The Power Of Modern Value Investing: A Guide To Financial Success, With Jitta

Value investing is a highly effective investment approach, but it can be challenging for individual investors to implement due to the significant amount of time and expertise involved. This article aims to educate readers on the concept of value investing, its merits as an investment strategy, and the essential principles associated with it. Additionally, the primary focus of this article is to introduce Jitta, a platform that addresses the obstacles faced by modern value investors by utilizing innovative app and web-based technology. To provide a practical example, we conclude with a case study featuring screenshots demonstrating how Jitta can assist investors in their value investing journey.

Investigate The Worth Of Value Investing

Investing is a form of artistic expression, not a set of rigid rules, implying that there are numerous approaches to it. Additionally, your investment goals will play a crucial role in guiding your chosen path.

If you are content with achieving the same returns as the overall market and not exceeding it, then a passive investment approach could be fitting for you. However, if you desire to surpass the market performance, then you are inclined to choose an active investment strategy such as growth, momentum, small-cap, or value investing.

Despite some strategies becoming obsolete, value investing has proven to be enduring. Prominent figures such as Benjamin Graham (known as the pioneer of value investing), Warren Buffett, and Seth Klarman have consistently achieved better results than the market for a significant duration.

Value investing requires being patient, having self-control, and taking a long-term approach. Its main objective is to detect and invest in companies that are currently undervalued, with the expectation that their true worth will eventually be acknowledged by the market. Furthermore, during times of economic downturn, this tactic can serve as an effective means of enduring challenging circumstances.

Value Investing: Essential Principles

Value investing is comprised of five fundamental principles that serve as the foundation of this investment strategy:

Selecting high-quality companies. According to Warren Buffett, it is much more advantageous to purchase an excellent company at a reasonable price rather than a decent company at an exceptional price. This is due to the fact that exceptional businesses continue to expand over time, granting your investment further potential for value appreciation.

Grasping the concept of equitable value holds immense significance in comprehending the actual value of a company in relation to its stock price. This necessitates delving extensively into a company's financial statements in order to comprehend its resources, debts, profit margins, and capacity to generate cash.

Achieving a substantial margin of safety can be attained by purchasing assets below their rightful worth. The greater the difference between the purchase price and fair value, the wider the margin of safety becomes, shielding against potential pitfalls and market turndowns.

Choosing stocks that are currently unpopular or facing temporary difficulties requires having a contrarian mentality. Understanding fair value is crucial in this process. As mentioned by Buffet, it is wise to feel cautious when others are overly confident and confident when others are apprehensive.

It is crucial to maintain a perspective that extends beyond the immediate future as the market typically requires substantial time to acknowledge a company's actual worth. Once you have thoroughly researched and committed to your investment, it is advisable to avoid being swayed by temporary price fluctuations.

Challenges For Value Investors

Value investing has the potential to generate impressive profits, however, it should not be underestimated in terms of difficulty. Initially, this investment approach demands substantial effort and a comprehensive comprehension of the factors influencing and the financial aspects of every individual company.

To give you some background, the MSCI World Index consists of over 1,500 companies from various industries. Therefore, if you're starting from the beginning, you'll have to gain extensive knowledge and comprehension of numerous businesses, which will require considerable time. Additionally, even when you do find a reputable company, there is a chance it may not be available for purchase at a reasonable price.

And in order to perform comprehensive analysis, you will require an ample amount of data - encompassing past statistics and future estimates - which can cost you a considerable sum of money even before initiating your investment journey.

Finally, just like in any investment endeavor, certain human biases may come into play. These biases could lead you to oversimplify intricate choices or be excessively confident in your decision-making process.

A Solution To These Problems ????

Enter Jitta, the platform that specializes in value investing. It generously provides users with an abundance of financial information at no cost, and that's not all. Jitta takes the data and transforms it into easily understandable and user-friendly tools. These tools are designed to assist you in identifying exceptional companies offering fair investment opportunities.

And in case you ever find yourself in need of inspiration, Jitta offers a variety of ways to analyze stocks: it includes almost 90% of all global stocks, so you have plenty of options. By utilizing technology, Jitta assists you in elevating your skills as a contemporary value investor, while still incorporating the fundamental principles of value investing in the current market.

