What To Expect From Tesla In 2023 (NASDAQ:TSLA)

Tesla, Inc. (NASDAQ:TSLA) is a trailblazer in the electric vehicle industry, completely transforming the automotive sector. With a workforce of 127,855 individuals and a streamlined business approach established under the guidance of Elon Musk, Tesla has emerged as one of the foremost players in the creation and distribution of automobiles and energy storage solutions.

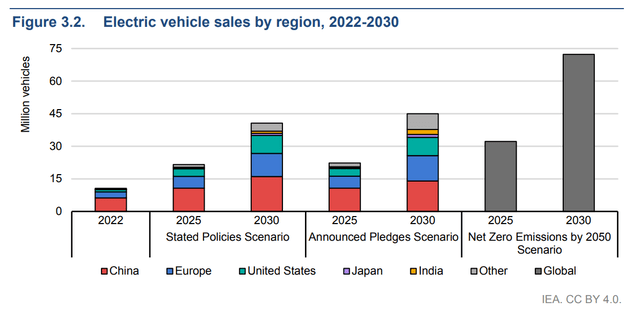

Based on the projections of the International Energy Agency and taking into account the Stated Policies Scenario (STEPS), it is anticipated that there will be around 240 million electric vehicles (EVs) on the roads by 2030. This would represent approximately 10% of all the vehicles present, presenting a significant potential for business growth for Tesla. Nevertheless, the rising competition in the automobile industry poses a challenge for Elon Musk's company as they must invest in improving battery technology and autonomous driving systems, which in turn impacts their profit margins.

In a recent development, Toyota Motor (TM) surprised the automotive industry by showcasing advancements in battery technology and electric vehicle design during a technical presentation. These breakthroughs are expected to result in considerable cost reductions. It is noteworthy that these vehicles are set to be launched by 2026 and will have an impressive range of 600 miles, surpassing that of Tesla. This development could potentially challenge Tesla's financial standing.

Still, 2026 is quite far into the future, but just at the beginning of June, Tesla made an announcement stating that purchasers of Model 3 sedans can benefit from a federal tax deduction of $7,500. This incentive is expected to boost the demand for the company's vehicles. Moreover, the recent discussions held between Tesla's management and the Prime Minister of India might present an opportunity for the company to tap into a rapidly expanding economy. This could potentially lead to a reduction in car production costs, which is crucial for sustaining a positive cash flow amidst declining prices.

We begin our analysis of Tesla by assigning a "hold" recommendation for the subsequent year.

Financial Status & Future Outlook Of Tesla

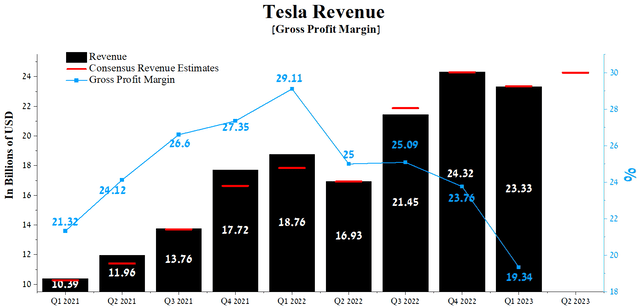

In the initial quarter of 2023, Tesla generated $23.33 billion in earnings, exhibiting a decline of 4.1% when compared to the previous quarter. However, this signifies a significant growth of 24.4% in comparison to the corresponding period of 2022.

The author's expansion, derived from the Seeking Alpha platform.

In the past few financial periods, Elon Musk's organization has faced lackluster financial outcomes, even though the automotive market has been progressing rapidly and the government has been making efforts to motivate people to transition from traditional gasoline cars to electric vehicles.

The year 2021 marked the beginning of bouncing back from the devastating effects of the COVID-19 outbreak. During this time, Tesla showed remarkable growth in vehicle sales, which left a lasting impression on investors, particularly those who tend to be more cautious. This demonstrated that Tesla stands apart from traditional car manufacturers like Ford, Toyota, and Volkswagen, not just in terms of their business approach but also in their progress. However, since 2023, uncertainties have started to loom over Tesla, causing doubts about its association with growth stocks that often have excessively high valuation ratios in the market.

