The bears in the China shop

It's never a positive update when the President of the United States anticipates a near future collapse from a significant trading powerhouse. However, Joe Biden's recent mention of China as a "time bomb waiting to explode" simply portrays the current state of heightened unease that has developed over the past few months. China's economy is experiencing a decline that has never been witnessed in the last four decades of its remarkable expansion. Its trade and foreign investments are plummeting, unemployment rates are soaring, the threat of deflation is imminent, demand is weakening, and its real estate predicament is intensifying. The countdown continues...

As the feeling of negativity becomes increasingly intense, some keen observers argue: We have been anticipating this for a long time, although it does not necessarily make it less challenging for the Chinese government to resolve this economic crisis. Firstly, there is not just one factor causing this period of economic uncertainty; rather, there are multiple factors that are conflicting with one another and exerting various influences. Some of these factors include:

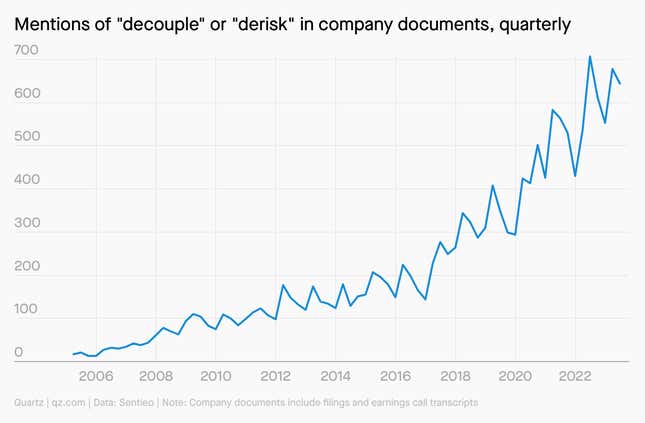

There are additional complicating factors to consider as well. One of the main concerns is China's declining population, which signifies that an increasingly smaller workforce will have to support a growing number of retirees. This situation transforms the country's demographic advantage into a burden of debt. Additionally, there are geopolitical tensions between China and Western countries. These nations are preparing to counter Beijing's growing aggression by reducing their reliance on China and imposing strict limitations on technology trade with them.

There are numerous unfortunate circumstances occurring simultaneously, making it difficult to find a simple solution. Any sincere effort to counteract the decline will require challenging compromises on both political and economic fronts. Moreover, it will jeopardize Xi's leadership as he embarks on his unprecedented third presidential term while his economic plans for the country are rapidly falling apart.

China's trade strategy has traditionally involved lessening its dependence on foreign nations while increasing their reliance on China. However, this approach is currently facing significant challenges as companies and investors abroad are urgently seeking to decrease their involvement with China.

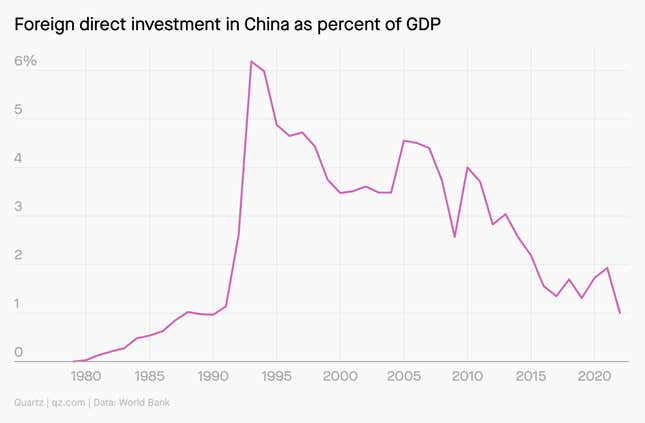

In the April-June quarter, the amount of overseas investment flowing into China dropped significantly, reaching its lowest level ever and decreasing by nearly 90% compared to the previous year. The recent strict actions taken by the Chinese government towards foreign consulting companies, coupled with their veiled warnings about potentially widening the scope of their crackdown, are definitely not improving the situation.

The Western world's endeavor to separate and reduce dependence on China poses a significant threat to the country's economic goals. The Chinese government is well aware of this, evident in how enthusiastically state-controlled media depicted Elon Musk as the ideal foreign investor during his visit to China in May. However, it seems that old patterns are difficult to change. Caixin, a business news platform, expressed concern in an editorial this week about the Chinese government's ongoing insulation, which is undermining foreign investment. This worrisome trend is decidedly harmful to the pursuit of high-quality development.

One positive thought for China is that the Western push to reduce risks is possibly a response to Beijing's own actions - such as deploying spy balloons, forming objectionable alliances, engaging in industrial espionage, and causing corporate conflict. This gives the Chinese government some level of influence on how the derisking process will eventually unfold. John O'Connor, CEO of JH Whitney Data Services, a consultancy specializing in managing geopolitical risks, stated that "the main force behind multipolarity, decoupling, derisking - whatever you want to call it - is still the People's Republic of China. The key determinant is: What does the PRC aim to achieve?"

The process of reducing risks, along with China's resulting difficulties, have negative impacts on the global economy. Prominent American corporations such as Caterpillar and DuPont, who heavily depend on China's manufacturing sector as a significant market, will experience a decline in profits. Furthermore, there will be a decrease in Chinese tourists visiting foreign destinations that heavily rely on tourism income. Western pension funds that have investments in China will witness a reduction in their financial holdings.

China purchases iron ore from India, crude oil from Malaysia, high-end items from France, soybeans from Brazil, and numerous goods from various nations. If China experiences a severe economic decline, it will negatively impact all these exporting countries. Moreover, if China reduces its interest in investing in environmentally friendly technology and sustainable energy, the global efforts to combat climate change, which are already moving sluggishly, will face additional setbacks.

Paul Krugman, an expert in economics, has the belief that an economic catastrophe in China will not cause a worldwide financial crisis like the one in 2008. He may be correct in his assessment. However, according to the projections made by the International Monetary Fund, it is anticipated that China will contribute to almost 23% of global economic expansion in the next five years. This is twice the proportion that the United States is expected to contribute. It is evident that if the Chinese economy experiences hardships, it will have a significant impact on the overall global economy.

Keyu Jin, an economist and the daughter of a previous deputy finance minister in China, asserts in her publication "The New China Playbook" that the vital pathway to achieving durable and superior growth, as well as resolving global conflicts, lies in diminishing China's dependence on manipulative industrial policies that may provide temporary satisfaction but have detrimental consequences in the long term.

However, there is still a lack of consensus regarding potential alternatives to these "steroidal" measures.

Some people believe that Beijing should change its economy from one that relies on investments to one that relies on consumer spending. This would involve giving Chinese households more money to spend by taking some of the country's economic resources away from local governments. However, this would likely result in significant changes in who holds power. Changing the economy in this way would also mean changing the political landscape, but Beijing seems hesitant to take this risk.

Thank you for taking the time to read! Feel free to get in touch if you have any comments, inquiries, or subjects you'd like to learn more about.

Enjoy a financially prosperous weekend,