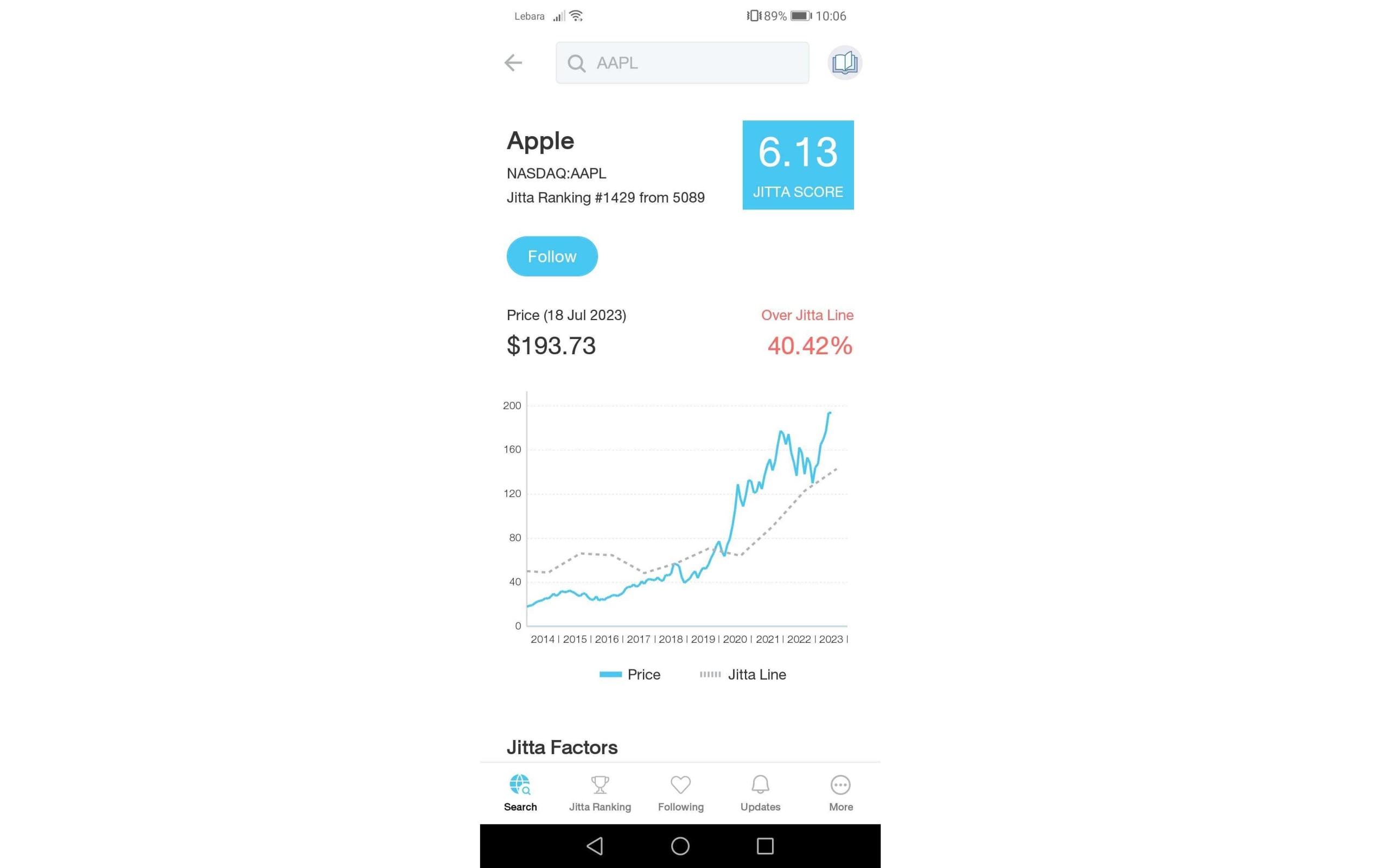

Each company on the platform is given a Jitta Score ranging from one to ten, which reflects its earnings quality. This score is derived from the company's financial statements of the past decade, considering factors such as revenue, profitability, shareholder returns, and balance sheet performance. A higher score indicates a stronger company.

However, simply discovering a remarkable business is not sufficient – it is crucial to be able to make a fair investment in it. This is where the Jitta Line complements the Jitta Score by illustrating the appropriate value of a company. Its rationale revolves around determining the highest price one should pay in order to achieve a break-even point within a decade. Moreover, these calculations solely rely on the company's specific operations, rather than any comparative market assessment.