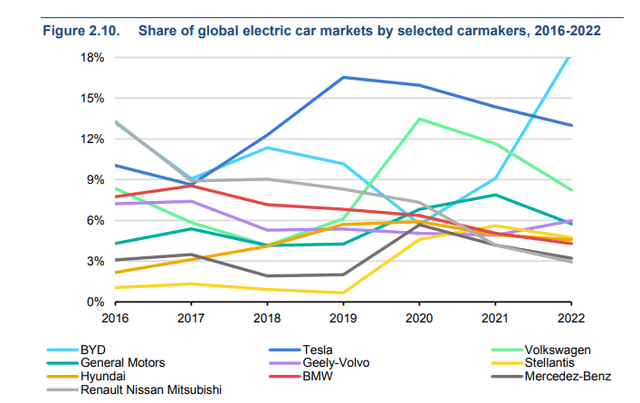

The company's circumstances have taken a turn for the worse in the last few months, and as per the International Energy Agency ("IEA"), Tesla's grip on the global electric car market is diminishing. By the conclusion of 2022, it is projected that Tesla will no longer be the frontrunner, with the Chinese EV powerhouse BYD Company Limited (OTCPK:BYDDF, OTCPK:BYDDY) taking the lead.

In general, the total earnings from car sales reached $18,878 million during the first quarter of 2023. This represents an increase of 21.7% compared to the previous year, but a decline of approximately 6.7% compared to the previous quarter. The decrease in revenue growth compared to the previous year, along with the emergence of negative trends on a quarterly basis, can be attributed to the persistent saturation of the electric vehicle industry and the strengthening of the U.S. dollar in relation to the euro, Chinese yuan, and Japanese yen.

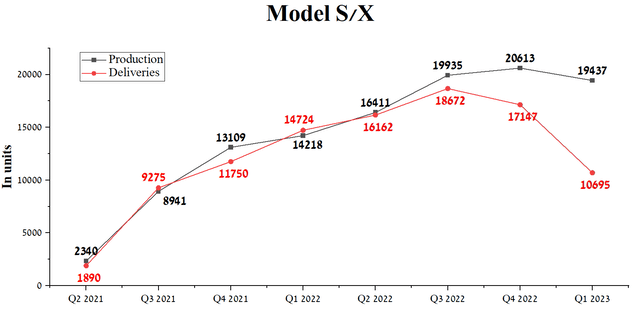

In addition, Elon Musk attempted to counterbalance the heightened rivalry from Chinese car producers and, as a result, initiated a strategy to decrease the retail prices of vehicles like Model 3, Model Y, and Model X in the United States, Asia, and Europe. Regrettably, this endeavor did not succeed, and the combined shipments of Model S and Model X in the first quarter of 2023 dropped significantly compared to the preceding quarter, amounting to a total of 10,695 units.

The author's detailed explanation, derived from the securities reports published every three months.

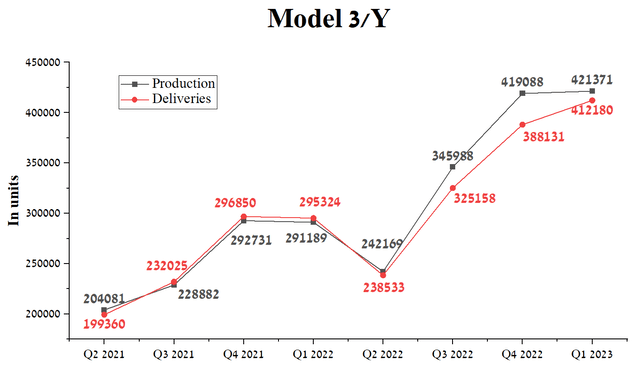

Furthermore, we are witnessing the steady establishment of production and transportation quantities for the economical Model 3 and Model Y from this American manufacturer. This not only brings into question Elon Musk's proficiency in drawing in fresh clientele, but also speeds up the progress of rivals who are increasingly nearing Tesla's dominant status in the lucrative electric vehicle industry. Consequently, investors are growing concerned.

In this blog post, the writer will expand on the information provided in the quarterly securities reports.

