Buy Now, Pay Later: How are Brits using it?

"Purchase First, Pay Afterwards" (PFPA) is a type of temporary financial support that enables shoppers to acquire a product and then divide the expense into several smaller payments and/or settle it at a deferred moment.

Buy now, pay later (BNPL) services, which are commonly presented as an option when making a purchase online or in-store, can be used for various items like clothes, food, gadgets, and even online betting. However, as BNPL gains more popularity as a payment option for individuals facing financial challenges, we can expect to witness an increase in the number of people facing financial hardships as a consequence.

As Buy Now Pay Later (BNPL) is becoming more widespread, we conducted a study to gather more information about how people utilize these services and their patterns of expenditure. The survey examined the most popular items and services purchased through BNPL, and also explored the matter of debt, including instances where consumers have faced financial troubles due to using BNPL services.

Popular Lending: Buy Now, Pay Later Emerges

Over 17 million UK citizens have availed themselves of a Buy Now Pay Later (BNPL) service in response to the financial hardship caused by the soaring cost of living, which has significantly reduced the disposable income of individuals.

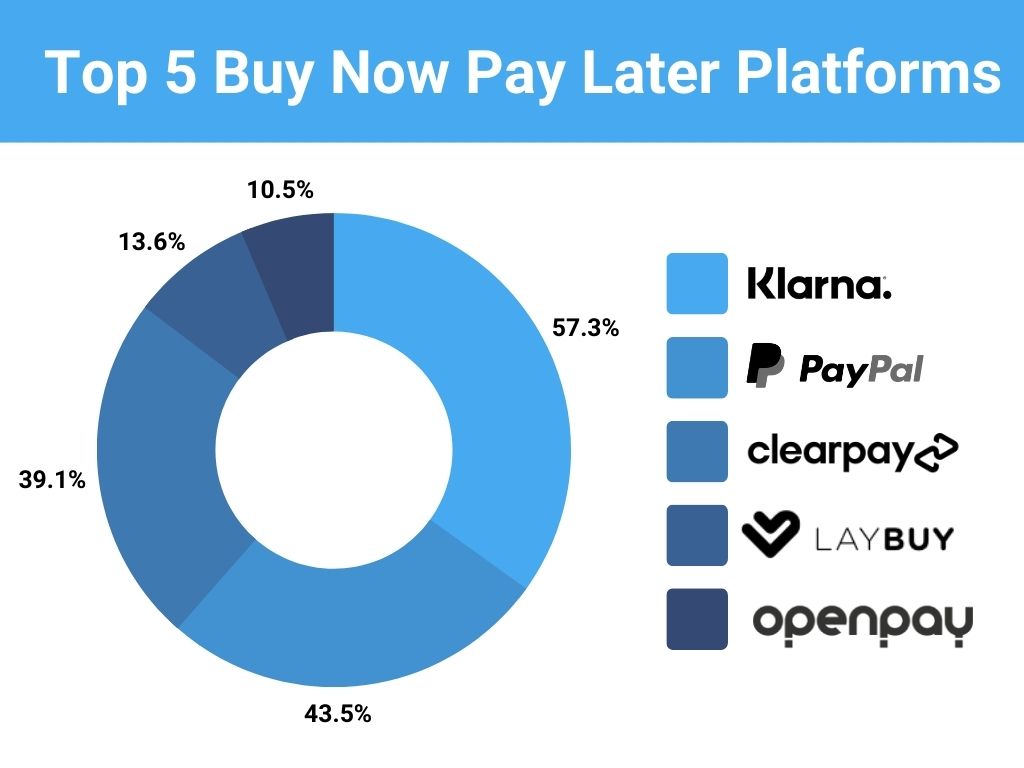

When inquired about the BNPL platforms they presently utilize or have utilized previously, the survey gathered the following Top 5 responses:

What Are Brits Buying With BNPL?

When queried about the items that are frequently bought using BNPL, the majority of respondents (62%) stated that clothing and footwear are the top choices. Following closely behind were health and beauty products, with just over a quarter (26%) of respondents selecting them. Other notable purchases made through BNPL include pet food, vacations, and children's toys.

