The Fed on Hold as Inflationary Pressures Decrease

The FOMC declared a policy rate "pause" during their June meeting after a long debt ceiling disagreement in Washington was resolved. Although the committee hinted at future rate hikes, Powell didn't place much emphasis on the Fed's projections. Inflation is declining, while the powerful labor market is starting to weaken. Our prediction is that growth and inflation will continue on a downward slope throughout the rest of the year due to increased Treasuries issuance, which will result in market liquidity withdrawal. Credit, equities, and rates have already reflected this with a consensus soft-landing outcome. However, we think that the economy and risk assets are still at risk due to our negative outlook on growth and liquidity.

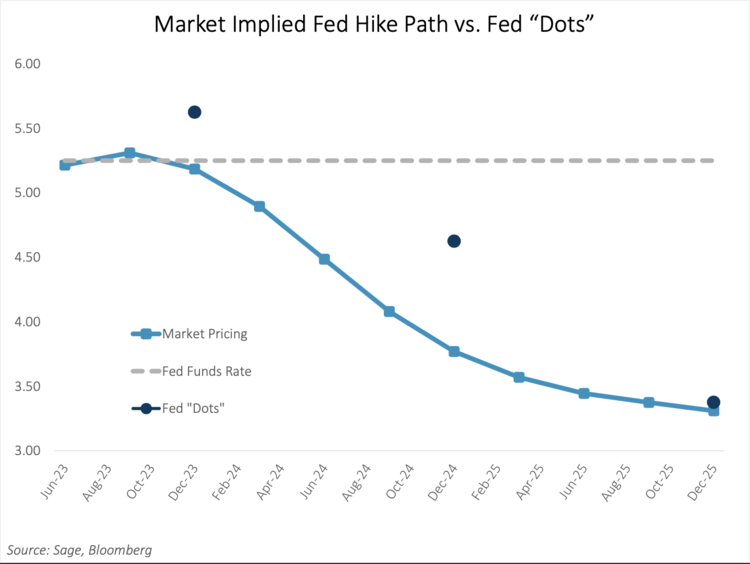

The FOMC decided to keep interest rates steady for the first time in over a year, but the market isn't convinced. The FOMC's projection of two more rate hikes was communicated through a "dot plot," but Powell tried to minimize the importance of this information. However, the market doesn't seem to be adjusting to the Fed's forecast and still anticipates just one more hike for this year, followed by a pause until 2024.

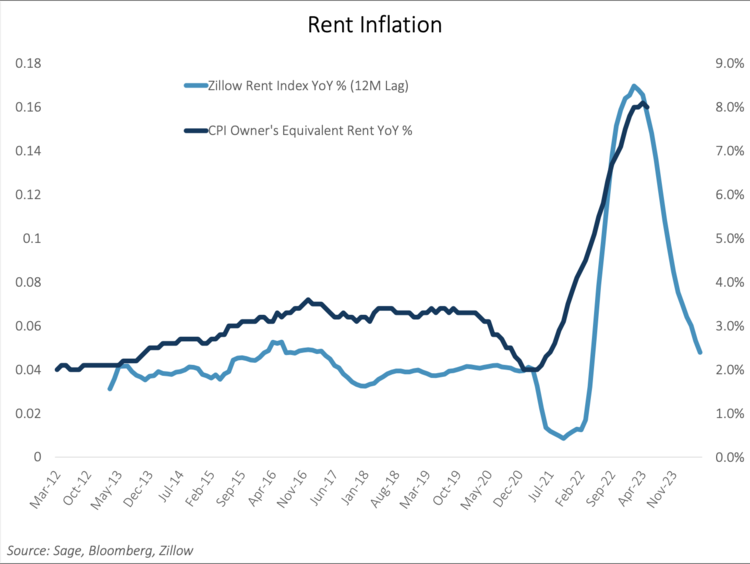

The portion of inflation that has been hardest to control seems to be getting better. Owner’s equivalent rent, which makes up the majority of the Consumer Price Index (CPI), is starting to show signs of decreasing. Rent prices from private sources have been decreasing for a while now, so it was only a matter of time before the OER part of CPI followed suit. Since this is a big and fairly consistent part of CPI, we think that a decrease in OER will lead to a decrease in overall CPI for the rest of the year.

