With 90% institutional ownership, Thermo Fisher Scientific Inc. (NYSE:TMO) is a favorite amongst the big guns

Due to the considerable ownership of Thermo Fisher Scientific's stock by institutions, the trading decisions made by these entities could potentially expose the stock price to risk.

The company is predominantly owned by its top 25 shareholders, who collectively hold a 48% stake in the company.

Conducting thorough investigations into ownership and analyzing projections from experts can offer valuable insights into the potential prospects of an individual stock.

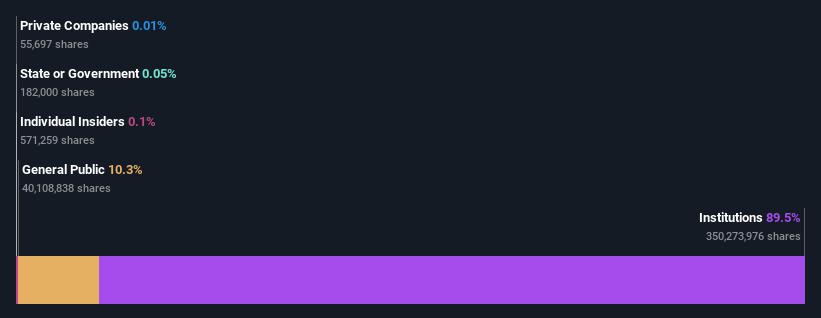

All Thermo Fisher Scientific Inc. (NYSE:TMO) investors should be informed about the dominant shareholder groups. The institutional investors hold the majority of shares in the company, approximately 90% to be exact. This means that they have the highest potential for profit (or loss) based on their investment in the company.

Due to the vast amount of resources and available funds possessed by institutional owners, their investment choices typically have significant influence, especially among individual investors. Consequently, when a substantial portion of institutional funds is directed towards a company, it serves as a strong affirmation of its promising prospects.

In the graph provided, we focus our attention on the various sets of individuals or organizations that possess shares in Thermo Fisher Scientific.

Take a look at our recent examination for Thermo Fisher Scientific.

Insight Into Thermo Fisher Scientific's Ownership?

Big investors often analyze their own profits against the performance of a widely tracked index. Therefore, they typically contemplate purchasing sizable corporations that are part of the applicable benchmark index.

As you can observe, Thermo Fisher Scientific has a significant ownership interest from institutional investors. This suggests that the company is trusted and respected among investors. Nevertheless, it is important to be cautious about placing too much reliance on the validation provided by institutional investors. Even they make mistakes occasionally. In the event that numerous institutions alter their perception of a stock simultaneously, the stock price may plummet rapidly. Consequently, it is advisable to examine Thermo Fisher Scientific's past earnings track record. However, it is crucial to keep in mind that the future performance is what truly matters.

It is important for financial backers to take into account that organizations possess more than half of the company, which grants them the ability to exert considerable influence together. It is worth mentioning that hedge funds have a negligible stake in Thermo Fisher Scientific. According to our analysis, The Vanguard Group, Inc. holds the highest number of shares at 8.3% of the total. BlackRock, Inc. and Capital Research and Management Company follow closely behind, holding 7.7% and 4.9% of the total shares, respectively.

According to our research, it appears that the company's shares are spread out among a large number of shareholders, as the top 25 shareholders only possess less than 50% of the shares combined. This indicates that there is no single majority shareholder and the ownership is fairly diversified.

