired. You can access information regarding the insider purchases of Woodward by clicking on this link.

If you are someone who enjoys purchasing shares in companies together with the executives, then you may find great interest in this selection of businesses available without charge. (Suggestion: individuals with insider status have been engaging in purchases).

Please be aware that the market returns mentioned in this blog represent the average returns of stocks traded on American exchanges, based on their respective market weights.

Making Valuation Simple: Our Helping Hand

Discover if Woodward is possibly over or undervalued by exploring our thorough analysis, encompassing evaluations of fair value, potential risks, cautionary notes, dividend information, insider activities, and overall financial well-being.

Check out the complimentary analysis

Do you have any thoughts about this article? Are you worried about the information provided? Contact us directly if you have any concerns. You can also send an email to the editorial team at editorial-team (at) simplywallst.com.

This blog post from Simply Wall St is of a general nature. We offer our thoughts and analysis based on past information and predictions from experts, using a fair approach. Our aim is to provide informative content, but please note that it is not intended to provide financial advice. We do not suggest buying or selling any stocks and we do not take into account your personal goals or financial situation. Our analysis focuses on long-term perspectives, using fundamental data. Please be aware that our analysis may not consider the most recent price-related updates or qualitative information from companies. Simply Wall St does not have any positions in the stocks mentioned.