For added convenience, Jitta has a straightforward guideline:

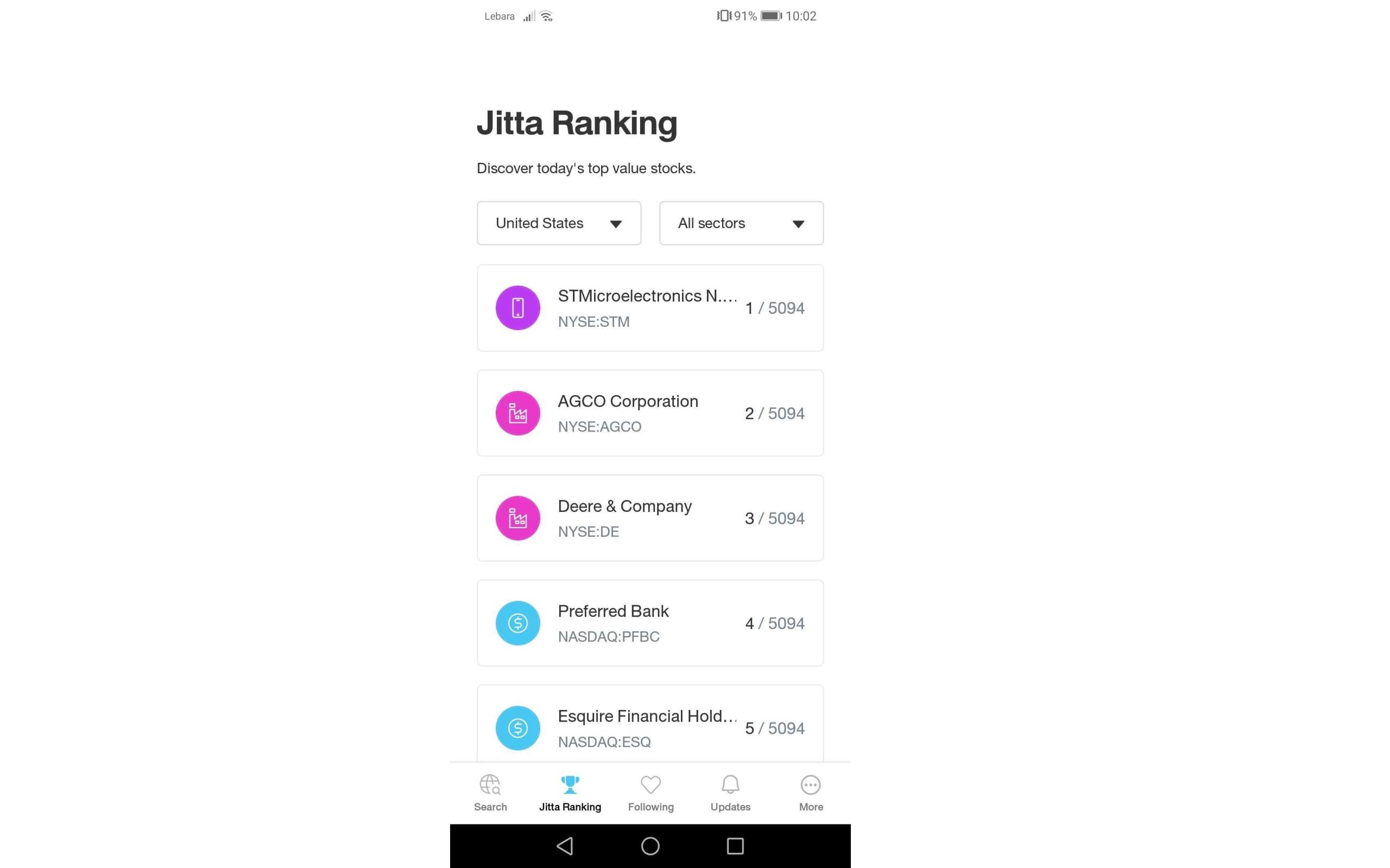

If you are still interested in passive investing, Jitta can assist you in that aspect as well. The Jitta platform determines the top 30 companies, out of a pool of over 30,000 stocks, that are traded at a reasonable price based on the Jitta Score and Jitta Line. These selected companies form the Jitta Ranking. If you had invested in this collection of stocks in 2009, you would have achieved an average yearly return that surpassed the S&P 500 by 3%.

Jitta's Value: A Case Study

Jitta includes stocks from various markets. The markets covered by Jitta are listed below.

