Tesla Stock Price Down 25% In 2024, Time To Take Your Profits

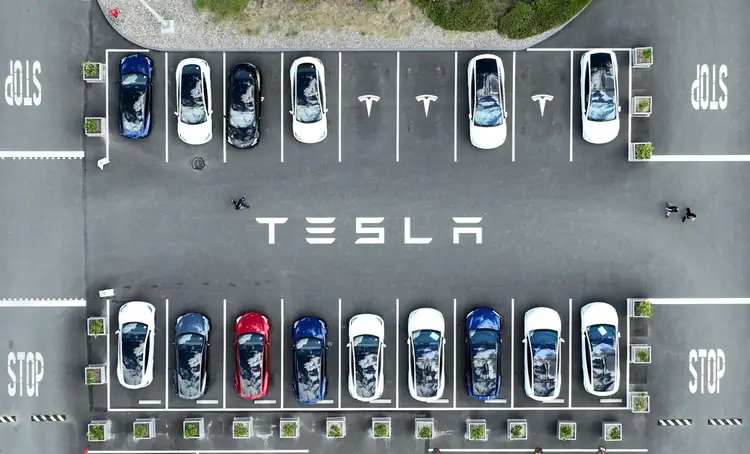

On April 20, 2022, an aerial view captured a parking lot at the Tesla factory in Fremont, California, where a number of Tesla cars could be seen parked. The reason for this was that Tesla had just reported its earnings for the first quarter, which exceeded the predictions of analysts. The revenue for this period was $18.76 billion, surpassing the expected $17.80 billion mark. The unexpected success that Tesla had experienced showed the company's continued growth and success in the industry.

Tesla didn't meet the expected results and decreased its projected earnings in the most recent finance report. As a result, Tesla's stock dropped by 10% in the morning of January 25th, and experts decreased their target prices for the firm's shares.

There are plenty of grounds for selling Tesla shares, but the key ones are the company's inadequate offer to customers and the CEO Elon Musk's inclination to dedicate more attention to artificial intelligence and robotics.

Investors ought to consider selling their Tesla stocks since its value has increased twofold in 2023. Those who still hold on to these stocks may experience negative consequences.

Tesla's Underperformance And Future Outlook

On Wednesday, Tesla released a fourth quarter report that left investors feeling let down. The report also included subpar guidance for 2024.

These are the essential statistics:

During Tesla's earnings conference call, Musk provided numerous explanations which, in my perspective, can be deemed as inadequate justifications.

Musk spoke to his investors about the company's new venture into robotics. There is a lot of uncertainty surrounding this new product, therefore it is difficult to make a precise prediction. However, Musk is optimistic and believes that they may be able to ship some Optimus units next year. Although, this is not a guarantee as it is a new and untested product.

Musk definitely has opponents in the field. There are other companies who are competing with him, such as Boston Dynamics, Agility Robotics, Figure, Sanctuary, Apptronik, 1X, Fourier, and Unitree. According to CNBC, these companies are also creating robots that have the hardware to handle tasks that involve intricate hand movement, similar to humans.

"Tesla's Poor Value For Customers"

Due to the significant decline in gasoline prices, there are a few major challenges that Electric Vehicle (EV) manufacturers are currently facing. These include the high cost of EVs, the amount of time it takes to recharge them, and the anxiety surrounding their limited range.

The Wall Street Journal recently criticized Tesla for its decision to prioritize the production of the Cybertruck, which is considered to be expensive, instead of following the approach of Chinese companies like BYD who increased their market share by offering reasonably priced electric vehicles.

Tesla is facing a greater disadvantage compared to its competitors. In December of last year, I noted that the Cybertruck, which was announced in November, had a range of only 250 miles and was priced at $60,990. This is 53% higher than the amount promised in November 2019, according to Wired.

The design of the Cybertruck isn't very attractive because of these characteristics:

Honestly, Tesla plans to develop more affordable cars. According to Bloomberg, it won't come to fruition until the latter half of 2025 in Austin and subsequently Mexico. This move could entice customers who find it challenging to purchase a US electric vehicle with an average cost of $39,000.

Musk stated that the production ramp of the upcoming vehicle will be quite challenging. Bloomberg reported that the manufacturing technology will surpass any other in the world and be exceptional once it gets going. It will be on an elevated tier of excellence.

Musk Seeks New Ventures

Musk seems to be taking his focus away from Tesla as he has gotten involved in buying Twitter and developing a Generative AI that competes with the likes of OpenAI. He hasn't been giving his full attention to Tesla's board and is making demands, which include increasing his share in the company from 13% to 25%. In doing so, he aims to make Tesla a notable player in the area of AI and robotics. The news was reported by Bloomberg.

This brings about numerous inquiries: Will Musk exit Tesla if he's denied what he desires? Would he give away the firm to a competitor with more investment in the EV industry? What is the reason for rewarding Musk with time to concentrate on AI and robotics rather than addressing the concerns of the EV producer?

Tesla’s Stock Targets Slashed By Analysts

Experts are not positive about the future of Tesla. Morningstar appears to be especially negative. Seth Goldstein, an analyst from Morningstar Research, shared in an interview with Bloomberg that Tesla is indicating that its yearly growth rate of 30% to 40% or even 50% will not be achieved in 2024.

Tesla saw a decrease in the price predictions provided by brokers. Specifically, Barclays lowered their estimate from $250 to $225. The analysts from Barclays stated on Thursday that, although the situation is not as grave as predicted, there is still some risk for an unfavorable outcome due to the uncertain path ahead. Similarly, RBC cut its estimate from $300 to $297, while Canaccord Genuity lowered its price target to $234 from $267, according to information provided by CNBC.

Avoid catching the plummeting cybertruck.