Tesla (NASDAQ:TSLA) pulls back 5.1% this week, but still delivers shareholders incredible 61% CAGR over 5 years

Investing in the top-performing companies can help you and your family accumulate significant wealth. Although it may be challenging to find these exceptional businesses, they have the potential to yield substantial returns over extended periods. Consider, for example, investors who wisely held onto Tesla, Inc. (NASDAQ:TSLA) shares for the past five years, enjoying a remarkable 968% increase in value. This demonstrates the remarkable growth potential of certain businesses. Additionally, shareholders can be pleased with the recent 50% gain in just three months. This may be attributed to the recently published financial results, which can be reviewed in our company report. We are delighted by success stories like this, and the company should take great pride in their outstanding performance!

Given that the overall performance has been satisfactory in the past, there has been a recent decrease of 5.1%. Hence, it is worth investigating if the underlying factors align with the current value of the stock.

Take a look at our most recent examination of Tesla

Although some still teach the efficient markets hypothesis, evidence has shown that markets are highly reactive and investors do not always act rationally. By examining the fluctuations in earnings per share (EPS) and the changes in share prices, we can gain insight into the evolving perspectives of investors towards a particular company.

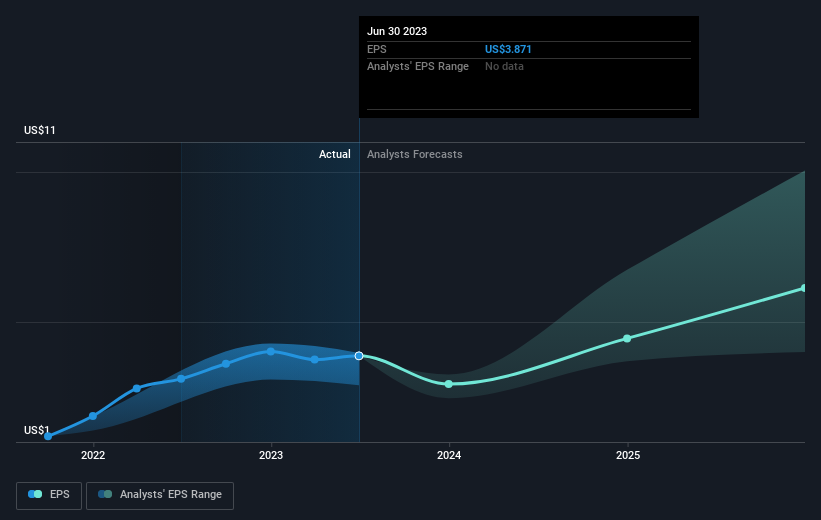

Over the past five years, Tesla has become profitable. This transition has led to a significant increase in the company's share price, as we can observe here. Looking at the past three years, when Tesla was not profitable but became profitable, it is important to consider the returns during this period. In the last three years, the Tesla share price has increased by 168%. Additionally, the earnings per share (EPS) has grown by 206% annually. This EPS growth is higher than the average annual increase of 39% in the share price over the same three years. This suggests that the market has adjusted its expectations for growth to some extent. However, it is worth mentioning that the market is still positive and optimistic, as indicated by the P/E ratio of 65.65.

The picture below illustrates the company's earnings per share (over a period of time). Click to view the precise figures.

It is certainly impressive to witness the remarkable growth of Tesla's earnings throughout the years. However, what holds greater significance for shareholders is the outlook for the future. If you are keen on delving deeper into Tesla's stock, this informative report, which allows for interactive exploration of Tesla's financial position, serves as an invaluable resource to begin your investigation.

While the overall market experienced an increase of approximately 8.2% in the past year, shareholders of Tesla encountered a loss of 13%. Although it is common for stocks to occasionally decrease in value, it is essential to observe improvements in a business's fundamental metrics before becoming too intrigued. Investors who take a long-term approach may not be as disappointed, as they would have witnessed an annual return of 61% over a period of five years. If the fundamental data continues to demonstrate sustainable growth in the long run, the current decline in Tesla's stock could present a potential opportunity worth considering. Monitoring the performance of stocks over an extended period is always intriguing. However, in order to comprehend Tesla more comprehensively, it is crucial to take into account various other factors. Nevertheless, it is important to note that our investment analysis has identified one warning sign regarding Tesla that you should be aware of...

If you enjoy purchasing stocks together with company executives, then you may have a strong affinity for this complimentary compilation of businesses. (Hint: insiders have been engaging in acquisitions).

Please keep in mind that the market returns mentioned in this blog represent the average returns of stocks listed on American exchanges, considering their market weightage.

If you have any comments or concerns about this article, feel free to contact us directly. Alternatively, you can email the editorial team at editorial-team (at) simplywallst.com.

This blog post from Simply Wall St is written in a broad manner. We offer opinions based on past information and expert predictions using an impartial approach. Our articles are not meant to be professional financial guidance. They do not offer suggestions to purchase or sell specific stocks and do not consider your goals or financial circumstances. Our goal is to provide in-depth analysis focused on long-term strategies using fundamental data. Please note that our analysis may not factor in recent company announcements or qualitative information that may impact stock prices. Simply Wall St does not have any holdings in the stocks mentioned.