Are Weak Finances Behind Malaysia Airports' Bad Performance?

Malaysia Airports Holdings Berhad (KLSE:AIRPORT) had a bad month, share price went down 4.3%. We want to see if the company will continue to go down or if it will bounce back. We looked at the company's financials, especially its ROE.

ROE is key for shareholders who want to know how their money is being used. It shows how profitable a company is compared to their investment.

Take a look at our newest evaluation of Malaysia Airports Holdings Berhad.

Calculating ROE: What's The Method?

To calculate return on equity, use the formula: Return on equity measures the profitability of a company. It shows how much profit a company generates compared to the amount of shareholder equity. A high return on equity indicates that a company is earning more profit per dollar of shareholder equity. A low return on equity may indicate that a company is not using its resources efficiently. Investors and analysts use return on equity as an important metric when evaluating a company's financial performance. It can also be used to compare the performance of companies within the same industry.

ROE is a formula used by investors. It measures a company's profit compared to how much shareholders have invested. The higher the ROE, the better the company is at generating profit with the money invested by shareholders. ROE is calculated by dividing the net profit from continuing operations by shareholders' equity.

Malaysia Airports Holdings Berhad's ROE comes from the formula above.

In the past 12 months until March 2023, RM350m was 4.7% of RM7.5b.

The 'return' is what was made after taxes in the past year. For every MYR1 of shareholders' equity, the company earned MYR0.05 in profit.

ROE And Earnings Growth: Any Connection?

We know that ROE measures a company's profitability. It helps to assess the company's potential to generate profits by looking at how much of its profits the company chooses to reinvest or keep. Companies with high ROE and profit retention have better growth potential than those without.

Malaysia Airports Earnings Growth And 4.7% ROE Compared

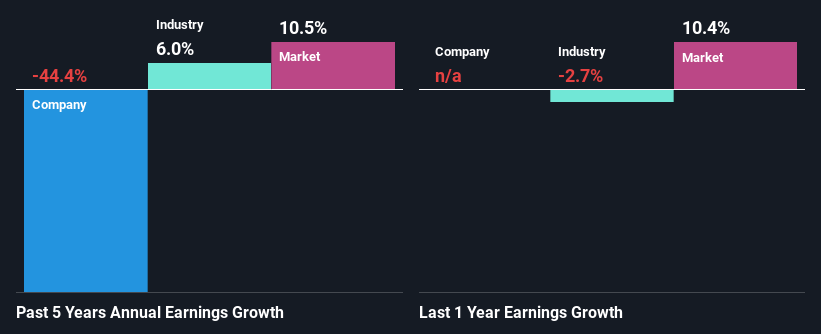

Malaysia Airports Holdings Berhad doesn't have a good ROE. It's lower than the industry average ROE of 6.9%. This may have caused a 44% decline in net income over five years. Other factors, like low earnings retention or poor capital allocation, might also be at play.

We looked at Malaysia Airports Holdings Berhad's progress compared to the whole industry. They didn't do as well. They earned less money while the industry made 6% more money.

To value a company, people look at its earnings growth. They want to know if earnings will go up or down and if it's worth investing in. Check if the market has already priced in the future outlook for AIRPORT. Find out more in our latest report.

Is Malaysia Airports Maximizing Its Profits Efficiently?

Malaysia Airports Holdings Berhad's earnings are going down. This is not a shock. The business is giving most of its profits to investors as dividends. The company has done this for three years. They give away 50% of their profits, while keeping only 50% for themselves. The company can't use that much money to invest. This is bad. The company needs to invest to grow in the future.

Malaysia Airports Holdings Berhad gives out dividends for ten years. That seems more important to the management than growing the business. Analysts estimate that the payout ratio will stay at 53% for the next three years. However, the company's future ROE could increase to 9.6%.

Malaysia Airports Holdings Berhad is not doing well because they're not investing enough in the business. They're not growing much, and their earnings are low. But according to analysts, their earnings are expected to improve a lot. We don't know if this is because of the industry or the company's performance. Check out the analyst's forecasts page to learn more.

Simplifying Valuation: Our Expertise

Want to know if Malaysia Airports Holdings Berhad is over or undervalued? Our analysis gives you all you need, covering fair value estimates, risks and warnings, dividends, insider transactions and financial health.

See the Analysis for Free This is the Analysis you can View for Free Check out the Free Analysis Take a Look at the Analysis that Is Free

Do you have any feedback about this article? Are you worried about the content? Contact us directly or email editorial-team (at) simplywallst.com.

Simply Wall St's article is for informational purposes only. We analyze historical data and analyst forecasts in an impartial manner. Our articles do not provide financial advice, and we do not endorse buying or selling stocks. Additionally, we do not consider individual financial goals or situations. Our analysis is based on fundamental data and focuses on long-term evaluation. It's important to note that our analysis may not reflect recent company announcements or qualitative factors. Simply Wall St does not hold positions in any of the discussed stocks.