Don't Buy Kentucky First Federal Bancorp (NASDAQ:KFFB) For Its Next Dividend Without Doing These Checks

For wealth growth, some investors rely on dividends. If you're someone who pays close attention to dividends, you might find it interesting that Kentucky First Federal Bancorp (NASDAQ:KFFB) is going ex-dividend in just 4 days. The ex-dividend date is usually set one business day before the record date, which is the deadline to be listed as a shareholder on the company's books in order to receive the dividend. The ex-dividend date is important because the settlement process takes two full business days. So if you miss that date, you won't be listed on the company's books by the record date. Therefore, investors of Kentucky First Federal Bancorp who buy the stock on or after July 28th won't receive the dividend, which will be paid on August 24th.

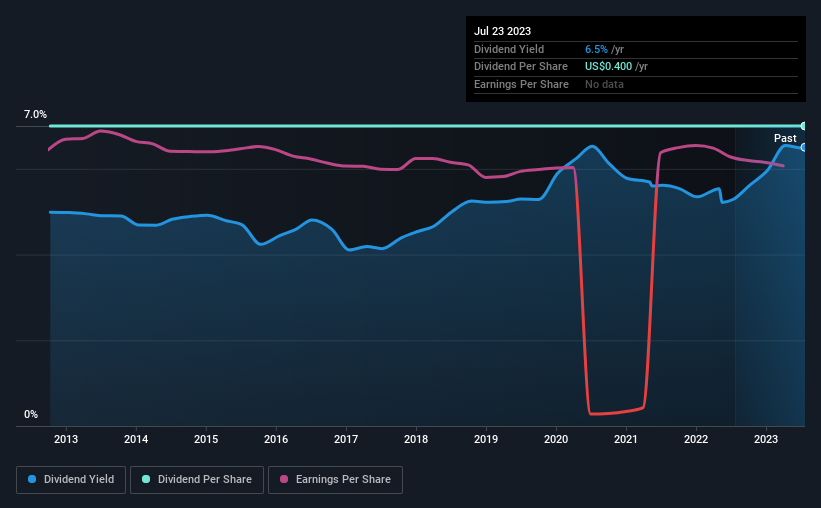

The upcoming payout from the company will be US$0.10 for each ownership unit. In the previous year, the total sum distributed to shareholders was US$0.40. By examining the payouts from the past year in relation to the current stock price of $6.15, Kentucky First Federal Bancorp has a trailing yield of 6.5%. Dividends play a significant role in generating returns for investors holding stocks for a long period, but this is only possible if the company continues to pay out dividends. Consequently, it is imperative to investigate whether Kentucky First Federal Bancorp is financially capable of maintaining its dividend and if there is potential for its growth.

Take a look at our most recent examination for Kentucky First Federal Bancorp.

Usually, companies distribute dividends using their earnings. However, if a company allocates more funds to dividends than it actually earned in profits, there is a possibility that the dividend is not sustainable. The fact that Kentucky First Federal Bancorp paid out an alarmingly high 298% of its profits as dividends last year raises concerns and suggests that there might be aspects of the business that we do not comprehend entirely.

If a company disburses a dividend that is not adequately supported by profits, it is usually considered to be at a higher risk of being reduced.

To discover the amount of profit that Kentucky First Federal Bancorp distributed in the past year, click on the link provided.

Are Earnings And Dividends Growing?

Companies that have a promising future in terms of growth are typically the ones that offer the most attractive dividends. The reason behind this is that when a company's earnings per share are on the rise, it becomes much easier for them to increase the dividends they pay to their investors. Investors have a strong affinity towards receiving dividends, so if a company's earnings decline and subsequently its dividend payments are reduced, it can expect to face significant selling pressure from investors. Therefore, it is reassuring to witness a 3.9% annual increase in Kentucky First Federal Bancorp's earnings per share over the past five years.

Most investors typically evaluate a company's potential dividends by examining its historical dividend growth rate. It appears that the dividends of Kentucky First Federal Bancorp have remained virtually unchanged over the past decade.

Summing It Up

Is Kentucky First Federal Bancorp a good stock to receive dividends from or should we avoid it? While Kentucky First Federal Bancorp has been increasing its earnings per share at a reasonable rate, its dividend in the past year was not adequately supported by these earnings. Kentucky First Federal Bancorp does not seem to have many positive factors, and therefore, we are not willing to take the risk of investing in it solely for the dividend.

With that being said, if you're examining this stock without placing much emphasis on the dividend, it is still important for you to be aware of the potential risks associated with Kentucky First Federal Bancorp. Every organization carries its own set of risks, and we have identified three cautionary indicators for Kentucky First Federal Bancorp that you should be informed about.

In general, it would not be advisable to simply purchase the initial dividend stock that catches your eye. Below is a carefully selected collection of captivating stocks that exhibit high dividend-paying capabilities.

Do you have any input on this article? Are you worried about the information? Contact us directly. Alternatively, send an email to editorial-team(at)simplywallst.com.

This blog post from Simply Wall St has a broad focus. We offer analysis that is based on past information and predictions from experts. We follow a fair approach in our methodology and our content is not meant to be financial guidance. It does not suggest any specific action to purchase or sell stocks and does not consider your goals or financial position. Our goal is to provide you with in-depth analysis that is driven by fundamental data and focused on long-term outcomes. Please note that our analysis may not include the most recent announcements from companies that could impact stock prices or subjective information. Simply Wall St does not hold any positions in the stocks mentioned.

Participate in a paid user research session and receive a generous US$30 Amazon Gift card in exchange for just 60 minutes of your valuable time. By joining us, you will play a crucial role in the development of improved investing tools tailored specifically for individual investors, just like you. Don't miss out on this opportunity and click here to sign up now!