Pathward Financial's (NASDAQ:CASH) three-year total shareholder returns outpace the underlying earnings growth

If you invest in a company without borrowing money, the absolute worst outcome would be losing all the money you invested. However, on the other hand, you have the potential to earn much more than 100% if the company performs well. For example, the stock price of Pathward Financial, Inc. (NASDAQ:CASH) has skyrocketed by 142% in the past three years, which most investors would be pleased with. However, in the last week, the shares have experienced a decline of 5.9%.

Given the recent decline of 5.9% in the stock's value over the last week, we aim to delve deeper into the bigger picture and determine if the company's positive three-year performance can be attributed to its underlying factors.

Take a look at our most recent examination of Pathward Financial

Although markets serve as an effective means of determining prices, the value of shares not only reflects the actual performance of a business but also the sentiment of investors. By examining the fluctuations in earnings per share (EPS) and share prices over a period, we can gain insights into how the perception of a company by investors has evolved.

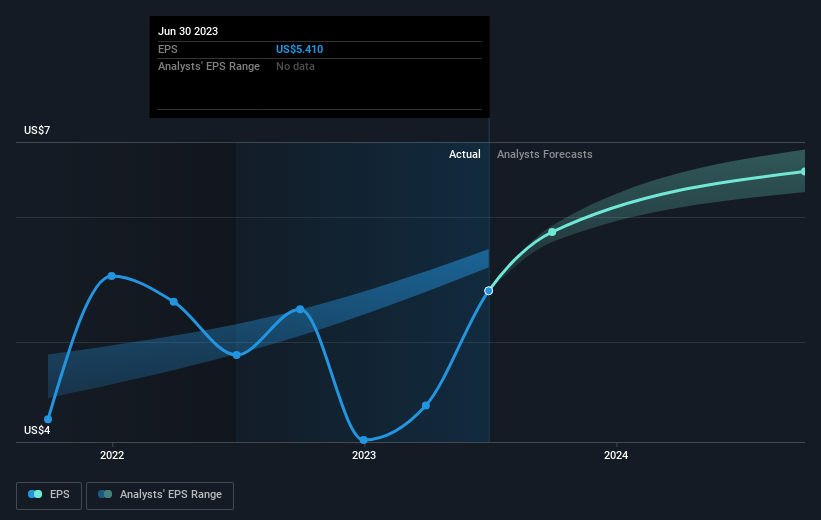

Pathward Financial experienced a commendable annualized EPS growth rate of 23% over a span of three years, which consequently propelled the share price upwards. However, it is important to note that this EPS growth falls short in comparison to the average annual increase of 34% in the share price. Therefore, it can be reasonably concluded that the market now holds a more favorable view of the business than it did three years ago. This development is not astonishing, given the consistent track record of earnings growth that the company has exhibited over the past three years.

Take a look at the chronological evolution of EPS (find the specific figures by selecting the image).

We are pleased to see that individuals with insider knowledge have been purchasing shares in the past year. However, it is generally believed that the growth patterns of earnings and revenue provide more significant insights into the company's performance. If you wish to delve deeper into the stock, we recommend exploring this informative report on Pathward Financial's earnings, revenue, and cash flow, which is available for free and offers interactive features.

It is crucial to take into account both the overall shareholder return and the return on the share price when evaluating a stock. The overall shareholder return includes the value of any spin-offs or discounted capital raisings, as well as the dividends, assuming that these dividends are reinvested. It can be argued that the overall shareholder return provides a more comprehensive view, especially for stocks that offer dividends. In the case of Pathward Financial, its overall shareholder return over the past 3 years stands at an impressive 146%, surpassing the previously mentioned share price return. This significant increase can largely be attributed to the dividend payments made by the company.

It's great to see that shareholders of Pathward Financial have experienced a total return of 34% in the past year, including dividends. This is higher than the five-year return of 12% per year, indicating an improvement in the stock's performance recently. With the share price continuing to increase, it would be wise to examine the stock more closely to avoid missing out on a potential opportunity. If you're interested in researching this stock further, checking out information on insider buying is a good starting point. Click here to view the individuals who have purchased shares and the prices they paid.

There are numerous other firms where insiders are purchasing shares. You certainly wouldn't want to overlook this complimentary compilation of flourishing companies being invested in by insiders.

Please be aware that the market returns mentioned in this article represent the average returns of stocks traded on American exchanges, considering their market weight.

What possible dangers and potential advantages does Pathward Financial face?

Pathward Financial, Inc. functions as the parent entity for Pathward, National Association, offering a wide range of banking offerings and solutions across the United States.

Trading at a significant discount of 41.4% under our calculated fair value

Profits are predicted to increase by 3.81% annually.

Profits have increased by 18.1% annually in the last 5 years.

Our risk evaluations have not identified any potential risks for CASH.

Do you have any comments about this article? Are you worried about the information in it? Contact us directly with your feedback. You can also send an email to editorial-team (at) simplywallst.com.

This blog post from Simply Wall St is of a general nature. We offer opinions based on past information and predictions from analysts. Our approach is impartial, and our articles are meant for informational purposes only, not as financial guidance. We do not provide suggestions to purchase or sell any stocks, and we do not consider your specific goals or financial circumstances. Our goal is to provide thorough analysis that focuses on the long-term, using fundamental data. Keep in mind that our assessment may not include recent company announcements or qualitative information that affects stock prices. Simply Wall St has no holdings in any mentioned stocks.