TG Therapeutics, Inc.'s (NASDAQ:TGTX) Shift From Loss To Profit

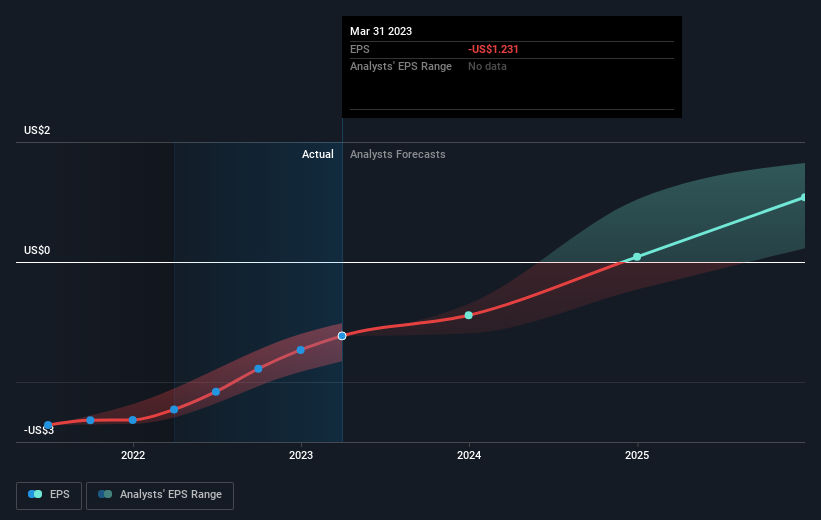

TG Therapeutics, Inc. (NASDAQ:TGTX) is potentially on the verge of a significant milestone in its business, so we would like to highlight the company. TG Therapeutics, Inc., a biopharmaceutical company in the commercial stage, focuses on obtaining, developing, and selling innovative treatments for B-cell diseases. The company, which has a market capitalization of US$3.2 billion, has seen a decrease in its losses. In the previous financial year, it reported a loss of US$198 million, but in the most recent twelve-month period, that loss decreased to US$169 million, indicating that it is getting closer to breaking even. Many investors are curious about when TG Therapeutics will start making a profit, and the main question is, "When will the company break even?" We have compiled a brief overview of what industry analysts expect for the company's break-even year and its anticipated growth rate.

Take a look at our most recent examination for TG Therapeutics.

Eight analysts from American biotech companies have reached a consensus that TG Therapeutics is close to reaching the point where they will have neither profit nor loss. They anticipate that the company will report a final financial loss in 2023, but will then make a profit of $22 million in 2024. Therefore, it is predicted that the company will reach the point of neither profit nor loss just over a year from now. To achieve this milestone, we have calculated the rate at which the company needs to grow each year. It has been determined that an average annual growth rate of 65% is expected, which is very optimistic. However, if this growth rate proves to be too ambitious, the company may not become profitable until a later time than what the analysts have predicted.

We won't delve into the specific advancements of TG Therapeutics in this overview, but it's important to consider that in the world of biotechnology, cash flows can be unpredictable and depend on the type of product and stage of development. Therefore, it's not unusual for a company to experience significant growth in the near future as they start to see returns on their previous investments.

Before we conclude, there is an important topic I'd like to address. TG Therapeutics presently possesses a debt-to-equity ratio that surpasses 2 times. Ordinarily, it is advisable for debt not to exceed 40% of your equity; however, in this instance, the company has greatly exceeded this threshold. It is crucial to mention that high debt obligations elevate the level of risk associated with investing in a company that is currently experiencing financial losses.

There are essential principles of TG Therapeutics that are not discussed in this article, but we want to emphasize again that this is only a simple summary. If you want a more detailed understanding of TG Therapeutics, visit their company page on Simply Wall St. We have also compiled a list of significant aspects that you should investigate further:

Simplifying Valuation: Our Expertise In Complexities

Discover if TG Therapeutics is potentially priced too high or too low by reviewing our thorough analysis that includes estimates of fair value, potential risks and alerts, dividend information, insider transactions, and financial stability.

Take a look at the complimentary analysis

Want to share your thoughts on this article? Worried about the information provided? Contact us directly. Alternatively, you can send an email to the editorial-team at simplywallst.com.

This content from Simply Wall St is not specific and is not intended to give personalized financial advice. The information is based on past data and expert predictions, using a fair approach. It should not be considered as a suggestion to trade any stocks and does not consider your personal goals or financial situation. Our goal is to provide in-depth analysis that focuses on the long-term prospects of a company, using fundamental information. Please note that our analysis may not include the most recent announcements or subjective material that may affect stock prices. Simply Wall St does not hold any positions in the stocks discussed.