Crypto Gaming Investments Surged in July as Metaverse NFTs Fizzled Out

According to a report collaborated by DappRadar and the Blockchain Game Alliance, the crypto gaming sector, encompassing video games that utilize blockchain tokens or NFTs, secured an impressive $297 million in investment funding in the previous month.

Around 63% of the funding allocated in July was dedicated to enhancing infrastructure, indicating that the sector is still in its nascent phase. Investors are placing their bets on the development of tools and platforms that will streamline and support upcoming crypto and NFT-based games.

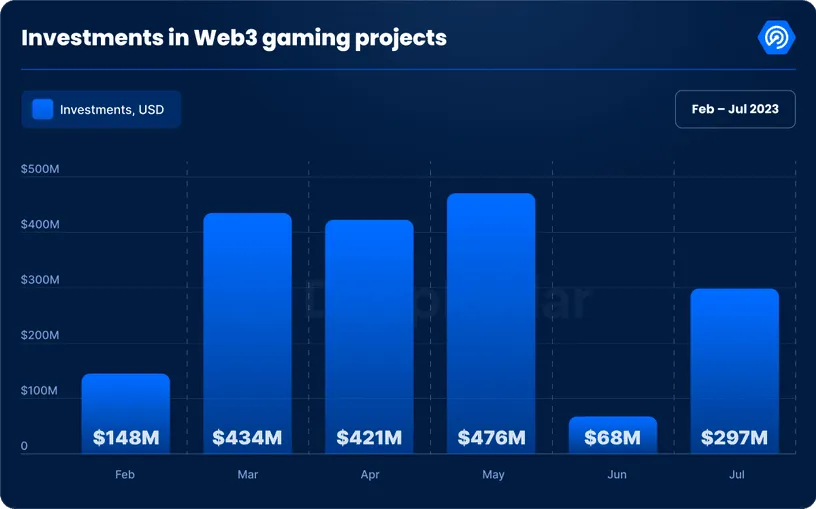

In contrast to the modest $68 million invested in crypto gaming during June, the industry experienced a remarkable surge in July.

The study hypothesized that the decreased figures in June might be attributed in part to the wider cryptocurrency sector experiencing turbulence caused by the U.S. Securities and Exchange Commission (SEC) focusing its attention on Binance and Coinbase during that month, thus creating an atmosphere of uncertainty within the industry.

However, Carlos Pereira, a partner at Bitkraft Ventures, doesn't think we can draw significant conclusions from the pause in activity observed in June and the sudden increase in July.

"I don't believe there is any specific explanation for why one month appeared noticeably distinct from the other," Pereira conveyed to Decrypt via a message.

"It is a compact collection of information that exhibits greater fluctuation when considering the sample size. Imagine that all those transactions deserving checks worth more than $30 million required several weeks to be completed, and they could have equally occurred in either of the two months," Pereira stated. "From our perspective, it certainly did not appear as if anything had changed."

Adding to the belief that the decrease in investment during June might have been a rare occurrence, it is worth noting that the industry received over $400 million in investment during each of the preceding three months, specifically March, April, and May 2023.

"It can be extremely difficult to extract valuable information from a monthly analysis, particularly since numerous financial transactions remain unannounced or experience delays in their announcements," stated Alok Vasudev, one of the co-founders at VC firm Standard Crypto, in an email response to Decrypt.

Vasudev further expressed that the development time of games makes the gaming industry particularly challenging, as any game being released in the market has most likely received financial backing quite some time ago. However, from our perspective, we firmly believe that gaming is an excellent way to utilize cryptocurrency, and we anticipate witnessing a rise in investments in this field as time goes on.

In July, there were several remarkable financial contributions in different industries. For instance, Animoca Brands, a company specialized in game publishing, invested a substantial sum of $30 million into the crypto "super app" called Hi. Similarly, Inworld AI, a startup focusing on artificial intelligence, managed to raise more than $50 million to enhance the intelligence and versatility of in-game characters.

Valhalla Ventures additionally formed a $66 million investment pool dedicated to gaming and technology, whereas Futureverse acquired $54 million to support its crypto metaverse initiatives.

Despite some metaverse-focused companies still in the process of securing funding, the prices of nonfungible tokens (NFTs) and the total volume of trades in established metaverse games experienced a significant decline in the previous month.

According to the DappRadar report, virtual world games experienced a significant decline in July, with a mere $5.6 million in monthly traded volume and 10,796 sales. The average price per NFT was $523, which is quite different from the peak of metaverse excitement in 2021. Back then, a parcel of virtual land adjacent to Snoop Dogg in The Sandbox was sold for an astonishing $450,000.

In July, Yuga Labs once again took control of the NFT economy in the metaverse. The sales of Otherdeed and Otherdeed Expanded NFTs accounted for 72.5% of the total trading volume in the virtual world category. Yuga Labs, the creators of the popular Bored Ape Yacht Club, are currently working on their Otherside metaverse game, where the NFT land plots will be put to use. The game is still in development.