Tesla's revenue for the second quarter of 2023 is predicted to range between $23.3-26.38 billion, representing a 4% increase compared to what analysts had initially projected for the first three months of that year. However, the anticipated revenue will remain on par with the amount earned in the fourth quarter of 2022, which could potentially mark a negative turning point for the company since there seems to be a lack of growth in sales for Tesla products.

According to the China Passenger Car Association (CPCA), there was a mere 2.44% increase in Tesla vehicle sales in May compared to the previous month. This occurred in China, which is considered a vital market for the automobile industry.

In contrast, the Inflation Reduction Act (IRA), which came into effect in January 2023, is once again starting to have a positive effect on the company's stock price. Therefore, at the beginning of June 2023, the company made an announcement that purchasers are now eligible for a $7,500 federal tax deduction on Model 3 sedans. This will contribute to an increase in demand for the company's cars. However, in order to sustain the projected growth in sales for their most affordable vehicle and uphold their position as a pioneer in the industry, Tesla will have to reduce service costs and maintain relatively affordable prices.

Another significant endeavor that will assist in the expansion goals of Elon Musk is the ongoing preparation for the launch of the highly anticipated Cybertruck. Thus, during the Q1 2023 earnings conference, Musk expressed the following.

As for the Cybertruck, we are currently manufacturing initial models of the vehicle on our test production line. This exceptional product is undergoing rigorous testing. Furthermore, we are in the final stages of setting up the main production line at Giga Texas. We anticipate a remarkable delivery event, most likely in the third quarter.

The company's plans are incredibly ambitious, and as reported by Electrek, they anticipate producing 375,000 Cybertrucks every year. However, we have doubts about these expectations being met in the near future. This is because Tesla not only needs to expand and increase the number of factories in the United States and China, but also must swiftly enhance its delivery and charging infrastructure to avoid disappointing customers who have purchased the company's futuristic pickup truck. It is worth noting that Tesla's cumulative sales of cars only surpassed 375,000 units in the fourth quarter of 2022, after approximately ten years since their initial sales. Considering the heightened competition in the market, we believe that the sales pace of the Cybertruck will likely resemble that of the Model S and Model X.

Furthermore, during the month of June in the year 2023, Elon Musk engaged in a meaningful conference with the Prime Minister of India, primarily focusing on the conversation surrounding the automaker's financial involvement in the nation. Assuming fruitful discussions between Tesla's leadership and the Indian government, it is highly probable that facilities for manufacturing electric vehicles and producing batteries will be established in this rapidly progressing nation with immense economic prospects.

Tesla revealed the Cybertruck in 2019, but the COVID-19 pandemic has affected those plans. Although the car is set to launch this year, competition has increased and other companies like Ford, Rivian Automotive, and General Motors have introduced their own pickup trucks. As a result, the prices of the Cybertruck may be lower compared to what they could have been if it was released in 2021. Furthermore, the novelty and excitement of seeing the Cybertruck on the roads may not be as strong as it was for the Tesla Model S back in 2012. This could potentially lead to lower sales than what Elon Musk had anticipated. During the Q1 2023 earnings call, Musk made the following statement.

We have intentions to continue making significant investments in our upcoming projects, such as the advanced Cybertruck platform, manufacturing our own cells, developing energy storage solutions, and enhancing our autonomous and AI-driven products. Our goal is to accomplish all of this while maintaining a strong financial position and remaining at the forefront of the industry.

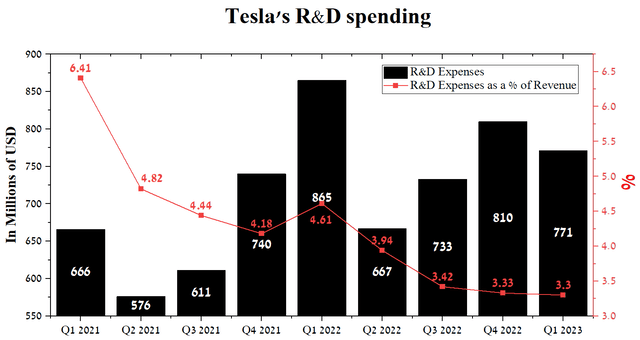

Nonetheless, there is a degree of uncertainty surrounding our ability to achieve the desired objectives, as we believe that the organization is still benefiting from past years when it held the advantage of being an early entrant in the market. However, the pace at which the company has been evolving has noticeably slowed down in recent years compared to the period spanning from 2012 to 2019. This can be attributed to a significant decrease in research and development (R&D) expenditures, which amounted to $771 million in Q1 2023, marking a 10.9% decline on a year-on-year basis. In contrast, Tesla's major rivals such as NIO Inc. (NIO) and Rivian allocate more than 20% of their revenue towards R&D, a situation that could potentially result in Musk's company losing its top position in the automotive industry.

