UK debt exceeds 100% of GDP for first time since 1961 – ONS

Official figures show that the UK's debt pile has exceeded 100% of its economic output for the first time since 1961. This was due to the government's borrowing more than doubling in May.

According to the Office for National Statistics (ONS), the amount of money the UK owes, known as net debt, had risen to £2.6 trillion by the end of May. This amount is equal to 100.1% of the country's total economic output, also known as gross domestic product (GDP).

For the first time since March 1961, the proportion of debt-to-GDP has gone beyond 100%. However, during the pandemic, this was initially decreased due to better GDP data.

The Government's borrowing increased to £20 billion in May compared to the previous year. This rise was mainly due to the expenses of supporting energy schemes, benefits that are linked to inflation, and paying interest on debts.

The amount borrowed by the UK in May reduced by £3 billion when compared to April. However, it was still £10.7 billion more than what was borrowed in the same month last year. This figure also represents the second-highest May borrowing since records began in 1993.

In advance, financial analysts estimated that the borrowing for the month of May would reach a total of £19.5 billion.

The Government's Chancellor, Jeremy Hunt, declared that they have had to make tough choices in order to restore economic stability after the pandemic and the military intervention by Russian President, Vladimir Putin, in Ukraine.

He mentioned that we had spent a considerable amount of money to protect families and businesses from the severe effects of the pandemic and the energy crisis caused by Putin. This expenditure was justifiable.

However, it would be completely unjust to burden upcoming generations with a debt they are unable to settle.

This is the reason why we made challenging yet crucial choices to stabilize our finances so that we can cut inflation in half, boost economic growth, and decrease our debt.

According to the ONS, in May, the Government used approximately £1.5 billion worth of energy support programs. These programs consist of the energy price guarantee, which places a cap on annual bills at £2,500, and the energy bills discount scheme.

The plans are believed to have resulted in an expense of 29.7 billion pounds for the UK just in the initial half-year period.

Originally, the assurance of fixed energy prices was planned for the months of October through March exclusively. However, the duration of the guarantee was prolonged and now applies until July.

Ofgem's price cap for yearly energy expenses, which has been established at £2,074, will take over on July 1, displacing the previous system.

According to the Office for Budget Responsibility (OBR), the UK's fiscal watchdog, the increase in borrowing is due to some unforeseen factors. One of these factors is the recent pay agreement for NHS employees adding an additional £2.7 billion to Government spending last month. Additionally, the cost of debt interest has also contributed to the increase in borrowing.

According to the data, the amount of money owed by the government had a smaller interest payment of £7.7 billion in May compared to the previous year, but it was still £700 million higher than what was predicted by the OBR. However, the figures showed a decrease of £200 million from the previous year.

The cost of Britain's debt interest has increased significantly in the past year due to the effects of high RPI inflation on index-linked gilt stocks. This has caused the bill to soar.

The rate of inflation has decreased since it reached a very high level in October of the previous year. However, new statistics released on Wednesday have shown that the Consumer Prices Index (CPI) inflation has not decreased as much as expected in May, remaining constant at 8.7%. Additionally, the Retail Prices Index (RPI) only slightly decreased from 11.4% to 11.3% in April.

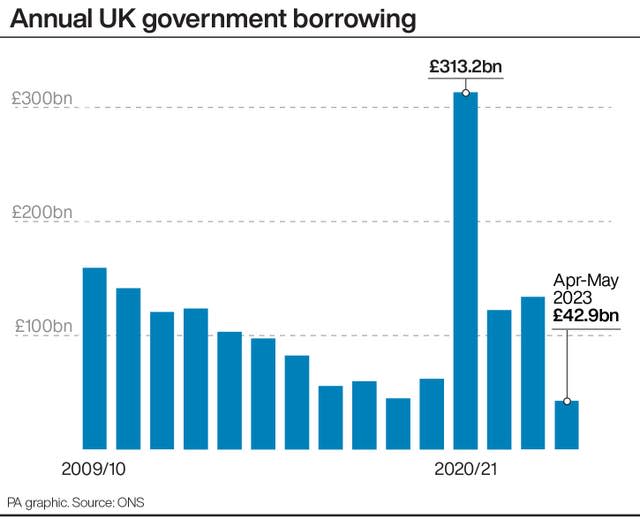

Lending in the initial two months of this fiscal year has already hit a whopping £42.9 billion. This is £19.6 billion more than the amount borrowed in the same two-month phase last year and it is also £2.1 billion beyond the prediction of £40.8 billion that was made by the OBR.

However, the Office for National Statistics stated that it has decreased its calculation for the amount of money borrowed in the prior fiscal year until March 2023, which now stands at £134.1 billion or £3 billion lower than its previous estimate.

This still amounts to an additional £11.8 billion from the previous year, and represents the fourth highest borrowing amount recorded on a monthly basis.

According to Martin Beck, the main economic advisor for the EY Item Club, it is possible that borrowing may exceed the OBR's predicted amount for 2023-24 by up to £20 billion. This could be a result of the recent significant rise in interest rate expectations, which ultimately increase the expense of Government borrowing.

He stated that during the upcoming financial event in the fall, the authorized predictor will most likely conclude that the Government has violated its fiscal policies due to its current approach.

It's probable that the Chancellor will react by implementing further budget reductions after the election, on top of an already difficult financial situation.

"It's unlikely that we'll see the actual plan for fiscal policy in the medium-term until the initial budget following the election."