Are Tredegar Corporation's (NYSE:TG) Mixed Financials Driving The Negative Sentiment?

Tredegar (NYSE:TG) has experienced a challenging three-month period as its stock price has declined by 18%. It is conceivable that investors have disregarded the company's contrasting financial situation and chosen to embrace the prevailing pessimism. In general, market results are typically influenced by the underlying fundamentals over time; hence, it is crucial to closely monitor them. Specifically, today we will focus on Tredegar's return on equity (ROE).

The return on equity (ROE) is a crucial aspect that shareholders must take into account as it informs them about the efficiency of capital reinvestment. In simpler terms, it showcases how well the company can transform shareholder investments into financial gains.

Take a look at our most recent examination of Tredegar.

Calculating Return On Equity: A Guide

Return on Equity (ROE) can be determined by utilizing the following mathematical expression:

Return on Equity is calculated by dividing the net profit from continuing operations by the shareholders' equity.

Therefore, utilizing the aforementioned equation, the return on equity for Tredegar is:

The percentage of 5.4 is derived from dividing $11 million by $202 million, which is based on the twelve-month period leading up to March 2023.

The 'yield' represents the income received post-tax within the past year. This indicates that for every dollar of shareholders' equity, the company produced a profit of $0.05.

Role Of ROE In Earnings Growth

Up until now, we have discovered that the return on equity (ROE) evaluates the effectiveness of a company in generating its profits. By considering the proportion of these profits that the company reinvests or keeps, and how well it utilizes those funds, we can determine the company's probability of earning more in the future. If we assume everything else remains constant, companies with a greater return on equity and better profit retention tend to have a higher rate of growth compared to those without these characteristics.

Earnings Surge In Tredegar With 5.4% ROE

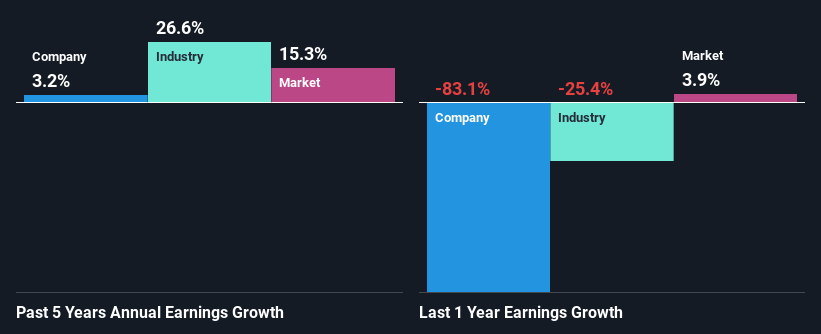

At first glance, the ROE of Tredegar may not appear appealing. Moreover, when we compare it to the industry average ROE of 12%, the company's ROE fails to generate much enthusiasm. Consequently, the modest net income growth of 3.2% experienced by Tredegar in the last five years could potentially be attributed to its low ROE.

Moving forward, we proceeded to evaluate the financial growth of Tredegar by contrasting it with that of the industry. Much to our dismay, we found that the company's progress falls short of the industry's notable average growth rate of 27% during the same timeframe.

When evaluating a stock, it is crucial to consider its earnings growth. Investors should assess whether the projected increase or decrease in earnings is already factored in the stock's price. This assessment helps determine whether the stock is likely to perform well or face challenges ahead. An effective way to gauge expected earnings growth is by examining the price-to-earnings (P/E) ratio, which reflects the market's willingness to pay for a stock based on its profit potential. Therefore, it is advisable to compare Tredegar's P/E ratio to that of its industry to determine whether it is trading at a higher or lower valuation.

Tredegar: Are Earnings Being Used Well?

Although Tredegar retains 63% of its income, its earnings growth was relatively sluggish, indicating the presence of potential obstacles hindering its progress. One factor could be the company's encounter with certain challenges or setbacks.

Furthermore, it can be observed that Tredegar has been distributing dividend payments for a minimum of ten years or potentially even longer, indicating that the company's leadership may have recognized that shareholders hold a preference for receiving dividends rather than prioritizing the growth of company earnings.

Overall, we believe that there are multiple ways to interpret Tredegar's performance. Despite their frequent reinvestment, the low return on equity suggests that this reinvestment is not benefiting investors and is actually hurting earnings growth. In conclusion, we advise approaching this company carefully, possibly by examining its risk profile. You can access our free risk dashboard on our platform to see the four risks we have identified for Tredegar.

If you have any thoughts regarding this article or any concerns about its content, do not hesitate to contact us directly. Alternatively, you can send an email to editorial-team (at) simplywallst.com.

This blog post from Simply Wall St has a broad scope. We offer our thoughts based on past information and expert predictions using a fair approach. Our writings should not be considered as financial guidance. It does not suggest purchasing or selling any stocks and does not consider your goals or financial circumstances. Our aim is to deliver analysis focused on the long-term, backed by fundamental data. Please note that our analysis may not include the most recent company updates or subjective information. Simply Wall St does not hold any positions in the mentioned stocks.