Investors in Despegar.com (NYSE:DESP) from five years ago are still down 63%, even after 12% gain this past week

Shareholders of Despegar.com, Corp. (NYSE:DESP) would no doubt be pleased to witness the share price rise by 49% in the previous quarter. However, it is important to acknowledge that over a longer period of five years, the returns have been rather disappointing. During this time, the share price has significantly declined, causing a great disappointment for investors who now find themselves down by 63%. Therefore, we are cautious about attributing too much significance to the recent short-term increase in share price. Considering the under-performance in the long term, we would exercise caution.

Despite the recent week providing some comfort to stockholders, they are still experiencing losses over the past five years. Hence, it is worth examining if the fundamental operations of the business are accountable for this downward trend.

Take a look at our most recent examination of Despegar.com

Since Despegar.com incurred a loss in the previous year, it is likely that the market is currently placing emphasis on generating revenue and increasing it. Investors generally anticipate substantial revenue growth from companies that are not profitable. This is because rapid revenue expansion can be used as a reliable indicator to predict potential profits, which could be significant in nature.

For more than five years, Despegar.com experienced a consistent decline of 6.5% in its revenue for each year. This is not an appealing trend for investors. With no signs of profit or revenue growth, it's not surprising that the company faced a loss of 10% every year. The likelihood of investors showing interest in this stock in the near future seems highly unlikely. However, it could be worth monitoring the situation, as if the revenue starts to improve, the share price might also see an upward trend.

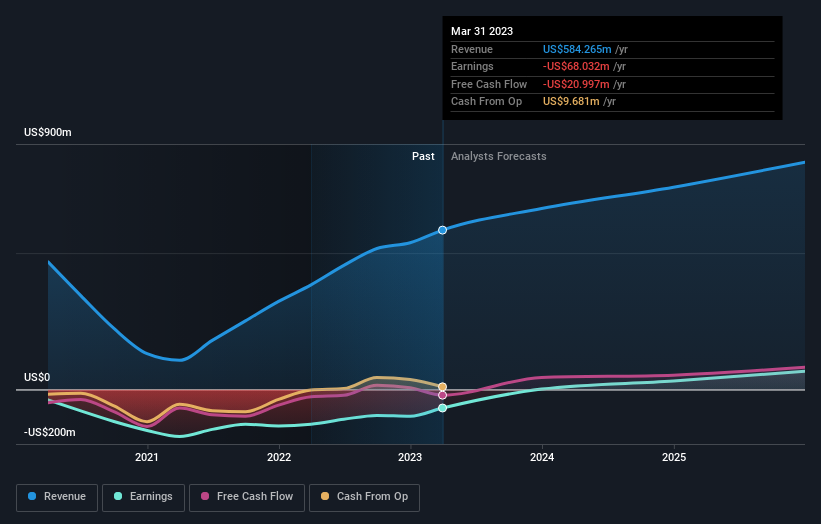

Take a look at the visual representation provided below to observe the fluctuations in both earnings and revenue throughout the years. Feel free to click on the chart in order to obtain the precise numerical data.

If you want to delve deeper into Despegar.com's stock, this complimentary and user-friendly report on the company's financial health is an excellent starting point.

Despegar.com achieved a total shareholder return (TSR) of 5.7% in the past year. However, this return is below the market's performance. On a positive note, it is still a profit and is definitely preferable to the 10% annual loss experienced over the past five years. Therefore, this could indicate a potential turnaround for the company. Shareholders are advised to analyze the comprehensive historical chart depicting previous earnings, revenue, and cash flow for further understanding.

We would find Despegar.com more appealing if we witness significant purchases made by influential individuals within the company. As we anticipate this, take a moment to explore this complimentary compilation of expanding businesses where insiders have made substantial recent purchases.

Please be aware that the market returns mentioned in this blog post represent the average returns of stocks listed on American exchanges, considering their market weight.

Making Valuation Simple, Our Expertise Simplifies The Process

Discover if Despegar.com is potentially overpriced or undervalued by exploring our thorough analysis, which encompasses fair value projections, potential pitfalls, dividend information, insider dealings, and overall financial stability.

Check out the Complimentary Analysis

Do you have any thoughts on this article? Are you worried about the content? Contact us directly if you have any concerns. Alternatively, you can send an email to editorial-team (at) simplywallst.com.

This blog post from Simply Wall St is informative but does not cater to specific needs. The content is based on past information and predictions from analysts, using a fair approach. It should not be considered as professional financial advice. It does not suggest whether you should purchase or sell any stocks, and does not consider your goals or financial status. Our goal is to provide in-depth analysis based on fundamental data for long-term investment decisions. Please note that our analysis may not take into account recent company announcements or subjective material. Simply Wall St does not hold any positions in the mentioned stocks.