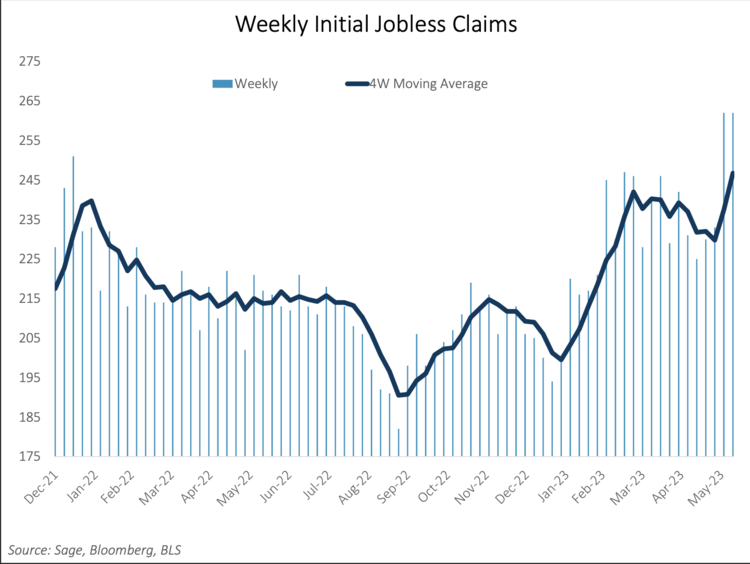

The availability of workers is getting better, and this is expected to help lessen the strain on pay rates. Despite the challenges posed by the pandemic, the workforce has shown great durability fueled by government stimulants provided post-COVID. However, labor markets are starting to give signs of faltering. The most recent data on weekly unemployment claims reveals that the numbers are above anticipated figures and the highest they have been over the past one and a half years.

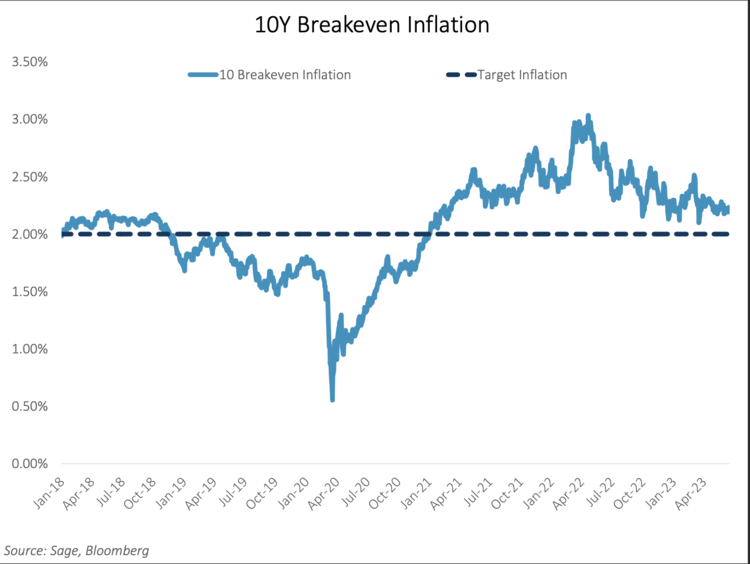

Four. Recommendations for Evaluating Current Market Value using Real Yield and BEI Metrics: The TIPS market's implied 10-year breakeven inflation is presently 2.2%, which is close to the lowest value since the COVID-19 pandemic began and aligns with the Federal Reserve's long-term objective. Moreover, the current real interest rate of 1.5% is the highest it has been in almost 15 years.

Opportunity for Historical Value in MBS: The difference between current-coupon MBS and corporate bond spreads has caught our attention since the latter is near its typical average. This indicates that the former is presenting a great chance for comparative worth, as it seldom trades above corporate bond spreads. With the Fed switching to a "pause" and a decrease in interest rate uncertainty, we hold a positive outlook towards MBS.

To access additional updates, details, and insight, head to the ETF Strategist Channel.

Please take note that this article is only meant to inform and is not intended to provide investment advice or a solicitation to buy or sell any investment product or security. Although the facts, analysis, data, and information presented here are believed to be reliable and sourced from trustworthy sources, Sage does not guarantee their accuracy, and they have not been audited for completeness or accuracy. Sage cannot assure readers that this information is complete or accurate and should not be relied on as such. The opinions presented here by Sage in this report are subject to change at any time due to numerous factors, including market conditions. Investors should carefully consider their financial position and objectives before making any investment decision. Every investment carries risks that may cause a loss of capital. Past performance does not indicate future outcomes. Sage Advisory Services, Ltd. Co., is an SEC-registered investment advisory company that delivers investment management services to institutional clients and high-net-worth individuals. To learn more about Sage and its services, please visit the website at www.sageadvisory.com or contact the firm at 512.327.5530 for its Form ADV.