The writer's explanation, derived from Seeking Alpha

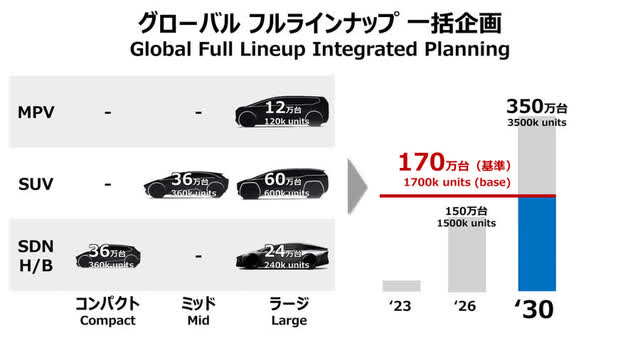

Additionally, as mentioned previously, Toyota Motor surprised the automotive sector by revealing advancements in battery technology and the manufacturing of its electric vehicles during a technical briefing. These innovations promise a longer range compared to Tesla's cars. Furthermore, the structure of Toyota's electric vehicles will consist of only three primary components, thanks to the implementation of giga casting. This breakthrough will considerably reduce the number of production steps and the time required to complete them. Simultaneously, the Japanese company has set a goal to sell 3.5 million electric vehicles by 2030, representing roughly 10% of the global sales in the entire industry, according to the International Energy Agency.

Furthermore, Toyota is actively pursuing the advancement of cutting-edge lithium-ion batteries for the future. These batteries are expected to be fully functional in four years, offering an extended lifespan and quicker charging capabilities. Additionally, the company has made significant technological strides in enhancing the batteries' durability. Considering their anticipated affordability, these advancements are likely to play a vital role in securing a significant market share in the electric vehicle industry, particularly within the affordable segment.

Musk's firm must persevere in broadening its range of vehicles once more and strive to reduce the chances of setbacks in launching fresh plants in order to achieve the target of escalating sales to 20 million electric vehicles annually by 2030.

Based on the findings of the International Energy Agency, and taking into account the projected scenario outlined in the Stated Policies Scenario (STEPS), it is anticipated that the quantity of electric automobiles on the road could soar to 240 million, making up approximately 10% of the entire road vehicle fleet by the year 2030. Concurrently, an estimated 40 million electric cars will be sold annually, presenting promising prospects for both fresh entrants in the market and established car manufacturers.

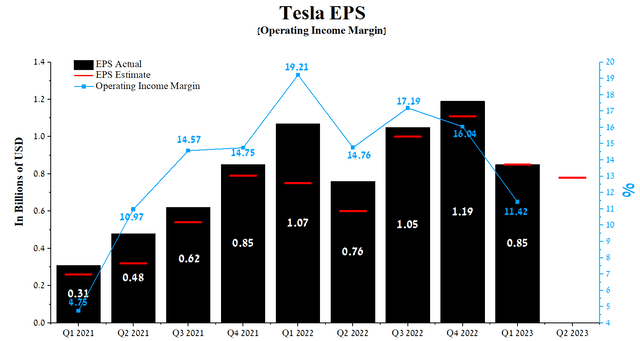

In the first quarter of 2023, Tesla experienced a decrease in its operating income margin, reaching 11.42%. This decline marked a continuation from the previous year's first quarter and fell below the average of 13.74% observed between January 1, 2021, and March 2023.

The monetary amount is greater in comparison to the car sector and major rivals like the Mercedes-Benz Group, Toyota, and Ford, excluding Ferrari. This is another reason why investors are drawn to selecting Tesla as a viable long-term investment.

