Despite shrinking by US$188m in the past week, TG Therapeutics (NASDAQ:TGTX) shareholders are still up 427% over 1 year

Investors of TG Therapeutics, Inc. (NASDAQ:TGTX) have observed a decline of 16% in the stock price over the course of a month. However, this decrease should not be a cause for concern when taking into account the substantial growth experienced by the stock in the past year. In fact, the share price has skyrocketed by an impressive 427% during that period. Therefore, it is understandable that the stock is experiencing a minor retracement. It remains uncertain whether the current share price accurately reflects the level of optimism surrounding the company, and only time will provide the answer.

Given that the overall performance over an extended period has been satisfactory, although there has been a recent decline of 5.6%, it is worth examining whether the core aspects align with the current value of the stock.

Take a look at our most recent examination for TG Therapeutics

TG Therapeutics did not make a profit in the past year, so it is doubtful that there will be a significant connection between its stock price and its earnings per share (EPS). Instead, we should look at its revenue as a potential indicator. Typically, when a company does not generate profits, we anticipate strong revenue growth. This is because rapid revenue growth, if sustained, often results in speedy profit growth.

Over the past year, TG Therapeutics experienced an 8.3% increase in its revenue. This growth rate is not particularly impressive, especially considering the fact that the company does not generate any profits. Therefore, the sudden 427% gain in just one year is a complete surprise. It is certainly exciting to witness some shareholders earning substantial profits, but we have doubts about whether this surge is justified. This situation exemplifies the remarkable profits that fortunate investors occasionally achieve with growth stocks.

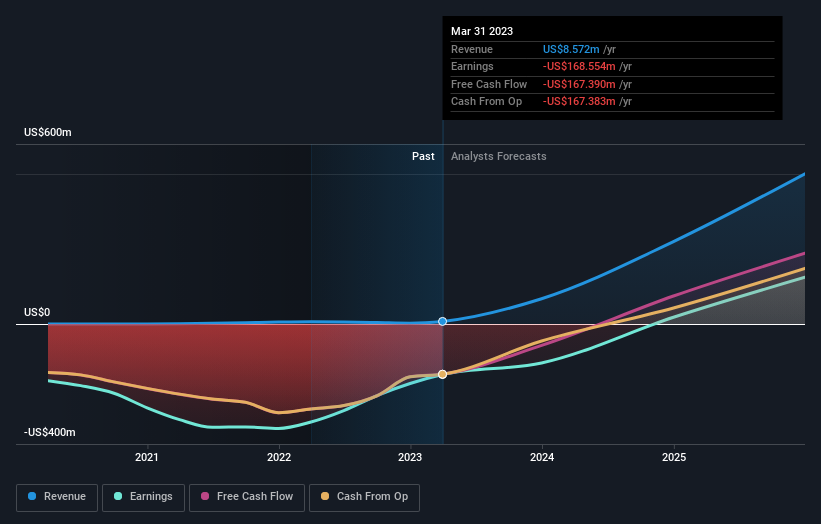

The image below illustrates the fluctuations in earnings and revenue over a period of time. To reveal the precise figures, simply click on the image.

You have the opportunity to observe the changes in its financial statement, whether it has become stronger or weaker, through this interactive visual display without any cost.

We're excited to announce that TG Therapeutics shareholders have experienced a significant increase in their returns. In just one year, they have seen a total shareholder return of 427%, which surpasses the average annualized return of 11% over the past five years. This suggests that the company has been performing exceptionally well recently. This positive trend could indicate that now is a favorable time to explore TG Therapeutics further. It's always fascinating to monitor how a company's stock price performs over an extended period. However, to truly comprehend TG Therapeutics, we must take into account various other factors. It's important to note that our investment analysis has identified four warning signs associated with TG Therapeutics that you should be aware of...

If you are interested in exploring a different company that may have better financial performance, make sure to take a look at this complimentary compilation of companies that have demonstrated their ability to increase their earnings.

Keep in mind that the market gains mentioned in this blog post represent the average returns of stocks listed on American exchanges, considering their respective market weights.

Do you have any thoughts or opinions about this article? Are you worried about the information it provides? Feel free to reach out to us directly. Alternatively, you can send an email to the editorial-team at simplywallst.com.

This blog post from Simply Wall St is written in a broad and non-specific manner. We offer insights based on past information and expert predictions, using a fair approach, and our blog posts should not be considered financial recommendations. They do not provide guidance on whether to purchase or sell any stocks, and they do not consider your personal goals or financial circumstances. Our goal is to provide in-depth analysis that focuses on long-term outcomes and is informed by basic data. Please keep in mind that our analysis may not include the most recent company announcements that could affect stock prices, or qualitative information. Simply Wall St does not have any holdings in the stocks mentioned.

Participate in a Paid User Research Session and earn a US$30 Amazon Gift card for dedicating 1 hour of your time. Your valuable input will assist us in enhancing investment tools specifically designed for individual investors like you. Enroll by clicking on the provided link.