Tesla Stock: Get Off The High (Risk) Way (NASDAQ:TSLA)

Tesla, Inc. (NASDAQ:TSLA) is slowly losing the profits it gained from its rally this year, with a decrease of around 9% in the last five days. Our recommendation to sell the stock remains unchanged; though we may have been premature in our bearish outlook last year, we still anticipate a decline in the stock price. We don't believe that the rally this year was driven by fundamental factors.

After thoroughly analyzing Tesla, it seems that the stock is overpriced, and the company is experiencing a decrease in profits due to the CEO's decision to lower prices. Unfortunately, this strategy did not have a significant impact on increasing demand, and the overall economic conditions are also negatively affecting people's willingness to spend. Moreover, there are growing concerns about a potential scarcity of lithium due to problems with the supply chain.

We have a positive outlook on the future potential of electric vehicles ("EVs"), but we don't believe the stock will perform well in the immediate future. Our suggestion for investors is to consider selling their positions at the current price levels.

Margins Matter: Shrinking Share Threat

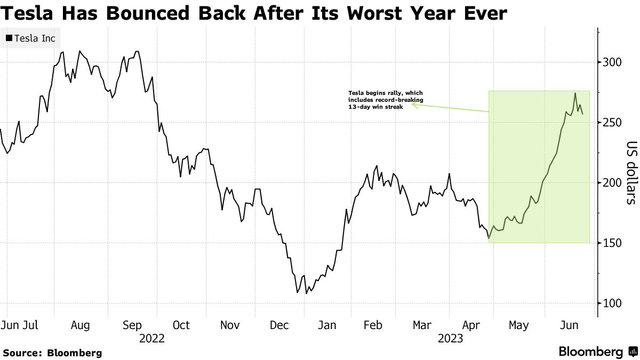

The stock has impressively recovered from its most challenging year, experiencing a 65% decline in 2022. This year, the shares have more than doubled, with the stock showing a 131% increase year-to-date, surpassing the S&P 500 (SP500) by approximately 116%. However, we are starting to notice indications that the company's rally is starting to unravel. We believe that the stock has become overbought due to excessive optimism surrounding Tesla's artificial intelligence capabilities and increased share expansion following price reductions.

Take a look at the chart below to see how Tesla's stock has fared between 2022 and 2023.

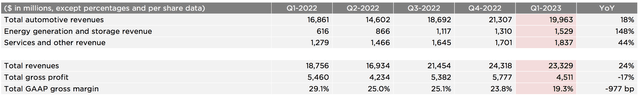

Tesla's decision to lower prices has negatively impacted the company's gross profit margins. According to their financial report, their gross margin was 19.3%, which is lower than the estimated 22.4%. This is the lowest profit margin they have seen since the fourth quarter of 2020. In the past, Elon Musk, the CEO of Tesla, prioritized increasing sales over profit margins. However, he has recently been adjusting the pricing strategy to increase profits again. The reason behind the price cuts was to make purchasing their Model 3 and Model Y vehicles more affordable, hoping to stimulate consumer demand during challenging economic times. Additionally, Musk's price reduction strategy is an effort to maintain and expand Tesla's market share in the electric vehicle industry. This is particularly important as competition in the market grows stronger. The S&P has projected that Tesla's market share will decrease to less than 20% by 2025, compared to its 79% share in 2020.

It is worth noting that in May, the company took the initiative to increase the prices of their vehicles, specifically Model 3 and Model Y, in various countries including the U.S., Canada, Japan, and China. However, despite these adjustments, Tesla's vehicle prices are still comparatively lower than they were at the beginning of the year. The company seems to be actively adapting their prices based on the overall market conditions, and there are speculations among analysts that this move might have ignited a price competition with rival companies.

In essence, the fact remains that even though Musk has lowered prices, it hasn't resulted in a substantial increase in demand. Last quarter, production still exceeded the number of cars delivered. Additionally, Tesla's portion of the electric vehicle market is not secure. Analysts from Bank of America (BAC) predict that by 2026, the company's market share will decline to 18%, a significant decrease from the 62% share it held just last year. Tesla has been facing an issue of having an excess supply as production levels have consistently surpassed the number of cars delivered over the past four quarters. The following chart provides a breakdown of Tesla's production compared to deliveries in the first quarter of 2023.

Tesla's Performance in the First Quarter of 2023 The output and distribution of Tesla vehicles during the initial quarter of 2023 is a topic worth discussing.

Moreover, the reductions in prices have caused a decline in the profits made on each vehicle. The overall gross margin profit of the company has decreased compared to the previous year and in a sequential manner. Despite implementing the price cuts, the total revenue generated from automobile sales has decreased to 19,963 million from 21,307 million, as seen in a sequential analysis. Considering these figures, we maintain our belief that the surge in the stock's value is not rooted in fundamental factors but rather influenced by market speculation. Consequently, we predict that the stock will relinquish its gains in the second half of 2023. The accompanying graph displays Tesla's financial performance in the first quarter of 2023.