We predict that Tesla's operating income margin will hit 10% by 2023, and it is anticipated to slightly rise to 11.5% in 2024. This positive development can be attributed to lower inflation, cost-effective manufacturing through economies of scale, and the introduction of Cybertruck and Tesla Semi in the market.

The earnings per share (EPS) of the corporation during the initial three months of 2023 tallied at $0.85. This equated to a decline of 28.6% compared to the previous quarter. Additionally, it is worth noting that in eight out of the past nine quarters, the company's EPS has exceeded the collective forecasts of analysts.

In addition, it is expected that Tesla's Q2 earnings per share (EPS) will be between $0.57 and $0.9, a decrease of 7.1% compared to the estimated earnings for Q1 2023. Meanwhile, Tesla's non-GAAP price-to-earnings ratio (P/E) for the trailing twelve months (TTM) stands at 66.71, which is 418.32% higher than the average for the sector and 60.57% lower than the average for the past five years. However, the non-GAAP P/E ratio for the forward (FWD) period is 73.02, indicating that Tesla is slightly overvalued in the current economic climate where inflation is declining and China is experiencing economic recovery.

The writer's expansion, built on Seeking Alpha

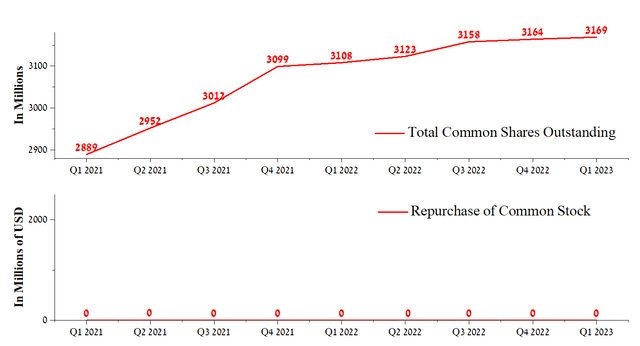

However, we also hold the viewpoint that Tesla's surpassing of the agreed-upon EPS is unrelated to the share repurchase initiative, which the company's leadership contemplated on authorizing in 2022. Elon Musk articulated the following during the Q3 2022 earnings conference.

However, our intention is to follow the correct procedure in implementing a buyback. Rest assured, it is indeed feasible for us to carry out a buyback ranging from $5 billion to $10 billion, even if next year proves to be a challenging period. We possess the capacity to execute a buyback of such magnitude even in the event of adverse circumstances.

Nevertheless, we view the chances of obtaining approval for a share repurchase initiative as fair, despite the fact that the combined cash and short-term investments surpass $22 billion. This is due to the imperative of incessantly advancing the organization in order to sustain its position as an industry frontrunner for as protracted a duration as achievable.

The writer's expansion, derived from Seeking Alpha

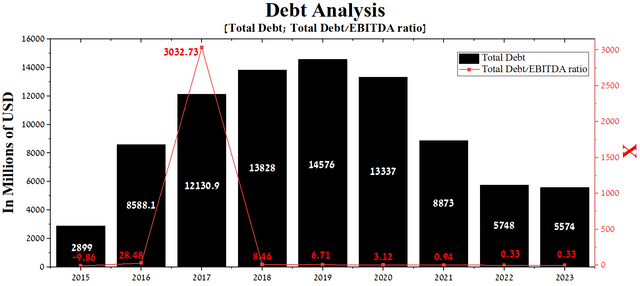

By the close of the initial three months of 2023, Tesla's overall liabilities amounted to roughly $5.56 billion, marking a noteworthy decline from the previous year. Furthermore, the company's debt-to-earnings before interest, taxes, depreciation, and amortization (EBITDA) ratio diminished from 0.94x to an all-time low of 0.33x.

The writer's explanation, drawn from Seeking Alpha.

Given the agreed dates for the senior notes to be paid back, consistent net income, and a low ratio of total debt to EBITDA, we don't foresee any obstacles for Tesla when it comes to redeeming their loans. In fact, we expect Musk to keep up his track record of actively expanding the business.

