AB: ESG-Labeled Bonds: Are Greeniums Doomed To Dwindle?

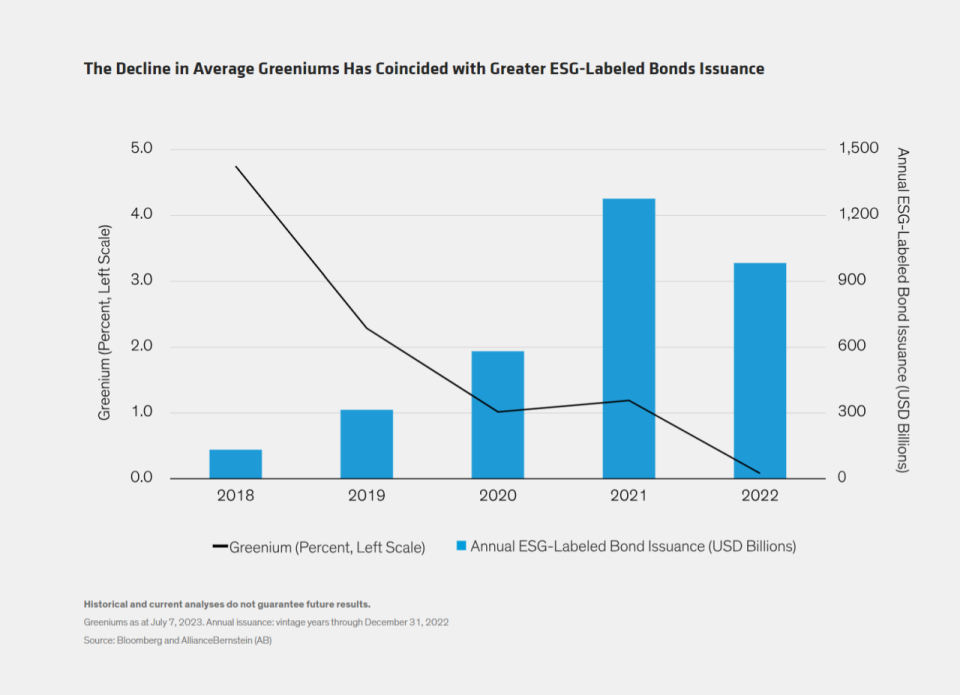

Investors who put their money into ESG-labeled bonds anticipate that these bonds, which have a solid environmental or social background, will be worth more than regular bonds from the same issuing company. This price increase, often referred to as the "greenium," appears to have been decreasing gradually (as shown in the display). However, when considering factors like the overall quality and amount of bonds issued in each specific year, a more detailed and complex outlook can be observed.

While many people are aware that the average premium for green bonds in major bond indices has declined in recent times, the importance of the year of issuance (vintage) for these premiums is not widely recognized. However, it is crucial to consider vintage year since the issuance volumes of bonds labeled with environmental, social, and governance (ESG) criteria, as well as the strength of their ESG offerings, have significantly fluctuated over time.

The decrease in typical green premiums has been primarily influenced by two interconnected factors: the higher issuance of bonds linked to environmental, social, and governance (ESG) practices, and the simultaneous decrease in the overall quality of the ESG offered by many of the more recent bond releases. We can observe the shifts in both aspects more distinctly when examining specific time periods.

We have observed that numerous ESG-certified bonds, which were issued during the period of 2018-2019, have consistently preserved their green premium over the years. This group comprises bonds from innovative financial organizations and top-notch European entities.

In comparison, the companies that recently joined the ESG trend have typically issued bonds that are not as well organized, resulting in very small differences in their value compared to regular bonds.

When it comes to ESG-labeled bonds, it is crucial to evaluate each bond separately because their features differ greatly, both within the specific category and from one bond to another. Conducting comprehensive fundamental analysis is the only way to ascertain if an ESG-labeled bond truly merits its green premium.

The opinions expressed in this blog do not qualify as extensive examination, endorsements for investment decisions, or trade suggestions, and may not reflect the viewpoints of every AB portfolio-management group. These opinions are subject to change in the future.

Discover further information about AB's perspective on accountability at this location.

Read the original article here

AllianceBernstein, announces on Tuesday, August 15, 2023, a depiction accompanying their official statement.

Discover extra multimedia content and additional ESG narratives from AllianceBernstein on the 3blmedia.com platform.

Contact Information: Representative: AllianceBernsteinWebsite: https://www.3blmedia.com/profiles/alliancebernsteinEmail: [email protected]