Tesla's Financial Report for the First Quarter of 2023

Chinese Market In Focus

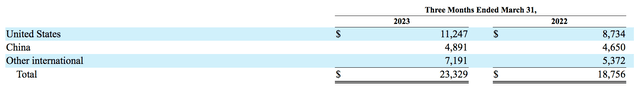

Tesla's business opportunities are increasing as more people choose electric vehicles (EVs) and governments enforce regulations to shift away from traditional gas-powered cars. The EV market is expected to grow steadily at a rate of 10.07% annually from 2023 to 2028. This growth means there will be a greater demand for Tesla's products, but it also means facing more competition. In China, specifically, Tesla faces strong competition from companies like BYD Company, NIO, Li Auto, XPeng, and other emerging EV startups. China is currently the largest EV market and accounted for about 21% of Tesla's total revenue in the first quarter of 2023. Therefore, the increasing competition in China is something investors should pay attention to.

The chart below illustrates the income generated from different regions, categorized according to the selling locations, represented in millions of dollars.

Musk is also considering India; the company's leadership had a meeting with India's Prime Minister to talk about expanding their business, as India is encouraging the automobile industry to make a big investment in the country. This decision could bring great benefits to Tesla and lower the expenses of manufacturing cars, which would help them maintain a good amount of money coming in. However, we don't believe that this move alone will be enough to prevent the stock from facing difficulties in the second half of 2023.

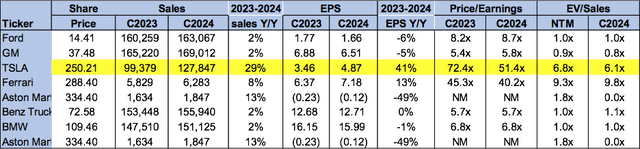

In our opinion, the stock of Tesla is priced too high and is trading at an unjustifiably high multiple compared to its peers. When considering the price-to-earnings ratio, Tesla's stock is trading at 51.4 times its projected earnings for 2024, while the average for its peers is only 19.7 times. Additionally, Tesla's stock is trading at 6.1 times its projected sales for 2024, compared to the average of 3.3 times for its peers. We believe that Tesla's stock is not being valued appropriately for its potential growth, especially considering the challenging economic conditions and the pressure on Tesla's profit margins. We think the market is giving Tesla too much credit for its long-term prospects. Therefore, we recommend that investors sell their Tesla stocks at the current prices and reconsider buying them toward the end of the year when the negative effects of the overall economic conditions have been taken into account.

The chart below illustrates Tesla's worth compared to its counterparts.

Wall Street's Buzz

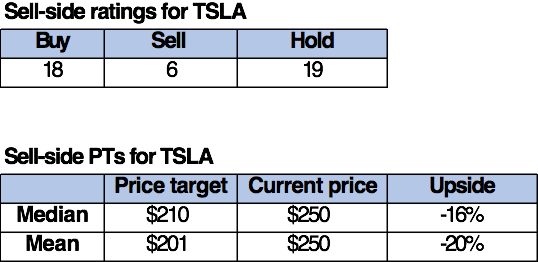

The stock on Wall Street is unexpectedly facing a pessimistic viewpoint. Out of the 43 experts analyzing the stock, 18 recommend buying, 19 suggest holding, and the rest advise selling. In recent weeks, we have observed a noticeable shift among analysts towards a more negative outlook on Tesla. The latest addition to the bearish camp is Goldman Sachs Group (GS), as Mark Delaney downgraded his previous recommendation from buy to neutral. This trend in market sentiment towards Tesla supports our belief that the company will experience a decline in the later half of 2023.

The cost of each stock is set at $250 per share. The middle sell-side target price is estimated to be $210, while the average target price stands at $201, indicating a possible decline of 16-20%.

Below are the charts that illustrate the sell-side ratings and price targets for Tesla.

Stock Question? Solution!

We maintain a negative outlook on Tesla, Inc. stock. While we are optimistic about Tesla's future prospects, we believe there will be a decline in the second half of 2023. As a result, we suggest that investors consider taking their profits at the current price and look for opportunities to sell their shares. We admit that our previous recommendation to sell was premature, but we still anticipate a decrease in the stock due to fundamental issues impacting profit margins, increased competition, and unfavorable market conditions affecting demand. Additionally, we foresee potential shortages of lithium in the future as the electric vehicle market expands, due to delays in obtaining mining permits, a shortage of labor, and high inflation. We encourage investors to capitalize on the year-to-date increase in Tesla's stock price and explore favorable exit points at the current levels.

Note from the Editor: This blog post covers the topic of certain securities that are not listed on a prominent American exchange. We kindly urge you to consider the potential risks linked to these stocks.

Thank you for your interest in our technology coverage. If you would like to have direct access to our examination of software/hardware and semiconductor industries, top ideas in the current economic situation, and our esteemed research approach, we invite you to try out Tech Contrarians, our Investing Group service, for free for 2 weeks. The initial group of subscribers will receive a substantial lifelong discount on annual subscriptions following the complimentary trial period, so we look forward to having you join our community soon.