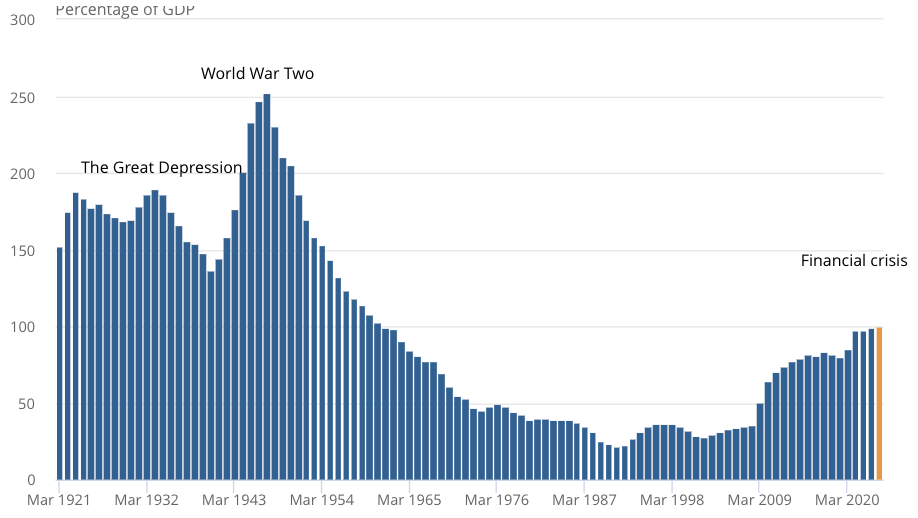

UK debt pile tops size of entire economy for first time since 1960s

It is currently 7:49 am on Wednesday, June 21st, 2023.

New figures released today show that Britain's debt stock has grown to a greater extent than its economy, which had last occurred in March of 1961. This increase is a result of the government's efforts to assist households with their energy expenses.

According to the Office for National Statistics (ONS), the total UK debt has reached over £2.5 trillion, which happens to be 100.1% of the gross domestic product (GDP).

Various unexpected events have forced the government to increase their spending to bolster the economy, which has resulted in a rise in the debt-to-GDP ratio. This particular ratio indicates how sturdy a nation's financial situation is.

Government borrowing has increased due to various events, including the worldwide financial crisis in 2008, the Brexit situation, the Covid-19 pandemic, and the energy price upheaval following Russia's invasion of Ukraine. These disruptions have caused significant instability in the banking sector.

During the pandemic, the government spent more money to assist the country's economy. This involved using the furlough scheme, vaccine programme, and measures to support household incomes. These actions were essential because the economy was in a difficult situation.

According to ONS professionals, the amount of borrowing that occurred in May, which was £20 billion, is the second highest figure for that particular month since data collection began. It was a tad lower than what the City had anticipated.

Chancellor Jeremy Hunt is on track to exceed the Office for Budget Responsibility's (OBR) borrowing estimate following last month's surge in debt. As of this fiscal year, borrowing has already reached £42.9bn, which is £2.1bn above the OBR's predictions.

Nevertheless, the ONS frequently modifies its evaluations of public finances. If the economic growth surpasses expectations, it could also contribute to improving the public finances.

If a government is spending more money than it collects in taxes, it is said to be experiencing a budget deficit. To cover this shortfall, the government borrows money from investors.

Since the start of fall, the administration has limited the standard yearly energy expenses for households at £2,500. The financial sector has been covering the variance between the cost of sourcing energy from wholesalers for gas and electricity companies and what they can reasonably charge their customers.

The assistance program will terminate during the summer season. Additionally, escalating payments for aid have caused an increase in borrowing.

The United Kingdom's economy has been performing poorly since the financial crisis in 2008. This has resulted in a decrease in tax revenues. Additionally, the population is aging and experiencing more health issues, leading to an increase in health spending. These factors have caused the deficit to rise.

The UK government owes a lot more money to people who have invested in their debt because the prices have gone up quickly. A lot of the debt is linked to an old way of measuring inflation called the retail price index, which has gone up a lot in the last year and a half.

Last month, the UK had to pay £7.7 billion in interest, which is less compared to the amount of £7.9 billion that was paid in May 2022.

New ONS data released today revealed that the rate of inflation remained unchanged at 8.7% in May, which was better than what experts had predicted. The City anticipated a decrease to 8.4%, but this did not come to fruition.

Although inflation is expected to decrease within the next year, it is expected to exceed the OBR's predictions, which will lessen the Chancellor's ability to implement tax reductions.

According to Samuel Tombs, who is the chief UK economist at Pantheon Macroeconomics consultancy, the recent decline in the projection of debt interest payments indicates that the Chancellor won't be able to reduce taxes before the upcoming general election, which is scheduled to take place by January 2025.

To put it simply, it's likely that the OBR will increase its prediction for how much money will be spent on paying off debt by £39 billion in 2024/25 and £17 billion in five years from now. This statement was made by the speaker.