The research also found that individuals were utilizing BNPL to cover the costs of groceries, beverages, and necessary household items. Approximately 14% of participants indicated that they had used this payment method for such purchases. It was observed that Millennials constituted the largest group within this category, accounting for a staggering 84% of all participants who used BNPL for food and drink expenses.

The study also discovered a new pattern of participants utilizing BNPL services to cover their home-related expenses. Alarmingly enough, a small fraction of individuals (5%) even admitted to using it for gambling purposes. Although only a mere 7% of the respondents claimed to use BNPL for bills or regular expenses, the majority of them happened to be millennials (71%).

When it comes to splurging on loved ones, the statistics revealed that not everybody can manage to cover the expenses outright. A significant portion of those surveyed, roughly 19%, resorted to Buy Now, Pay Later (BNPL) services to finance their purchases for birthdays, special occasions, and Christmas gifts.

Insights: BNPL Helps Shoppers Afford More

In our analysis of how frequently British individuals utilize BNPL services, it was revealed that 12% of respondents confessed to using a BNPL service on a weekly basis, and 28% use it at least two or three times every month. Additionally, 25% attributed their increased online purchases to BNPL, as it allows them to divide the cost over time.

When questioned about the most attractive part of BNPL, 43% of participants expressed that being able to divide payments into instalments enabled them to more effectively handle their monthly and future financial obligations. Additionally, 29% of participants stated that being able to postpone payment for desired products and services appealed to them the most.

When examining the usage of BNPL services by consumers, it comes as no surprise that 85% of respondents reported utilizing them for online purchases. Intriguingly, a significant proportion of individuals (16%) expressed a higher propensity to employ BNPL offerings for buying essential items when physically shopping, particularly with the increasing availability of BNPL options at store checkouts. This trend underscores the ongoing financial challenges faced by individuals in affording daily necessities.

Permitting customers to utilize BNPL face-to-face actively promotes individuals to expend funds they currently lack, empowering them to acquire items right away, yet settle the payment within 30 days or through periodic payments. However, does this facilitate households to accumulate debts more effortlessly?

BNPL Sparks Ongoing Debt

Alarmingly, it appears to be the case. The results of our research unveiled that 15% of individuals polled confess to neglecting crucial bill payments in order to guarantee they have sufficient funds to meet a BNPL (Buy Now Pay Later) deadline. Furthermore, one out of every six participants (16%) are consistently failing to make their BNPL payments on time.

This demonstrates that numerous customers are falling into a pattern of continual debt. Liz Hunter, the Commercial Director at Money Expert, recommended, "Although buy now, pay later can provide a temporary solution for individuals who wish to make a purchase but don't currently have the funds, it's crucial to keep in mind that it is still a form of credit and it could affect your credit report if you don't repay it."

BNPL: Gateway To Luxe Expenses

The emergence of Buy Now Pay Later (BNPL) has revolutionized people's spending habits. Although it is generally advised against taking on debt for unnecessary purchases, consumers are opting for BNPL options to acquire lavish and pricey items.

This information shows that Buy Now Pay Later (BNPL) is enabling British people to exceed their usual spending capacity by purchasing items they wouldn't normally be able to afford. Almost half of the respondents (49%) stated that BNPL services enable them to make pricier purchases by dividing the cost into several monthly payments. Furthermore, almost two-thirds (59%) of those polled indicated that when they opt for splitting payments, they typically spend up to £300.

Shoppers are becoming more astute with their expenditure as 40% of participants indicated that utilizing BNPL permitted them to obtain a greater number of products than they would have been able to if they paid the full amount upfront. This approach enables them to choose which items they prefer to retain and which ones they prefer to return.

Millennials heavily depend on the Buy Now, Pay Later option in order to cover their day-to-day necessities.

Our research shows that millennials are the generation that relies heavily on BNPL services for covering their household expenses, including grocery shopping. However, these individuals also face the challenge of accumulating debt and resorting to BNPL for even their daily necessities like groceries and utility bills.

