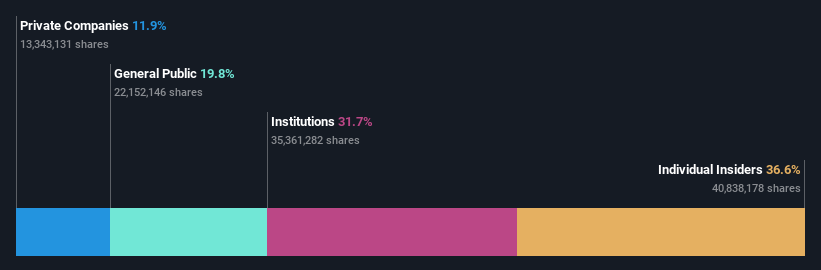

Despite recent sales, FTC Solar, Inc. (NASDAQ:FTCI) insiders still hold the largest share with a 37% interest

Insiders evidently have a genuine stake in the expansion of FTC Solar, evident through their substantial ownership.

The company is predominantly owned by 7 investors, who collectively hold a majority stake of 51%.

Insider transactions in the past

If you are curious about the true owners of FTC Solar, Inc. (NASDAQ:FTCI), you should examine the composition of its shareholder list. It is evident that the majority of the company is owned by insiders, specifically, individual stakeholders, holding a sizable 37% ownership. This implies that this particular group stands to gain the most in the event of the stock's ascent (or suffer the greatest loss should a decline occur).

Despite the recent selling of shares by those with insider knowledge, the group still maintains the highest ownership within the company.

Now, let's further explore every category of FTC Solar's owner, starting with the diagram provided.

Take a look at our most recent evaluation for FTC Solar.

Insights Into FTC Solar's Institutional Ownership

Institutional investors often assess their performance by comparing it to the returns of a widely tracked index. Consequently, they tend to explore the possibility of purchasing sizable companies featured in the applicable benchmark index.

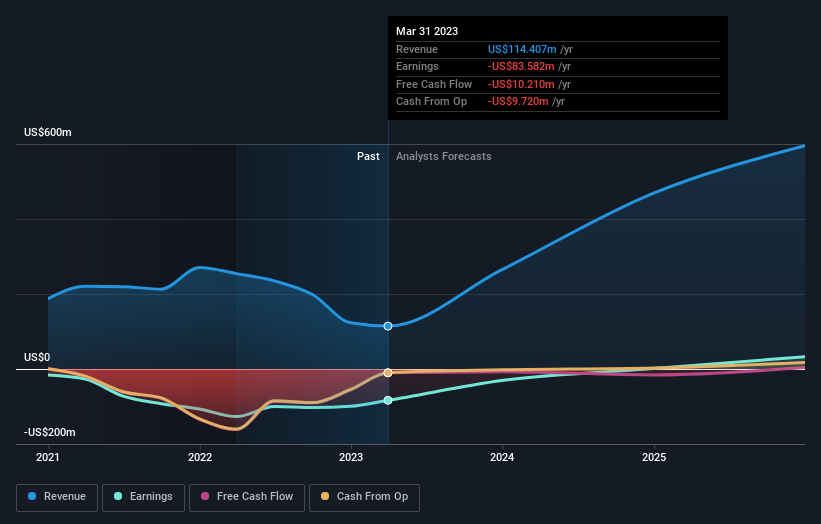

FTC Solar already has established financial institutions as shareholders. In fact, these institutions own a significant portion of the company's shares. This could suggest that the company enjoys a certain level of credibility within the investment community. However, it is important to exercise caution when placing too much trust in institutional investors' validation. Even they are not infallible and can make mistakes. It is not uncommon to witness a substantial drop in share price if two large institutional investors decide to sell their holdings simultaneously. Therefore, it is advisable to examine FTC Solar's previous earnings performance (shown below). Of course, it is important to take into account other factors as well.

Hedge funds don't hold a significant number of shares in FTC Solar. According to our information, Isidoro Quiroga Cortés is the top stakeholder, possessing 14% of the outstanding shares. ARC Family Trust is the second-largest stockholder, controlling 12% of the common stock, while David Springer owns approximately 8.8% of the company's shares. It's worth noting that David Springer, the third-largest shareholder, also serves as a Member of the Board of Directors. Additionally, our findings reveal that the CEO, Sean Hunkler, has a mere 0.6% of the shares attributed to their name.

Additionally, it was noted that the predominant portion of the share register is held by the top 7 shareholders, constituting over 50%. However, to a certain degree, the interests of the larger shareholders are counterbalanced by a few smaller shareholders.

Examining the data on company ownership is logical, but it is also logical to analyze the opinions of analysts to understand the prevailing trend. There are numerous analysts who provide coverage on the stock, making it convenient to explore predictions of future growth.

FTC Solar's Insider Ownership

The meaning of an insider can vary a bit across various nations, but individuals who serve on the board of directors are always considered insiders. While the company's management team is responsible for running the business, the CEO is accountable to the board, even if they happen to be a part of it.

Having a significant portion of insider ownership is advantageous as it signifies that the top management is making decisions with a mindset aligned with the true proprietors of the organization. Nonetheless, an excessively high level of insider ownership might result in a concentrated group within the company gaining excessive control, which can be unfavorable in certain situations.

According to our latest data, a decent portion of FTC Solar, Inc. is owned by individuals within the company. Insiders have a share value amounting to a whopping US$128 million in this US$350 million company. It's quite impressive to witness such a deep commitment from those who hold influential positions within the business. It could be beneficial to verify whether these insiders have made any recent purchases.

The general population, comprised mainly of individual shareholders, holds a 20% stake in FTC Solar, granting them a certain level of control over the company. Although they may not possess absolute decision-making power, their presence holds significant sway and can impact the management of the company.

It appears that a portion of the FTC Solar stock, approximately 12%, is owned by private companies. These private companies may possibly have some connection or relationship with the company. In certain cases, individuals who have insider connections with a public company may hold an interest in it through a private company rather than in their personal capacity. Though it is difficult to make sweeping generalizations based on this information, it is worth considering as an aspect that warrants additional investigation.

I am fascinated by exploring the individuals or entities that have ownership of a company. However, to truly understand the situation, we must also take into account additional data. Therefore, it is important for you to be mindful of the three red flags we have observed regarding FTC Solar.

However, it is the upcoming years, rather than the previous ones, that will decide the success of the business's owners. As a result, we recommend examining this complimentary report that showcases if industry experts anticipate a more promising outlook.

Please note that the numbers mentioned in this blog are derived from data collected over the past year, specifically referring to the 12-month timeframe ending on the final day of the month indicated in the financial statement. It should be noted that these figures may not align with the comprehensive annual report for the entire year.

Do you have any thoughts on this article? Worried about what it says? Contact us directly. Otherwise, send an email to editorial-team (at) simplywallst.com.

This blog post from Simply Wall St is written in a broad manner. We offer our opinions based on past information and expert predictions using a neutral approach. Our articles are not meant to provide financial guidance. They do not suggest whether to invest in or divest from any stocks and do not consider your goals or financial status. Our goal is to provide you with in-depth analysis based on fundamental data that focuses on long-term outcomes. It's important to note that our analysis may not include the most recent company announcements or subjective material that affects stock prices. Simply Wall St does not hold any positions in the stocks mentioned.

Participate in an exclusive user research session and get a generous US$30 Amazon Gift card in exchange for just 60 minutes of your valuable time. By joining us, you will play a vital role in enhancing the quality of investment tools tailored for individuals like you. Don't miss out on this opportunity, register now!