In the latest turn of events, Toyota Motor surprised the automotive industry by showcasing advancements in battery technology and the design of electric vehicles during a technical presentation. These breakthroughs are anticipated to bring substantial cost reductions. It is noteworthy that Toyota's electric cars, set to be available by 2026, are projected to have a range of 600 miles, surpassing Tesla's capabilities. This development poses a challenge to Tesla's financial standing.

Yet, Elon Musk shows no signs of slowing down. He intends to introduce the Cybertruck and Tesla Semi in the upcoming year, with their sales expected to greatly contribute to restoring Tesla's previous levels of substantial revenue, as was the case prior to 2023.

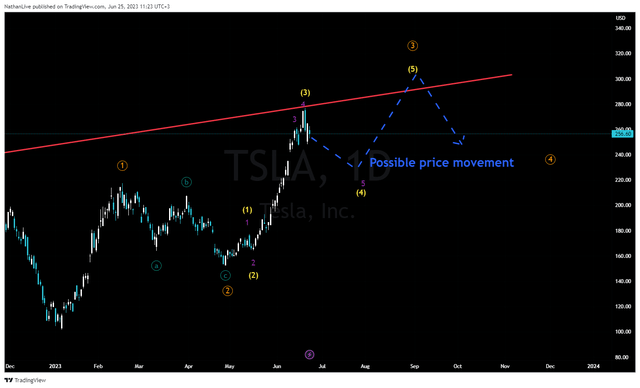

In terms of analyzing Tesla's performance, we have observed that its stock price recently rebounded after hitting a level it struggled to surpass back in 2020. We predict that this corrective trend will persist until it reaches a significant level of support, ranging from $228 to $232 per share. Following this, the company's stock price will likely continue to rise, surpassing the resistance line. This will indicate to investors on Wall Street that those who engage in high-risk investments are once again optimistic about Tesla's prospects.

TradingView is a platform created by Nathan Aisenstadt where users can engage in trading activities using various financial instruments.

We are starting our analysis of Tesla by assigning it a "hold" rating for the upcoming year.

Author's Note: This blog post focuses on one or more stocks that are not traded on a prominent U.S. market. We kindly advise you to acknowledge and consider the potential dangers linked with these securities.

the blog post was authored by.

I am an independent analyst who focuses on finding assets that are undervalued and have the potential for above-average growth. I also look for developments within companies that can greatly improve their financial position. When it comes to investing, I employ medium-term and long-term trading strategies that consider the psychological and behavioral aspects of the market. This helps me reduce the risks linked to macroeconomic and geopolitical instability. The main areas I analyze are industries, materials, cryptocurrencies, and healthcare. In the healthcare sector, I not only examine the financial position of assets but also deeply assess the safety and effectiveness data of a company's product candidates from preclinical and clinical studies. This helps me evaluate their potential success in the market. My education at the Hebrew University of Jerusalem has equipped me with knowledge on biotechnological and physicochemical processes used in various industries, such as agriculture, oil, gas, and chemicals. This enables me to identify the most promising assets in a rapidly changing market and share insightful articles on Seeking Alpha. If you have any questions or suggestions, feel free to reach out to me via email at [email protected].

Analyst Disclaimer: I do not hold any shares, options, or similar financial instruments in any of the mentioned companies, nor do I intend to do so in the next 72 hours. This article is solely my own creation, and the opinions expressed are my own. I am not receiving any form of compensation for it, except from Seeking Alpha. I have no affiliation with any company mentioned in this article.

This blog post might not consider all the potential dangers and triggers for the stocks mentioned. Every portion of this analysis is offered solely for informational purposes and should not be taken as a personal investment suggestion, idea, guidance, offer to purchase or sell securities, or any other financial instruments. The accuracy and comprehensiveness of the information in this analysis cannot be guaranteed. If any fundamental factors or events change in the future, I am not obligated to update this blog post.

Disclosure from Seeking Alpha: Previous performance does not guarantee future outcomes. We are not making any suggestions or giving advice on whether an investment is appropriate for a specific investor. The opinions expressed above may not represent the views of Seeking Alpha as a whole. Seeking Alpha is not authorized to trade securities, act as a broker or US investment advisor, or operate as an investment bank. Our analysts consist of external authors, including professional and individual investors, who may not possess licenses or certifications from any institute or regulatory body.