Interestingly, an alarming proportion of individuals aged 25-34, specifically 48%, have confessed to having failed to meet multiple Buy Now Pay Later (BNPL) payment deadlines. Furthermore, 14% of this age group resorted to missing payments for other expenses in order to fulfill their obligations towards BNPL deadlines. Equally noteworthy is the fact that a significant majority of millennials, comprising 71%, have acknowledged utilizing BNPL to cover their bills.

Speaking about the findings, Liz Hunter, our Head of Business Operations expressed: "It is evident that the emergence of Buy Now Pay Later platforms has had a significant influence on our purchasing habits here in the UK. It comes as no surprise that consumers have responded positively to the option of securing interest-free loans for a short duration, enabling them to acquire desired items without the need for delayed gratification."

Nevertheless, the research indicates that due to the limited assessment of financial capacity by BNPL services, there is a growing number of individuals utilizing them to acquire items that were typically not purchased through any form of credit, like groceries, betting, and utility bills. This shift in behavior is likely a consequence of the persisting affordability crisis, along with rising costs of food and energy, which are starting to impact people's finances and making it harder for households to afford the basic necessities for survival.

Hunter further mentioned that, "The research not only pinpointed millennials as the group most inclined to utilize BNPL services but also as the generation with the highest probability of defaulting on payments, and consequently, accruing undesirable debts."

When utilized appropriately, the buy-now-pay-later (BNPL) payment scheme can serve as a handy and practical substitute for upfront payment of goods and services. Nevertheless, individuals must guarantee their ability to adhere to timely payment deadlines and should only avail BNPL services if confident in their capability to settle the outstanding balance. Failure to meet payment obligations may lead to the imposition of additional fees and have a detrimental impact on your credit rating, potentially causing complications when seeking future credit opportunities.

Liz Hunter concludes by emphasizing the importance of realizing that just because an item can be obtained immediately doesn't mean it should be. When using BNPL schemes, it is crucial to ensure that payments can be made on time and to avoid excessive spending beyond one's means. Before committing to BNPL, it is essential to consider the necessity of the purchase, whether BNPL is the only feasible option, and if one is confident in their ability to meet the repayment schedule. If the answer to any of these questions is negative, it is wise to wait until the item can be purchased with savings to avoid falling into debt.

Avoid Late Fees With Buy Now Pay Later

Keep track of your expenses - It is crucial to keep a record of your purchases and monitor your spending with BNPL. Aim to stick with a single provider, as this will simplify monitoring your purchases and payment due dates, avoiding the hassle of managing various payments across different applications.

Can you manage the future payments? - Before you buy anything, make sure you can handle the repayments for BNPL a month from now. This will protect you from getting stuck if you realize you can't afford the payment when the due date comes, or if you end up neglecting other important payments while trying to pay off your BNPL purchase.

Take the time to go over the terms and conditions - Prior to making your initial purchase, take some time to acquaint yourself with the terms of service and any other policies presented by the BNPL provider. This will help you grasp the exact fees you may face in case you happen to miss a payment deadline. Although reading through terms and conditions can be a bit dull, it can actually save you from incurring extra costs and potentially accumulating debts.

Embrace phone alerts - Arrange payment reminders or notifications to guarantee you never overlook any payment deadlines while using a Buy Now, Pay Later (BNPL) service. All BNPL providers offer notifications that notify you when a payment is due within their applications, and you can also arrange to receive alerts through email and text messages. It is important to verify that these alerts are correctly configured to avoid missing any future payment deadlines.

Make the most of extended payment choices - Certain companies like Klarna offer the opportunity for customers to make payments over several months without any additional interest. If you're buying a pricey item and distributing the expenses over a period of three months would ease the strain on your monthly budget, it's worth considering this beneficial option. Additionally, it will safeguard you from incurring any late fees, as long as you ensure timely repayment of the monthly installments.

Opt for Autopay - It is advisable to activate an automatic payment system while utilizing BNPL to avoid overlooking any payment due dates. Additionally, you can still opt to make manual payments before the due date if you find that you are capable of settling the amount earlier.