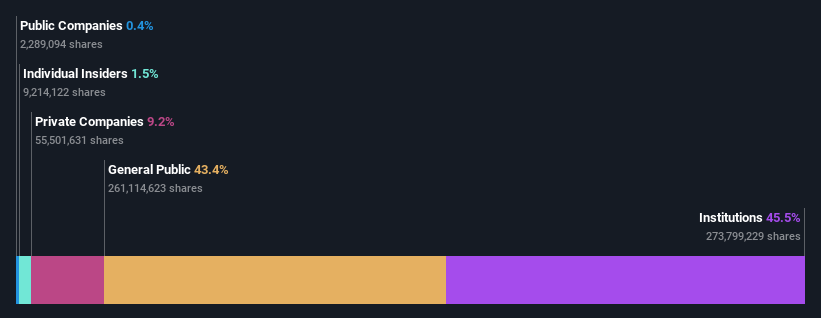

Institutional investors have a lot riding on Hummingbird Resources PLC (LON:HUM) with 45% ownership

In order to comprehend the true power dynamics at Hummingbird Resources PLC (LON:HUM), it is crucial to grasp the composition of the company's ownership. The largest share is held by institutional investors, accounting for 45% of the ownership. Therefore, this group has the greatest potential to profit (or suffer losses) from their investment in the company.

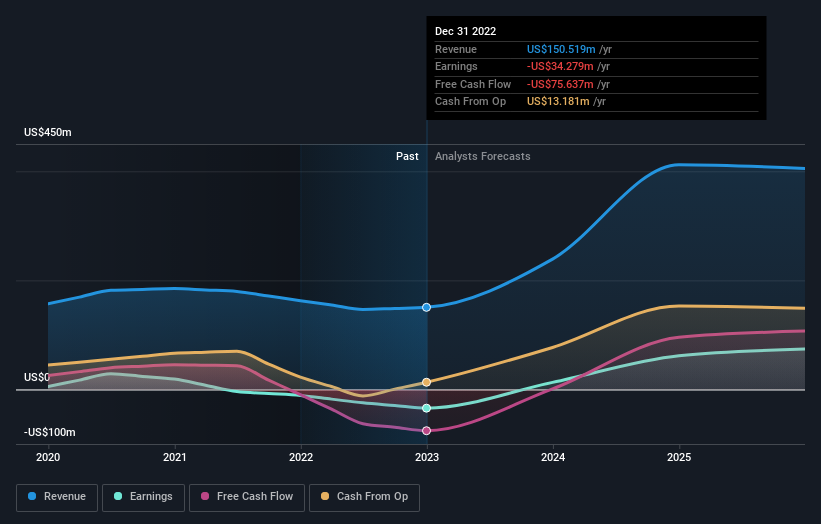

Consequently, the company's stock value experienced a 12% increase last week, leading to institutional investors enjoying substantial benefits. Currently, the investment's annual return stands at an impressive 53%, making last week's gain an extremely favorable outcome.

Now, let's explore further into every category of Hummingbird Resources' owners, commencing with the diagram provided below.

Check out our most recent examination for Hummingbird Resources

Hummingbird Resources: Insights From Institutional Ownership

Numerous organizations gauge their progress by comparing it to an indicator that closely resembles the domestic market. Consequently, they predominantly focus on businesses that are listed in prominent indexes.

If you observe, professional investors hold a significant share of Hummingbird Resources. This suggests that the company is trusted and respected within the investment community. However, it is important to be cautious and not solely rely on the perceived endorsement from institutional investors. These investors are fallible too and make mistakes at times. If several institutions suddenly change their opinion about a particular stock, it could lead to a rapid decline in its share price. Hence, it is worth examining Hummingbird Resources' past earnings performance. Nonetheless, it is ultimately the future prospects that hold the most significance.

There aren't many hedge funds holding shares in Hummingbird Resources. The biggest shareholder at the moment is Cig Sa, who owns 6.5% of the outstanding shares. The second largest shareholder is AIMS Asset Management Sdn Bhd, who holds 4.9% of the common stock. A J Bell Holdings Limited, Asset Management Arm, owns about 3.7% of the company's stock. Additionally, CEO Daniel Betts holds 0.9% ownership in the company's shares.

Upon further examination of our ownership data, it becomes apparent that the top 25 individuals or entities who own our company shares together possess less than half of the overall share register. This analysis indicates that there exists a widespread presence of numerous small shareholders, with no single shareholder having a majority stake.

Although examining the level of institutional ownership can enhance the quality of your analysis, it is also advisable to explore analyst suggestions to gain a comprehensive insight into a stock's projected growth. Considering the limited analyst coverage on this company, it is likely that it may attract increased attention in the future.

Although the exact interpretation of an insider may vary, nearly everyone agrees that board members fall into this category. The board holds the ultimate authority over management. Nonetheless, it is quite common for managers to also serve as executive board members, particularly if they are a company's founder or the CEO.

In my personal opinion, I believe that insider ownership can be quite advantageous. Nonetheless, there are instances when it poses challenges for fellow shareholders who aim to hold the board responsible for their choices.

According to our latest information, individuals with internal knowledge possess a portion of the shares in Hummingbird Resources PLC. The market value of this company is a modest UK£83 million, and insiders personally possess UK£1.3 million worth of shares. While it is promising to observe insider investment, we generally prefer higher insider stakes. It may be advisable to investigate whether these insiders have recently made any purchases.

The general populace, consisting mostly of individual shareholders, holds a significant 43% stake in Hummingbird Resources, giving them a certain level of control over the company. Although they may not have the final say, their influence definitely carries weight in shaping the company's operations.

According to the information available, 9.2% of the shares in Hummingbird Resources are owned by private companies. These companies could potentially have some connection to the company. In certain cases, people within the company may have an involvement with a public company by holding shares in a private company, rather than owning them individually. Although it's difficult to come to any definite conclusions, it is worth considering this aspect for further investigation.

When analyzing a company like Hummingbird Resources, it is essential to take into account various aspects beyond just the shareholders. One crucial aspect to consider is the associated risks. Every company faces risks, and in the case of Hummingbird Resources, we have identified two warning signs that you should be aware of.

However, in the end, it is the forthcoming events and not the ones that have already passed that will have a significant impact on the success of the business owners. Consequently, we believe it would be wise to examine this complimentary report, which presents insights on whether analysts are forecasting a more promising future.

Please note that the statistics mentioned in this blog post are based on information collected over the past year, specifically covering the twelve-month period leading up to the final day of the month indicated on the financial statement. These numbers may differ from the figures reported in the annual report, which accounts for the entire fiscal year.

Making Valuation Simple

Discover whether Hummingbird Resources is possibly over or undervalued by exploring our thorough evaluation, encompassing estimations of fair value, hazards and cautions, returns, insider dealings, and fiscal wellbeing.

Take a look at the analysis for free

Do you have any thoughts or opinions about this article? Are you worried about the information it contains? Contact us directly if you'd like to share your feedback. Alternatively, you can send an email to the editorial team at editorial-team (at) simplywallst.com.

This post from Simply Wall St is of a general nature. We offer observations based on past information and predictions made by experts, using an objective approach. Our posts are not meant to be financial recommendations. They do not offer advice on whether to purchase or sell any stocks, and do not consider your particular goals or financial circumstances. Our goal is to provide you with analysis that is focused on the long term and grounded in fundamental data. Please note that our analysis may not take into account the most recent company announcements that may have an impact on stock prices or qualitative information. Simply Wall St does not hold any positions in the stocks mentioned.