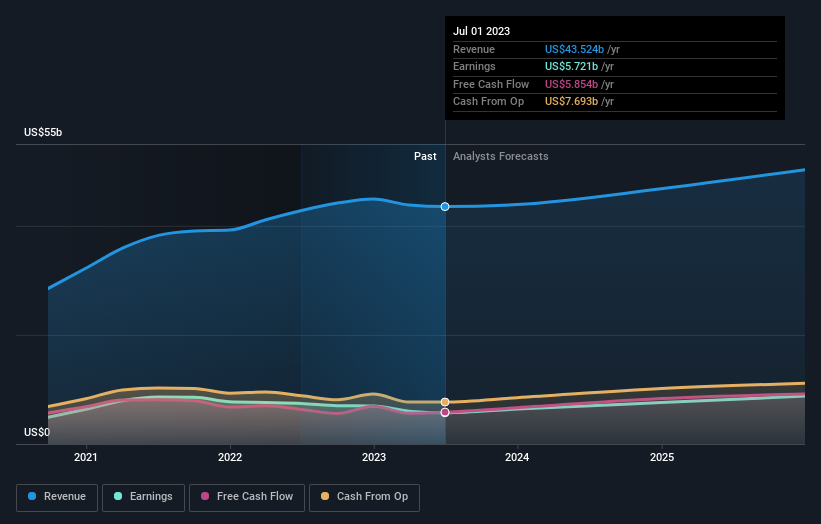

Examining the level of ownership by institutions is a valuable approach to assess and sort out the anticipated performance of a stock. Similarly, analyzing the opinions put forth by financial experts can yield similar results. Numerous analysts closely follow this particular stock, thus enabling you to easily delve into projected growth figures.

The meaning of company insiders can be open to interpretation and differs depending on the particular area of jurisdiction. Our information focuses on individual insiders, capturing at least the members of the board. The management of the company is accountable to the board, which in turn should act in the best interest of the shareholders. It is worth mentioning that at times, the highest-ranking managers are also part of the board.

In general, I view insider ownership as advantageous. Though sometimes, it can pose challenges for other shareholders in holding the board responsible for their actions.

According to our latest data, individuals within Thermo Fisher Scientific Inc. possess a minority ownership stake of less than 1%. Considering that this company is of substantial size, it is not unexpected to observe owners with a small portion of the business. Although their ownership is below 1%, it is worth noting that board members jointly possess stocks valued at approximately US$302 million (based on current market prices). Given these circumstances, it may be intriguing to investigate whether these insiders have engaged in any recent buying or selling activities.

The common folks, typically made up of independent investors, possess a 10% ownership in Thermo Fisher Scientific. Although this collective may not possess ultimate decision-making power, they undoubtedly wield significant sway over the company's operations.

It's important to take into account the various teams that possess stocks in a corporation. However, to gain a deeper understanding of Thermo Fisher Scientific, we should take into consideration numerous additional factors. For example, we have pinpointed one cautionary indication regarding Thermo Fisher Scientific that you should take note of.

If you are similar to me, you might consider contemplating whether this corporation will expand or contract. Fortunately, you can examine this complimentary document that displays analyst predictions for its forthcoming trajectory.

Please note that the statistical information presented in this blog post is based on data collected over the past twelve months. These calculations pertain to the period of 12 months leading up to the final day of the month specified in the financial statement. It is important to acknowledge that these figures may not align with the comprehensive data provided in the annual report for the entire fiscal year.

Do you have any opinions on this article? Are you worried about the information provided? Contact us directly if you do. Another option is to send an email to the editorial team at simplywallst.com.

This blog post from Simply Wall St is of a general nature. We offer opinions based on historical information and expert predictions, using an impartial approach. Our articles should not be considered as financial guidance and do not recommend any specific stocks to buy or sell. They do not consider your personal objectives or financial situation. Our aim is to provide in-depth analysis based on fundamental data, with a long-term perspective. Please note that our analysis may not include the most recent company announcements or subjective information. Simply Wall St does not hold any positions in the mentioned stocks.

![ALEX JONES [1 of 4] Friday 5/3/24 • CIVIL UNREST LEADING TO CIVIL WAR, News, Reports & Analysis](https://bfn.today/@btc/live/cover_images/U8pFRoeI7dXM/200Pg3uj1ozO_640x360.jpg.webp)