If you're unsure of what to do, you can select a market on the application and observe which stocks are rated highly on the Jitta Ranking. For more intricate options, you can also arrange stocks based on the Jitta Score or Jitta Line using Jitta's online tool.

After discovering a stock that catches your attention, you have the option to explore its Jitta Score and Jitta Line fluctuations by simply clicking on it. These metrics are refreshed every quarter as soon as the company discloses its financial earnings. For those with more expertise, Jitta provides a comparative ranking of the stock against its competitors and the overall market. Moreover, you can access a comprehensive summary of the company's past financial statements on its web tool.

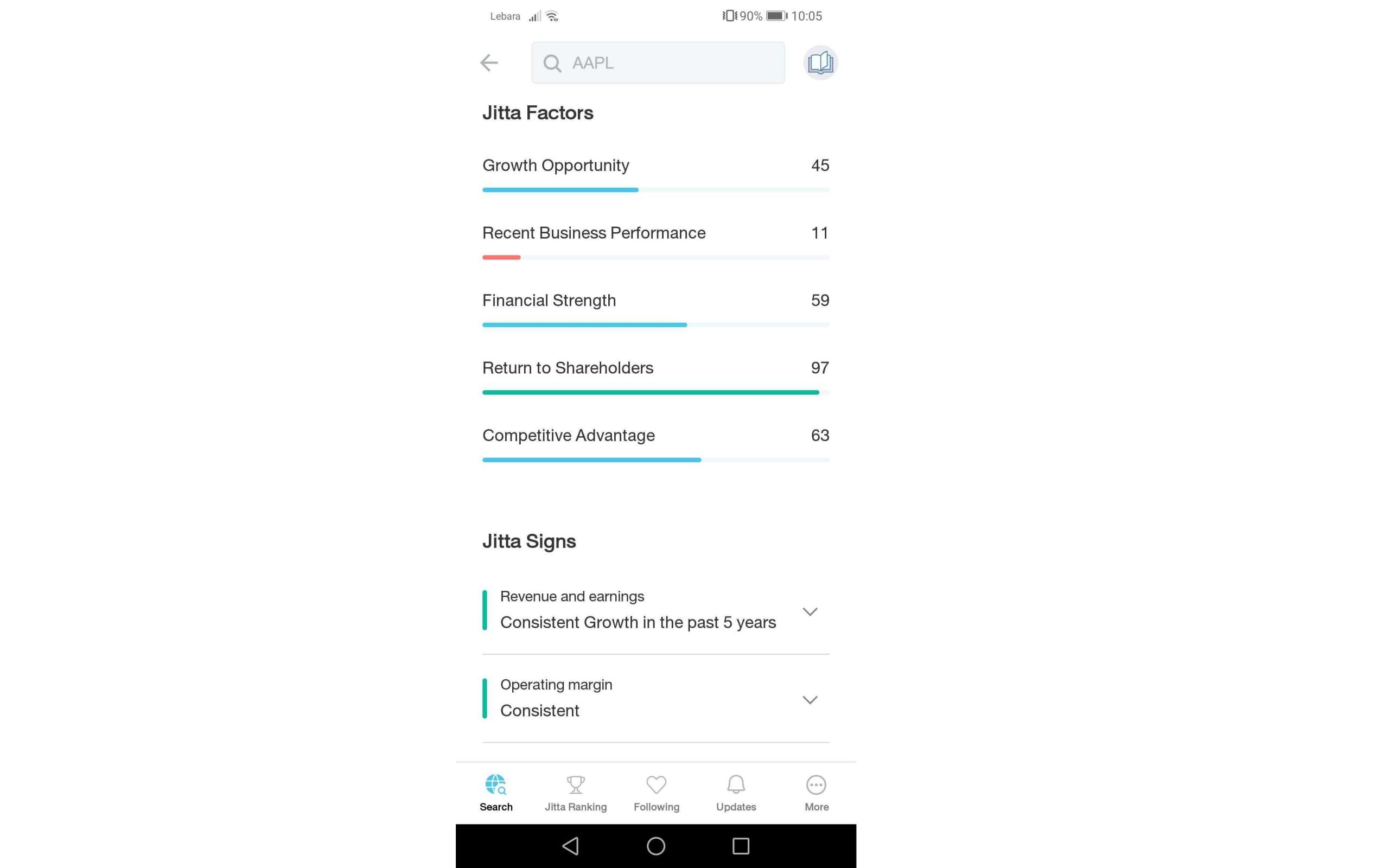

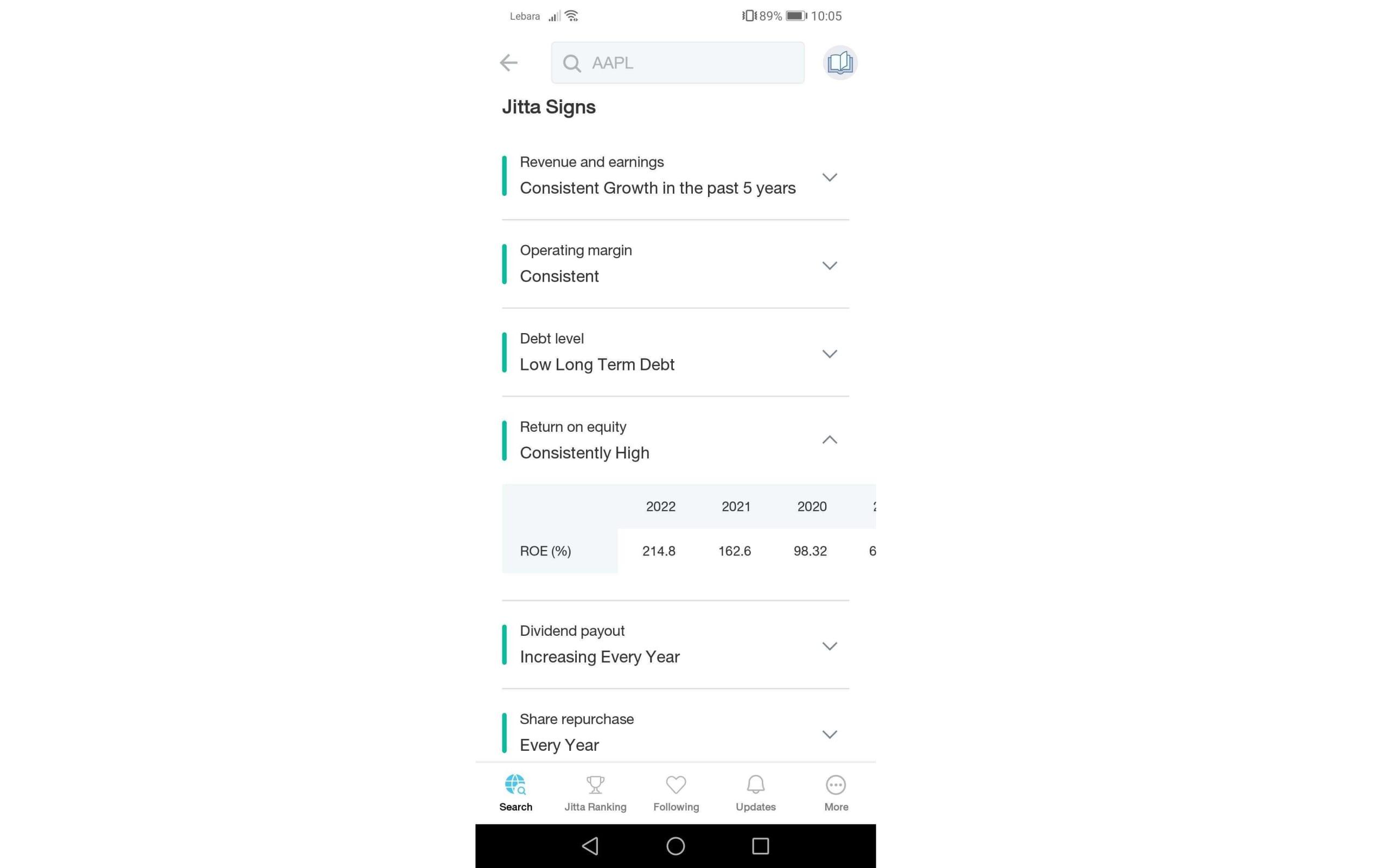

If you're interested in knowing the Jitta Score for a company, you can explore a detailed analysis of the factors that contribute to it, referred to as Jitta Factors and Jitta Signs.

Incorporated in the platform is a new feature called Jitta Wise, which elucidates the company's operational plan alongside assessing its business caliber and growth prospects. Moreover, you will also stumble upon a concise summary of the company's crucial financial records spanning over a period of three years.

