Are we due a stock market crash? Here’s what the charts say

Image credits: Getty Images

Lately, I've come across a few articles discussing the possibility of a stock market crash happening before the year ends. These articles suggest that one of the reasons behind this prediction is the ongoing global economic slowdown. Additionally, there are concerns about the current overvaluation of artificial intelligence (AI) stocks, which could lead to a decline in their value in the upcoming months. After analyzing these arguments, let me share with you the insights I've gathered from studying the charts.

Firstly, let's examine the S&P 500's volatility index (referred to as the VIX). At any given moment, the VIX provides an estimation of the anticipated market fluctuation for stocks in the upcoming month.

This provides investors with an understanding of the extent to which they should be concerned about the likelihood of a significant change. Granted, volatility has the potential for an upward movement - it doesn't necessarily imply a crash!

It is evident that the significant rise on the extreme left was connected to the Covid-19 outbreak, which indeed led to a slump in the stock market. However, if we observe the current trading position of the index, it is near the bottom levels seen at the beginning of 2020. In my perspective, this suggests that no one anticipates a substantial fluctuation in the forthcoming weeks.

Another graph that is helpful is the ratio of put options to call options for the technology-focused NASDAQ 100 index. A put option is a type of financial contract purchased when an individual believes that the market will decrease in value. Conversely, a call option is obtained when someone anticipates a rise in market value. These options are purchased by paying an initial premium, resembling the acquisition of an insurance policy in several aspects.

If the proportion is greater than one, it demonstrates an increase in the purchase of put options compared to call options. This suggests that investors are aiming to safeguard themselves and counter a potential market downturn. Currently, the proportion stands at 1.61, implying a pessimistic outlook. Nevertheless, the proportion has been notably higher, even at the beginning of this year. Hence, this does not persuade me that technology stocks are signaling a major concern.

Identifying Support Areas

Prior to experiencing a complete market collapse, it is crucial to acknowledge certain significant levels of support.

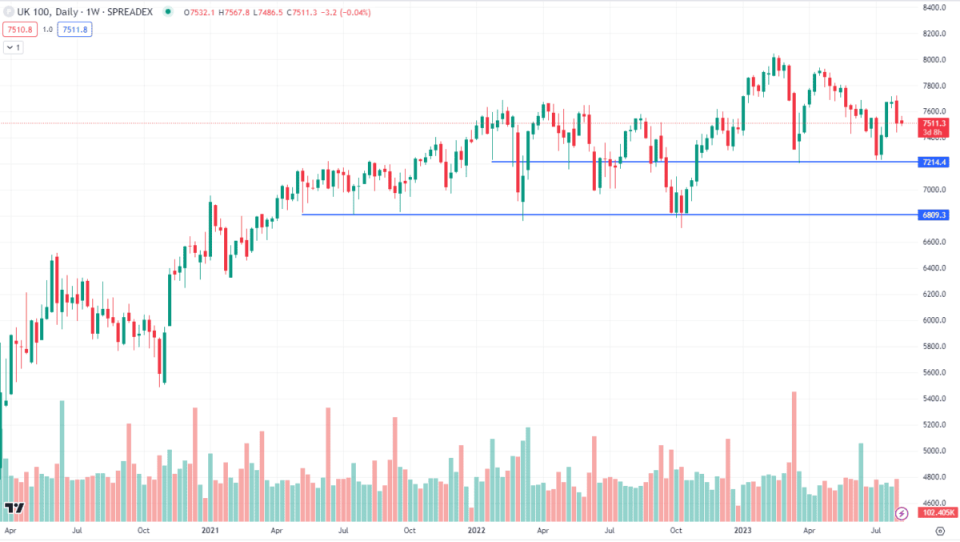

As an illustration, the following displays the FTSE 100. In recent years, purchasers have frequently acquired any decline occurring around the 7,200 or 6,800 mark.

However, it should be noted that the price may have already decreased or may continue to decrease below that level. Nevertheless, it is evident that investors in the UK who value long-term returns have been content to put their money into the market during those periods. Consequently, the overall index has experienced a strong recovery from those key support levels.

Hence, I won't begin to feel excessively worried unless the market falls beneath 6,800 points. In the event that such a situation occurs, I will seize the chance to purchase stocks within the FTSE 100 that are expected to be underestimated.

Is a stock market crash on the horizon? Let's see what the charts have to say. This article can be found on The Motley Fool UK.

5 Stocks to Consider for Wealth Building in Your Golden Years Are you over 50 and looking to enhance your financial portfolio? We've got you covered with five top-performing stocks that may help you achieve your wealth-building goals. Take advantage of these investment opportunities and secure a prosperous future.

A Recommended Stock with High Potential from the Motley Fool

Jon Smith does not hold any positions in the mentioned stocks. The Motley Fool UK also does not hold any positions in the mentioned stocks. The opinions expressed about the mentioned companies in this article are solely those of the writer and may not align with the official recommendations provided in our subscription services like Share Advisor, Hidden Winners, and Pro. At The Motley Fool, we believe that taking into account a wide variety of perspectives improves our abilities as investors.

The Motley Fool UK in the year 2023 is the subject of discussion.