These 4 Measures Indicate That Strategic Education (NASDAQ:STRA) Is Using Debt Reasonably Well

David Iben expressed it effectively when he stated, 'We do not concern ourselves with volatility as a risk. Our main concern is to prevent the permanent loss of investment.' Therefore, it becomes apparent that when assessing the level of risk associated with a particular stock, one must take into account its debt, as excessive debt can potentially lead to the downfall of a company. In the case of Strategic Education, Inc. (NASDAQ: STRA), it is apparent that the company does utilize debt in its operations. However, the crucial inquiry remains as to whether this debt is posing a significant risk to the company.

Is Debt A Problem?

When a business is unable to meet its financial obligations through available funds or by obtaining funding at a favorable cost, debts and other liabilities become a source of risk. In the most severe situation, a company may face bankruptcy if it is unable to repay its creditors. However, a more common yet still costly outcome is when a company is forced to issue shares at significantly reduced prices to strengthen its financial position, thereby diminishing the ownership stake of existing shareholders. Nevertheless, debt can be a useful tool for businesses, especially those that require significant capital investment. The initial step in evaluating a company's debt levels is to examine its cash reserves and outstanding debts in conjunction.

Take a look at our most recent evaluation for Strategic Education

Strategic Education's Debt: How Much?

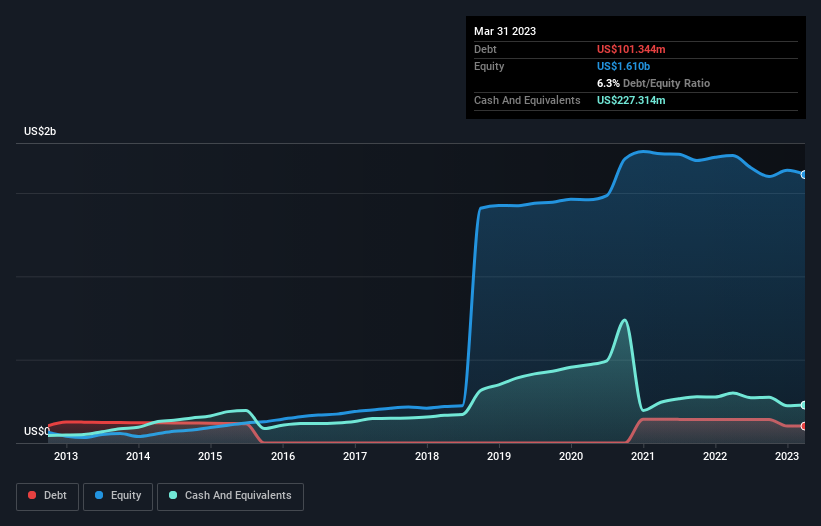

To access the historical data, simply tap on the image provided. It reveals that Strategic Education's debt dropped from US$141.7m to US$101.3m in March 2023 when compared to the previous year. However, it's worth noting that the company also holds US$227.3m in cash, resulting in a net cash position of US$126.0m.

Is Strategic Education's Balance Sheet Healthy?

Based on the most recent financial statement, Strategic Education had debts amounting to US$241.7m that needed to be settled within a year, and debts of US$313.6m that were due beyond a year. Conversely, it possessed a cash balance of US$227.3m and US$71.9m worth of receivables that were expected to be collected within a year. Hence, the total obligations outweighed its available cash and receivables by approximately US$256.2m.

Given that the overall market value of Strategic Education's publicly traded shares is US$1.67 billion, it appears improbable that these liabilities would pose a significant risk. However, it is prudent for us to keep an eye on its financial position, in case it deteriorates. Although there are noteworthy liabilities, Strategic Education also possesses more cash than debt, creating a sense of assurance that it can effectively handle its debt obligations.

It is fortunate that Strategic Education has a manageable workload, as its EBIT declined by 34% in the past year. If this trend persists, decreasing profits could potentially make even small debt quite risky. While we gain valuable insights about debt from the balance sheet, it is the future earnings that will ultimately determine if Strategic Education can sustain a stable financial position. Therefore, if you are interested in the future prospects, you can access a complimentary report featuring analyst predictions for profits.

In the end, a company must have enough available money to pay off its debts, and simply having profits on the books is not enough. Although Strategic Education has some cash on hand, it is important to consider how efficiently they can turn their earnings before interest and tax into free cash flow. This will help us determine how quickly they are either increasing or decreasing their cash balance. Fortunately, Strategic Education has generated more free cash flow than their earnings over the past three years. This is good news for shareholders, as having a steady influx of cash keeps lenders happy.

While Strategic Education may not have a particularly strong financial position based on its balance sheet due to its total liabilities, it is encouraging to see that it has a positive net cash of US$126.0m. What's even better is that it was able to convert 102% of its EBIT into free cash flow, generating US$63m. Therefore, we have no concerns about Strategic Education's utilization of debt. It is undeniable that we glean much information about a company's debt from its balance sheet. However, it is important to note that there may be risks inherent in a company that go beyond what is reflected on the balance sheet. These risks can be difficult to identify. While every company has them, we have identified one warning sign for Strategic Education that you should be aware of.

After everything is considered, it can be simpler to concentrate on corporations that do not require any borrowed money. Right now, readers can freely explore a compilation of growth stocks that have absolutely no net debt.

Making Valuation Simple

Discover whether Strategic Education is possibly overpriced or underestimated by exploring our extensive examination, which encompasses unbiased valuation projections, potential risks and cautions, dividend information, insider dealings, and overall financial well-being.

Take a look at the complimentary analysis.

Do you have any thoughts or opinions about this article? Are you worried about the information it contains? Feel free to contact us directly. Alternatively, you can send an email to editorial-team (at) simplywallst.com.

This blog post from Simply Wall St is written in a broad and general manner. We offer observations based on past information and predictions from analysts, using a fair and impartial approach. Our articles are not meant to act as financial guidance. They do not suggest whether you should buy or sell any stocks, and they do not consider your goals or financial circumstances. Our objective is to provide comprehensive analysis that focuses on long-term factors using fundamental data. Please note that our analysis may not incorporate the most recent company updates or qualitative information that affects stock prices. Simply Wall St has no investments in any of the mentioned stocks.