Future plc (LON:FUTR) Stock Has Shown Weakness Lately But Financials Look Strong: Should Prospective Shareholders Make The Leap?

After observing the recent decline of 29% in the stock of Future (LON:FUTR), it is not easy to feel optimistic. Nevertheless, a more detailed examination of its strong financials may change your perspective. Considering that the company's long-term market results are typically influenced by its fundamentals, it is worth investigating further. In particular, this article aims to analyze Future's return on equity (ROE).

Return on equity, also known as ROE, holds significant significance for shareholders as it provides insights into the efficiency of reinvesting their capital. In simpler terms, ROE indicates the profit generated per dollar in relation to the investments made by shareholders.

Check out our most recent examination for the upcoming times.

Calculating Return On Equity: A Simple Guide

The equation for calculating return on equity is as follows:

Return on Equity is calculated by dividing the net profit (generated from ongoing business activities) by the shareholders' equity.

Using the information provided, we can calculate the Return on Equity (ROE) for Future to be:

11% equals £115 million divided by £1.1 billion, which is based on the past twelve months up until March 2023.

The 'yield' represents the earnings received after taxes within the past twelve months. This signifies that, for every £1 of shareholders' equity, the company generated a profit of £0.11.

Why ROE Matters For Earnings Growth

In previous discussions, we have determined that ROE is a valuable tool for predicting a company's future earnings. Now, we must examine the amount of profit that the company reinvests or keeps for future expansion. This will provide insight into the company's potential for growth. In general, all else being equal, companies with both a high return on equity and a tendency to retain profits have a greater rate of growth compared to those lacking these qualities.

The Future: Earnings Growth & 11% ROE

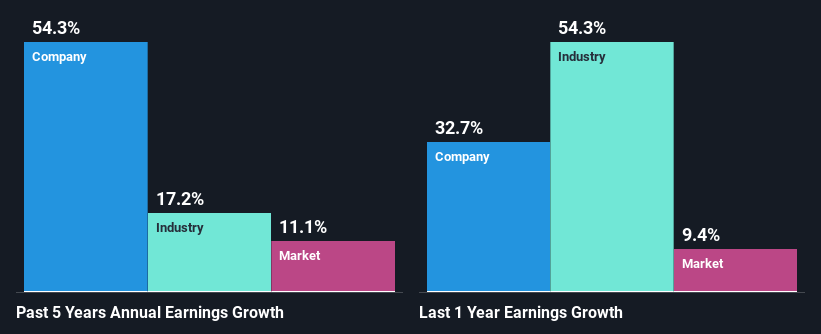

Upon initial observation, Future appears to possess a satisfactory return on equity. Particularly when compared to the average ROE of 8.9% within the industry, the company's ROE appears quite remarkable. This undoubtedly provides some perspective on Future's outstanding 54% increase in net income observed over the previous five years. We opine that there may be additional factors contributing favorably to the company's growth in earnings. For example, Future maintains a low payout ratio and demonstrates efficient management.

Afterwards, we analyzed the rise in Future's net income in relation to the overall industry, and we were delighted to discover that the company's growth rate surpassed that of the industry, which experienced a 17% growth over the same span of five years.

When evaluating a stock, it is crucial to take into account the growth in earnings. Investors should be informed whether the market has already factored in the anticipated increase or decrease in the company's earnings. This analysis will provide clarity on whether the stock's prospects are positive or negative. If you are interested in Future's valuation, you can examine its price-to-earnings ratio in comparison to its industry.

Is Future Maximizing Profit Efficiency?

The payout ratio of Future, which is calculated based on the median payout over a span of three years, is relatively low at 3.4%. This indicates that the company is keeping a larger portion (97%) of its profits. It suggests that the management team is reinvesting the majority of the earnings to expand the business, as evidenced by the noticeable growth achieved by the company.

Furthermore, Future remains committed to distributing its earnings to shareholders, as evident from its extensive track record of consistently paying dividends for a minimum of ten years. According to our recent analysis, we anticipate a decrease in the company's future payout ratio to approximately 2.1% within the next three years. Despite this anticipated decrease, there is not expected to be a significant alteration in the company's return on equity (ROE).

Overall, we have a positive view on Future's performance. It is especially encouraging to witness the firm's significant investments in its operations, which, coupled with a strong return rate, has led to substantial growth in its profits. However, recent analysis suggests that the company's future earnings growth might experience a slowdown. For further insights into analysts' predictions regarding Future, take a look at this visual representation of their forecasts.

Do you have any thoughts on this article? Worried about the information provided? Contact us directly if you do. Alternatively, you can send an email to editorial-team (at) simplywallst.com.

This blog entry from Simply Wall St is broad in scope. We offer observations based on past information and predictions from analysts, employing an objective approach, and our blogs are not intended to serve as financial guidance. The content does not propose any particular stocks to purchase or sell, and does not consider your goals or financial status. Our aim is to provide in-depth analysis driven by fundamental data, focusing on the long term. Keep in mind that our analysis may not incorporate the most recent company announcements that impact stock prices or any qualitative material. Simply Wall St is not invested in any of the stocks mentioned.

Participate in a Paid User Research Session and get rewarded with a US$30 Amazon Gift card for contributing 1 hour of your valuable time. By joining, you will not only assist us in enhancing investing tools specifically designed for individual investors like you but also earn a beneficial gift card. Don't miss out and register now!