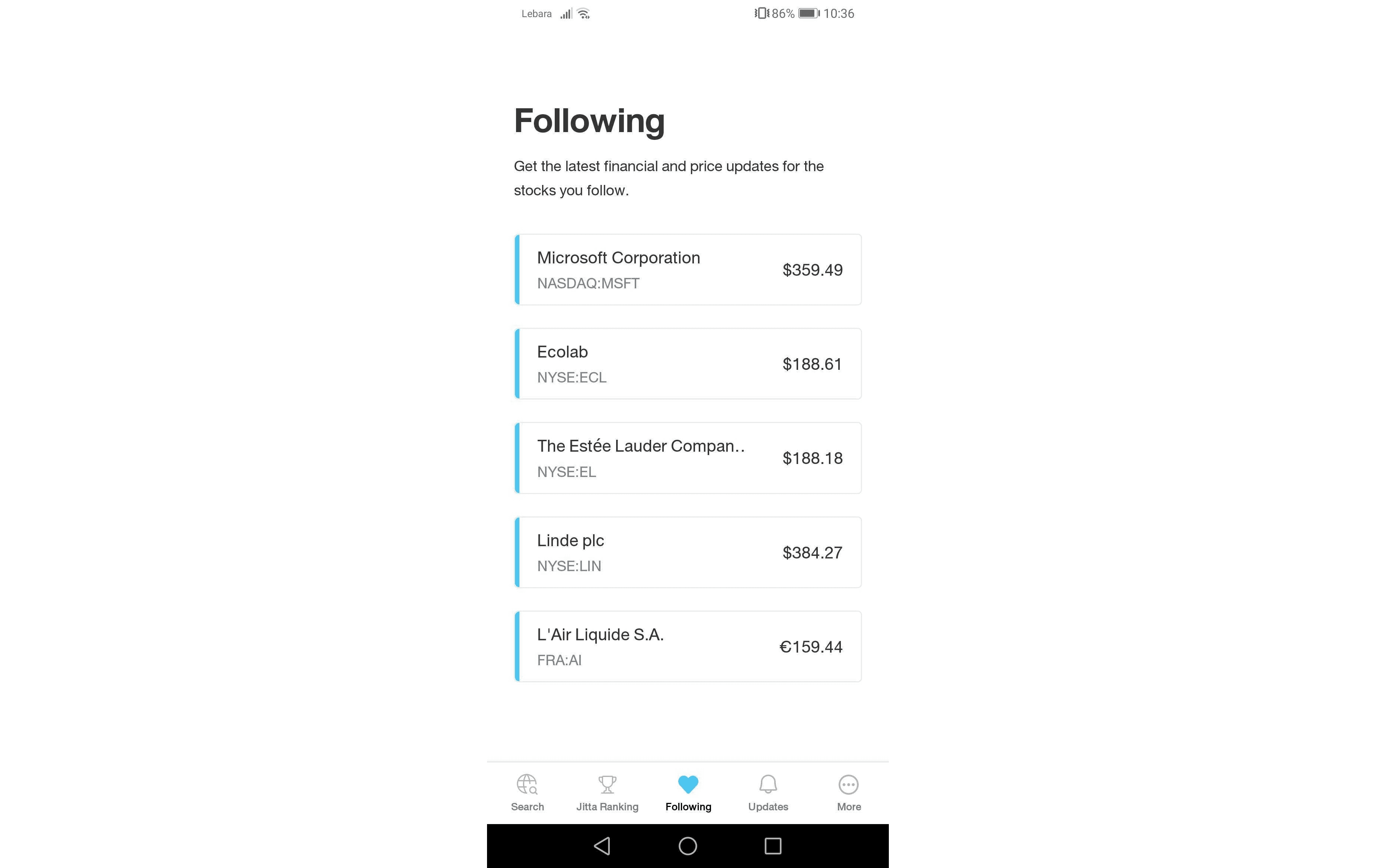

Additionally, you have the option to track your preferred stocks and receive immediate alerts regarding important financial developments or any notable alterations in its core business aspects.

If you have an interest in contemporary value investing, Jitta is a costless technology accessible to you through both the application and website. By completing a quick and complimentary registration process, you will instantly obtain comprehensive quality assessment and historical information on over 30,000 stocks from across the globe. Why not give it a go at this moment?

This manual was created by Finimize in collaboration with Jitta.

Take a look at Jitta's small website on finimize.com.