Muted Investment Banking to Hurt BofA (BAC) in Q2 Earnings

Bank of America, a major provider of financial services, is anticipated to have experienced a lackluster performance in its investment banking division during the second quarter of 2023. Consequently, the company's revenues from investment banking are unlikely to have had a significant impact on its overall quarterly results. The announcement of Bank of America's performance for the second quarter is expected to take place on July 18th.

The main source of income for investment banks comes from providing advice on mergers and acquisitions and helping businesses restructure. They also earn money through underwriting, which involves managing the issuance of stocks and bonds. Now, let's examine how these revenue streams are expected to have performed in the upcoming financial quarter.

The worldwide process of making deals experienced a decline compared to the previous year during the second quarter of 2023. However, there were signs of improvement towards the end of the quarter. Various factors such as political tensions between countries, a disagreement over the U.S. debt limit, inflation, increasing interest rates, and concerns about a global economic downturn were significant obstacles in this scenario.

As a result, there was a significant decline in the amount of deals made and the overall value of those deals during the last quarter. Consequently, Bank of America's fees for providing advice on these deals are expected to have been negatively affected.

Due to similar circumstances, initial public offerings (IPOs) and subsequent equity offerings became scarce in the upcoming quarter's report. The volume of bond issuances was also subdued as investors became more pessimistic. As a result, it is anticipated that BofA's underwriting fees (which make up approximately 40% of the total investment banking fees) will have been impacted negatively in the quarter ending in June.

We have calculated that BAC's investment banking fees amount to $1.13 billion, showing a slight decrease compared to the amount reported in the same quarter of the previous year.

The management anticipates that the revenues from investment banking in the second quarter will remain relatively unchanged compared to the same period of the previous year.

Q2 Earnings & Revenue Projections

According to the Zacks Consensus Estimate, the earnings for the second quarter are projected to be 84 cents per share. This estimate has been adjusted downwards by 1.2% in the last month. It is expected to show a growth of 15.1% compared to the earnings reported during the same time last year. Our own estimate for the earnings is slightly lower at 83 cents.

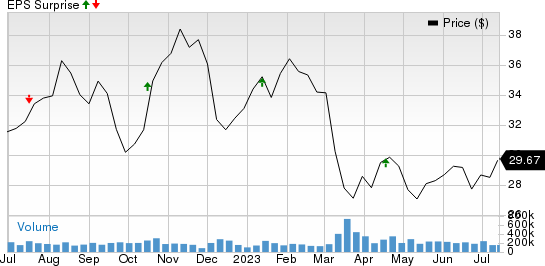

Bank Of America's Surprise Price And Earnings

Surprise in Price and Earnings per Share for Bank of America Corporation

Bank of America Corporation price-to-earnings surprise exceeds expectations.

The general agreement predicts that sales will reach $24.97 billion, showing a growth of 10% compared to the previous year. However, our own estimation places sales at $24.77 billion.

To discover additional elements that may have impacted BAC's overall performance in the upcoming quarter, click on this link.

BAC is anticipated to have profited from elevated interest rates during the second quarter. Nevertheless, the less-than-satisfactory trading and IB results are expected to have detrimentally impacted the Zacks Rank #3 (Hold) stock's revenue growth.

You have the opportunity to view the entire compilation of today’s Zacks #1 Rank (Strong Buy) stocks at this link.

The income generated from IB activities makes up a significant portion of total revenues for financial institutions such as Morgan Stanley and Goldman Sachs.

As the deadline approaches, MS is gearing up to disclose its quarterly performance on July 18, while Jul 19 is the chosen date for GS to release its second-quarter figures.

In regard to MS, the company's management anticipates a decrease in IB revenues compared to the same period last year.

It is anticipated that Goldman Sachs' consultation charges may also have suffered during the quarter due to a drop in transaction activity. Based on our analysis, we predict that GS' investment banking fees for the second quarter will amount to $1.75 billion.

Keep yourself updated on the next earnings announcements using the Zacks Earnings Calendar.

Looking for the most recent suggestions from Zacks Investment Research? Today, you have the opportunity to acquire the 7 most favorable stocks for the upcoming 30 days. Simply click to obtain this report at no cost.

The analysis report for The Goldman Sachs Group, Inc. (GS) is available without any charge.

Bank of America Corporation (BAC): Complimentary Stock Assessment Bulletin

Morgan Stanley (MS): Comprehensive Stock Evaluation Document

To access this post on Zacks.com, simply click here.